Key Insights

- •Pump.fun co-founder Sapijiju has denied allegations of cashing out $436 million in stablecoins, as reported by Lookonchain.

- •Sapijiju claims that USDC transfers to Kraken represent treasury management and not a liquidation of funds.

- •Data shows Pump.fun has moved approximately $436.5 million USDC to Kraken since October 15.

Pump.fun Co-Founder Rejects Cash-Out Claims

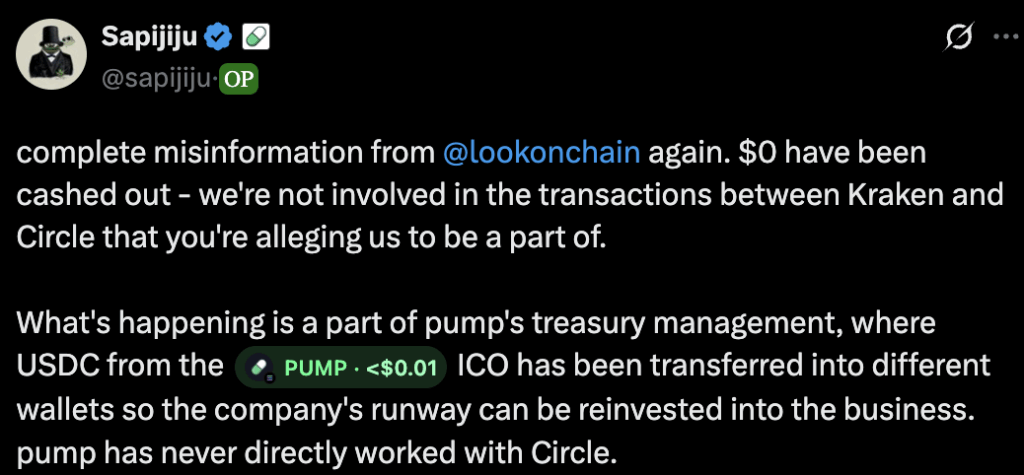

Pseudonymous Pump.fun co-founder Sapijiju has rejected claims that the project cashed out more than $436 million in stablecoins. The response came after blockchain analytics firm Lookonchain reported significant USDC movements to the cryptocurrency exchange Kraken. Sapijiju characterized the allegations as "complete misinformation" in a post on X, asserting that none of the transferred funds were sold.

In a November 24 X post, Sapijiju stated, "$0 has been cashed out – we’re not involved in the transactions between Kraken and Circle that you’re alleging us to be a part of." This statement addressed Lookonchain's tracking of wallet movements over a 40-day period. The co-founder clarified that USDC originating from the PUMP initial coin offering (ICO) was transferred into different company-controlled wallets, explaining these movements were part of treasury management rather than liquidating positions.

Sapijiju further explained that treasury management involves allocating, storing, and moving funds such as operating capital, ICO proceeds, or reserves. The USDC in question originated from the PUMP token's initial coin offering and was redistributed to internal wallets as part of this treasury management strategy.

Pump.fun Response Follows Initial Reports

The co-founder emphasized that Pump.fun has never directly worked with Circle, despite USDC flows occurring between Kraken and the stablecoin issuer. The denial was issued approximately 10 hours after Lookonchain's initial report gained traction on social media. User Voss pointed out apparent contradictions within Sapijiju's statement, highlighting the shift from claiming no involvement in Kraken-Circle transactions to admitting USDC movement from the PUMP ICO. The user suggested that the response appeared self-contradictory, especially after a substantial period had passed to formulate an answer.

It is common for projects to move ICO proceeds between wallets for various operational purposes, including development funding, marketing budgets, and reserve management.

Lookonchain Reports Significant USDC Movement

Lookonchain published data indicating that Pump.fun deposited $436.5 million USDC into Kraken since October 15. The blockchain analytics firm also tracked flows of $537.6 million USDC from Kraken to Circle through wallet DTQK7G during the same period. The report also referenced historical Solana sales totaling 4.19 million tokens, valued at $757 million, at an average price of $181 per token, which occurred between May 19, 2024, and August 12, 2025.

The breakdown of SOL liquidation methods showed 264,373 SOL were dumped on-chain for $41.64 million, while the remaining 3.93 million SOL, worth $715.5 million, were moved to the Kraken exchange. Data platforms such as DefiLlama, Arkham, and Lookonchain indicated that Pump.fun-related wallets still held over $855 million in stablecoins, along with an additional $211 million in Solana holdings across associated addresses.

Community Questions Treasury Management Transparency

Following Sapijiju's statement, the community response was mixed, with some users questioning the explanation's internal consistency and others defending the project's autonomy in managing its funds. User Matty.Sol commented that platforms have the authority to deploy revenue and ICO proceeds according to their business needs, emphasizing, "Nothing wrong even if it's true. It's your own revenue tho," supporting discretionary treasury management. User Oga NFT argued that moving USDC should be standard practice for legitimate projects post-ICO and questioned whether USDC reserves truly backed the circulating supply, rather than focusing solely on transfer mechanics.

Pump.fun Revenue Declines Below $40 Million Monthly

According to DefiLlama data, Pump.fun's platform revenue has fallen below $40 million monthly for the first time since July. November revenue stood at $27.3 million, marking a 31.75% decrease from the previous month's performance. Monthly tracking showed consistent revenue above $40 million from July through October, prior to the November decline. DefiLlama data also indicated revenue volatility in previous months, with peaks exceeding $50 million during periods of high activity. The platform achieved its highest monthly revenue during the earlier expansion of the meme coin market.