Emory University has significantly increased its holdings in Grayscale's Bitcoin Mini Trust ETF, now possessing over one million shares valued at approximately $52 million. This expansion, with nearly half a million shares added in the second quarter, positions Emory as one of the largest Bitcoin ETF holders within the U.S. academic sector.

As institutional endowments expand their cryptocurrency exposure and new ETF options become available, retail traders are actively seeking high-upside investment opportunities that can capitalize on this evolving financial infrastructure.

The early-stage presale project, DeepSnitch AI, has launched its SnitchFeed layer. The platform aims to offer a 100x potential as the intelligence layer that retail investors need to keep pace with market dynamics. It has already raised over $526,000 at a price of $0.02289, representing a 51% increase from its initial offering price.

University Endowments Double Down as Corporate Treasuries Weather Volatility

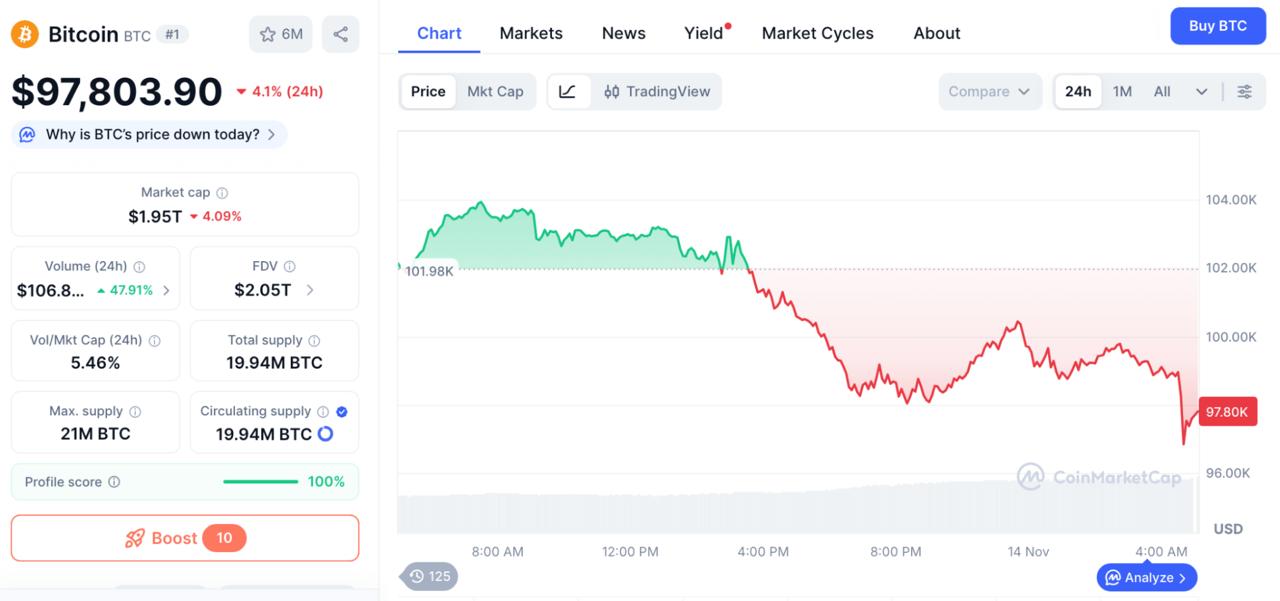

Emory's substantial accumulation of Bitcoin ETF shares occurs while other institutions are navigating market volatility. Metaplanet experienced a 39% decline in its Bitcoin treasury gains during the third quarter, dropping from approximately $2.4 billion to $1.4 billion. This downturn was influenced by the market crash in October, which pressured corporate Bitcoin holders. The Japanese investment firm holds 30,823 BTC with an average acquisition cost near $108,000 per coin, leaving its position currently underwater as Bitcoin trades around $97,000.

In parallel, Canary Capital's first U.S. spot XRP ETF received Nasdaq certification on November 13, with trading anticipated to commence the following day. This ETF marks the sixth single-crypto asset fund, following those for Bitcoin, Ethereum, Solana, Litecoin, and Hedera. Bloomberg analyst Eric Balchunas confirmed the official listing notice, indicating an expansion of institutional access beyond major cryptocurrencies.

These developments underscore a market trend where institutions are actively building positions amidst volatility rather than withdrawing from it. This period suggests that sophisticated investors are accumulating Bitcoin while retail investors may be capitulating. The maturation of the underlying infrastructure could potentially benefit assets like Dogecoin, among others, due to this renewed institutional interest in the broader cryptocurrency market.

DeepSnitch AI: Telegram-Native Intelligence Network with Coinsult and SolidProof Audits

With projected AI spending exceeding $1.5 trillion in 2025 and November historically marking the start of crypto's strongest six-month period, DeepSnitch AI has already launched. The platform aims to provide traders with an early advantage in identifying and capitalizing on early-stage opportunities. DeepSnitch AI delivers its intelligence directly through Telegram, leveraging a user base of over a billion people, offering a reach that Dogecoin did not possess at its inception.

The SnitchFeed feature continuously monitors alpha groups, social channels, and private discussions around the clock. It flags whale activity, sudden shifts in sentiment, and FUD (Fear, Uncertainty, Doubt) storms before they become widespread topics of discussion. This allows traders critical seconds to take action or exit positions, transforming real-time alerts into a tangible competitive edge. Concurrently, SnitchGPT provides instant decoding of blockchain data, and SnitchCast curates top-tier channel alpha and cryptocurrency news, delivering insights without requiring users to monitor numerous disparate sources.

