Current Dogecoin Market Overview

Dogecoin is currently trading around $0.176. Its broader market structure mirrors earlier cycles characterized by periods of accumulation followed by sharp expansions. Market data indicates the presence of firm liquidity around the market cap of $26.7 billion, with traders closely monitoring the support level at $0.171 and the resistance at $0.186.

Community sentiment remains strongly bullish, reinforcing the long-standing pattern of cyclical behavior and crowd-driven momentum observed in Dogecoin's history.

Dogecoin and the Recurring Macro Cycle Structure

Dogecoin is currently consolidating within a tight band as the market absorbs recent volatility and traders observe recurring macro trends. The long-term structure remains appealing, with the present pricing pattern fitting into broader historical patterns.

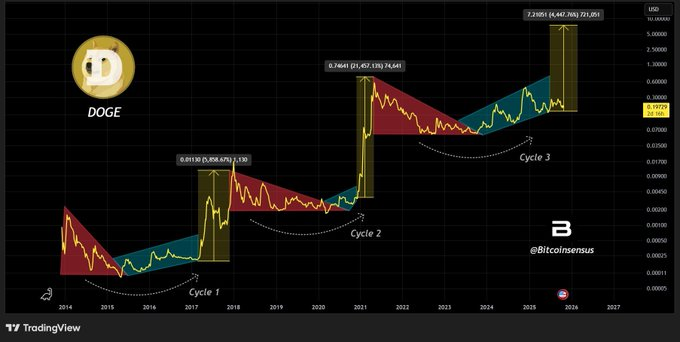

The current cycle for Dogecoin is being discussed with a focus on repeating formations, as noted by Bitcoinsensus on social media. The shared chart divides DOGE's long-term history into three distinct phases that reflect broad market psychology. Cycle 1 and Cycle 2 both feature an extended corrective phase, followed by accumulation and substantial upward expansions.

The commentary highlights that DOGE moved from deep lows toward $0.0181 in Cycle 1 and advanced to nearly $0.74 during Cycle 2. Each phase retained a similar geometric structure, suggesting a rhythm in its price development. The consistency of these cycles has generated renewed attention as Cycle 3 develops from the ongoing base structure.

Cycle 3 continues to form in near symmetry, with projections suggesting a possible expansion if historical patterns hold true. The speculative target extends beyond prior peaks, although the time frame remains dependent on market conditions and broader liquidity trends. This positions the current trading range as a critical portion of the developing formation.

Current Market Conditions and Price Behavior

Dogecoin is presently traded at $0.1760, showing a slight decrease of 1.13 percent over the last 24 hours, according to recent market information. The trading range between $0.173 and $0.179 indicates a period of consolidation following an intense increase in value earlier in the week. DOGE continues to maintain its market capitalization of around $26.7 billion, keeping it in the upper category of digital assets.

Trading volume has dropped to its lowest point in nearly three years, at $1.48 billion, representing a decrease of over 55 percent. This suggests a reduction in speculative activity following a previous surge. Despite lower volume, liquidity remains stable due to the large circulating supply of 151.7 billion coins. The fully diluted valuation matches the market cap due to Dogecoin's inflationary issuance model.

Support has held at the $0.171–$0.172 level, with buyers entering during intraday weakness, forming a base for the current rebound toward $0.176. Resistance near $0.186 remains a key threshold. A break above that level could redirect momentum toward the psychological $0.20 mark, which often encourages broader participation.

Market Sentiment, Community Strength, and Technical Context

Community sentiment indicates a strong bullish outlook, with 85% bullish votes across more than 1.5 million respondents. This ratio continues to reflect the coin's strong retail-driven presence. Social positioning has long been a defining factor in DOGE's market behavior, particularly during periods of consolidation.

The intraday pattern, as shown by CoinGecko at the time of writing, reveals early selling, followed by stabilization and gradual re-accumulation. This is consistent with a cooling-off phase after earlier volatility. Market depth supports the current trading range, as both buyers and sellers operate within tight conditions.

The broader analysis frames Dogecoin's behavior as steady while it forms the next structural leg. Traders monitoring price movement continue to track the supportive base near $0.171 and the upper boundary at $0.178–$0.179. Movement beyond these areas may define the next short-term direction as Cycle 3 progresses.