The Countdown to Judgment

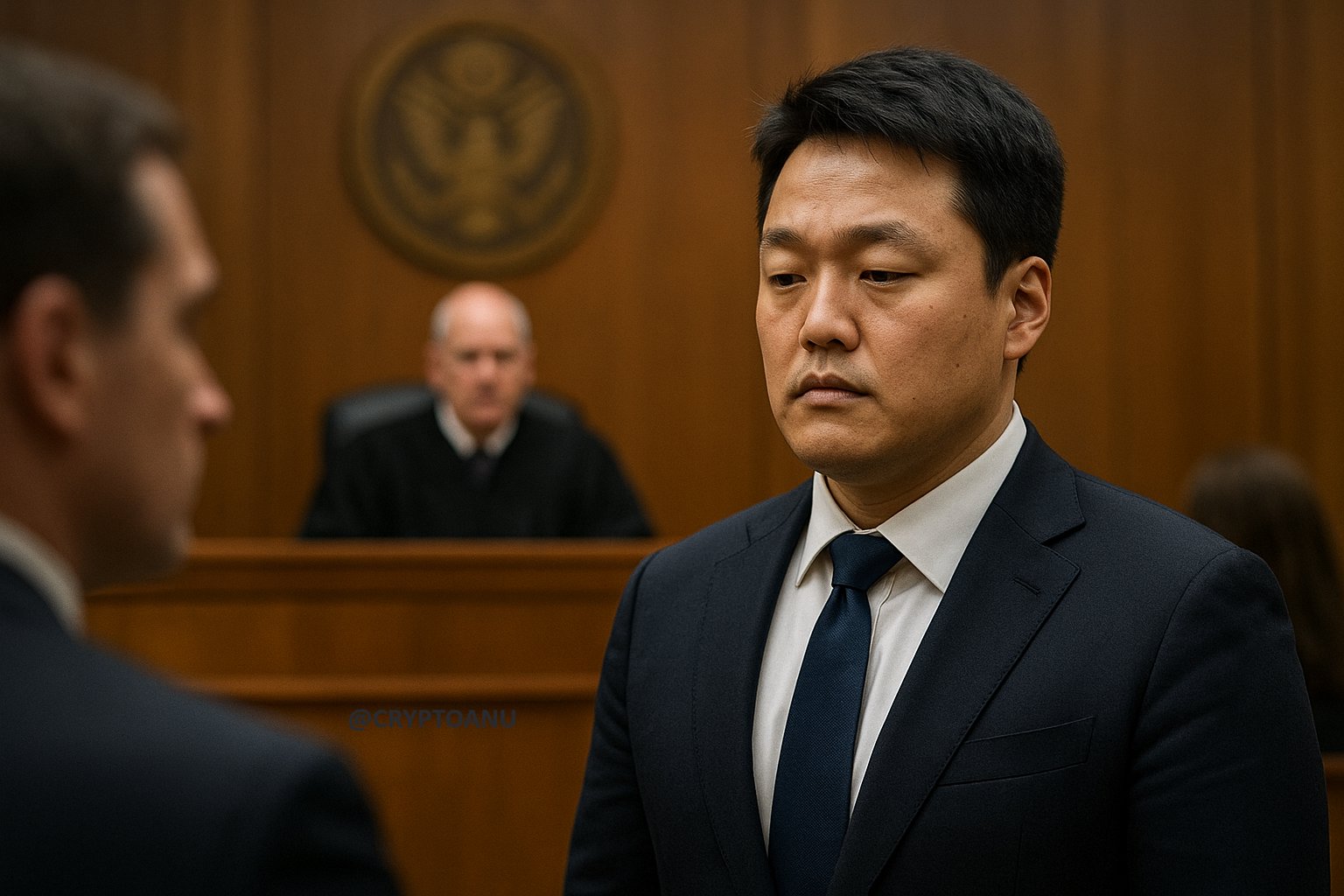

The highly anticipated legal saga surrounding Do Hyeong Kwon, the controversial co-founder and former CEO of Terraform Labs, has reached a pivotal conclusion. Kwon has officially pleaded guilty to two federal charges in the United States, bringing an end to a three-year period that significantly impacted global cryptocurrency markets.

One chapter ends — another begins.

The Guilty Plea Formalized

On August 12, 2025, the U.S. Attorney’s Office for the Southern District of New York (SDNY) confirmed that Kwon admitted guilt to charges including conspiracy to commit commodities, securities, and wire fraud, as well as wire fraud. Each of these counts carries a potential prison sentence of up to 25 years. In addition to these admissions, Kwon has agreed to forfeit $19 million in alleged illegal profits, which includes his stakes in Terraform Labs.

U.S. Attorney Jay Clayton commented on the proceedings, stating, “Kwon used crypto’s technological promise to commit one of the largest frauds in history.”

Terraform Labs: A Constructed Illusion

Founded in 2018, Terraform Labs initially presented itself as a leader in decentralized finance, aiming to create a self-sustaining financial ecosystem. The platform was built around key components such as UST, its algorithmic stablecoin, and LUNA, its native token. Additional offerings included Anchor Protocol, which promised high yields, Mirror Protocol for synthetic assets, the Chai payment gateway, and the Luna Foundation Guard (LFG).

However, court documents later revealed that the company’s operations were far from the decentralized ideal it promoted. Terraform’s products did not function as advertised, and the data presented to simulate adoption was reportedly manipulated.

Unraveling the Core Deceptions

Investigations uncovered several fundamental deceptions underpinning Terraform's operations:

- •The Stablecoin Deception: The peg of UST was not maintained through a purely algorithmic mechanism. Instead, it was artificially supported through an agreement with a trading firm, particularly after encountering early stability issues.

- •The LFG Reserve Manipulation: The Luna Foundation Guard (LFG) was presented as an independent entity. However, it was under the direct control of Kwon, who is also alleged to have diverted millions of dollars from the reserve for his own purposes.

- •Mirror Protocol Fraud: Kwon and Terraform were accused of secretly manipulating the prices of synthetic assets on the Mirror Protocol using automated trading bots.

- •The Chai Transaction Falsification: The claimed blockchain usage for Chai transactions was misrepresented. Transactions were not actually processed on-chain, and the blockchain integration was fabricated.

- •The Genesis Stablecoin Fund Misuse: A significant portion of $145 million in pre-minted tokens from the Genesis Stablecoin Fund was reportedly used to facilitate fake Chai transactions and engage in market manipulation schemes.

The Collapse of an Empire

By the spring of 2022, Terra's market capitalization had surged to over $50 billion. The situation dramatically shifted in May 2022 when UST lost its peg to the U.S. dollar. This depegging event triggered a catastrophic collapse, wiping out more than $40 billion in investor value. The fallout from Terra's implosion had widespread repercussions across the crypto economy, contributing to the downfall of numerous funds, exchanges, and decentralized finance lenders.

In an attempt to mitigate the damage, Terraform Labs reportedly commissioned a fake "independent audit" to obscure the severity of the disaster.

Arrest, Extradition, and International Response

Do Kwon was apprehended in Montenegro in March 2023 while attempting to travel under a false passport. Following nearly two years of legal proceedings, he was extradited to the United States on December 31, 2024.

Meanwhile, South Korea initiated its own criminal proceedings, with prosecutors concentrating on domestic investor losses and violations of capital markets regulations. The country's Financial Services Commission (FSC) has since responded by banning algorithmic stablecoins and implementing stringent registration requirements for decentralized finance (DeFi) activities, citing the Terra case as a primary catalyst for these regulatory changes.

The Future of Terra Classic ($LUNC)

As Do Kwon faces his sentencing, the Terra Classic community, which was largely abandoned following the collapse, is actively engaged in rebuilding efforts. Through decentralized governance mechanisms, the implementation of new utility-focused upgrades, and a deflationary burn strategy, $LUNC has evolved into a community-driven blockchain initiative.

Recent developments include:

- •The deployment of Market Module V2, which re-enables secure swapping functionalities.

- •Integration of continuous burn mechanisms across various DeFi protocols.

- •Decentralization of validators driven by community governance proposals.

Terra Classic survived not because of its founder — but because of its community.

Legacy and Enduring Lessons

Do Kwon's guilty plea signifies the legal resolution of the Terra scandal and serves as a symbolic moment for the broader decentralized finance sector. The outcome sends a clear message:

“Accountability and transparency are no longer optional in crypto.”

As the $LUNC ecosystem continues to reconstruct itself from the aftermath, a fundamental truth emerges: Hype can dissipate rapidly, but genuine development, robust governance, and unwavering integrity are enduring forces.