Audits from Coinsult and SolidProof have established significant trust through rare third-party verification in a market where scams can still outnumber legitimate projects. The presale has successfully raised over $526,000 at $0.02289 per token. Early backers have the ability to stake their tokens immediately, earning a dynamic, uncapped Annual Percentage Rate (APR) with rewards distributed every few seconds and the option for free withdrawals during the claiming process. These yield-while-you-wait incentives are designed to keep holders engaged as new features are progressively rolled out.

For traders, DeepSnitch AI is not a typical meme coin investment. While Dogecoin would need to reach $0.25 for modest gains, DeepSnitch AI is fully operational with its tools and infrastructure in place. This positions it to potentially deliver exponential returns if adoption scales. Its combination of real utility, widespread distribution, and live intelligence makes it a high-leverage, early-stage opportunity in a rapidly evolving market.

Dogecoin Price Prediction: Can DOGE Future Outlook Support a Rally to $0.25?

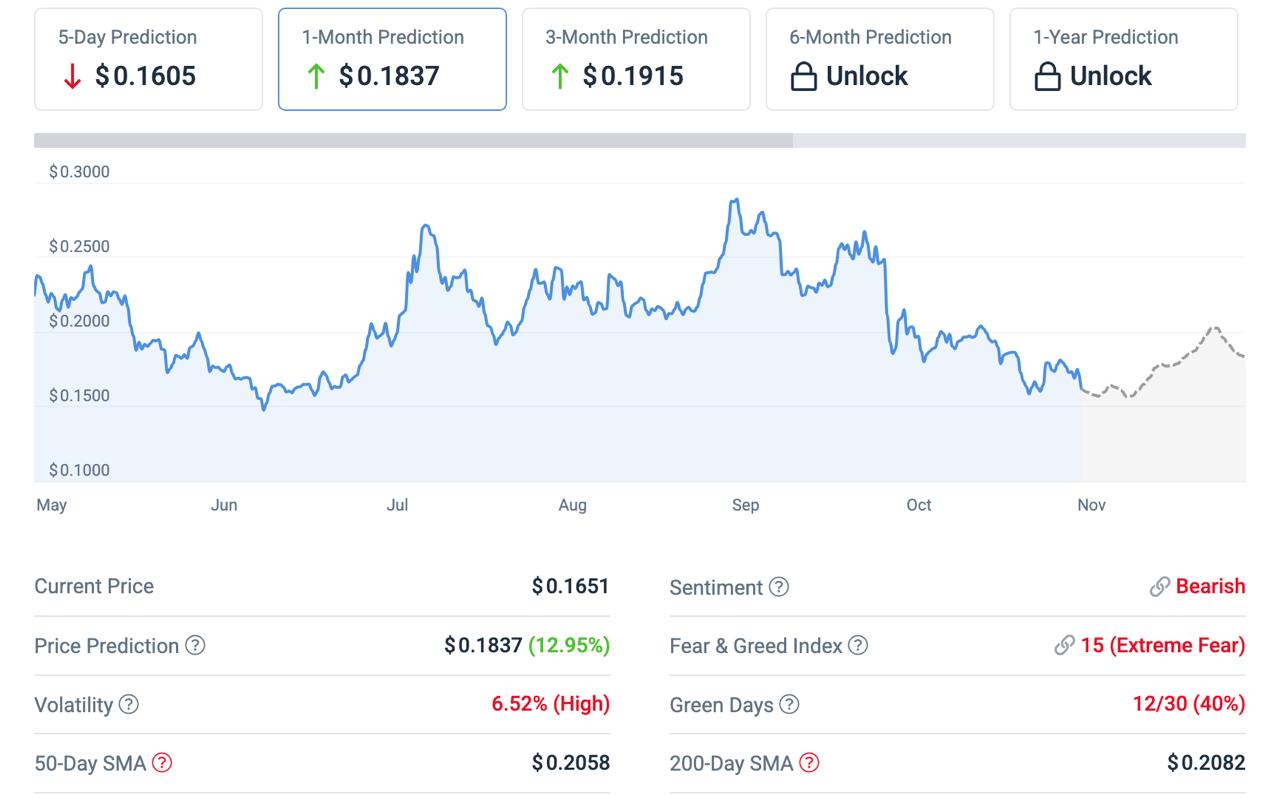

On November 13, Dogecoin was trading around $0.16, experiencing a decrease of approximately 7% over a 24-hour period. The future outlook for Dogecoin is dependent on whether bullish momentum can be regained, pushing DOGE above the $0.20 mark. Technical analysts have cautioned that a decline below $0.14 could lead to Dogecoin retesting its October low, which was near $0.10.

The price prediction for Dogecoin could improve if institutional capital begins to rotate into meme coins as Bitcoin's dominance wanes. Given the significant market developments observed so far, this scenario is highly plausible. Furthermore, Dogecoin's integration with platforms like Shopify, Tesla, NordVPN, and Travala provides a fundamental use case that purely meme-based tokens lack.

Meanwhile, updates related to Elon Musk's involvement with Dogecoin remain an unpredictable factor, as his past tweets have triggered rallies exceeding 50%. With potential rate cuts easing liquidity, Dogecoin could benefit from capital flowing into high-beta assets. Price predictions targeting $0.25 often cite improvements in market structure as key catalysts. However, Dogecoin's current market capitalization exceeding $24 billion means that a tenfold increase would necessitate reclaiming its all-time high valuation.

Bitcoin Consolidates Above $100,000 as ETF Demand Persists

Bitcoin is currently trading near $97,800, balancing between institutional support and macroeconomic challenges. Potential post-shutdown regulatory backlogs at the SEC and CFTC could expedite Bitcoin ETF approvals, serving as a catalyst for increased inflows. Concurrently, large holders, often referred to as whales, have accumulated 225,320 BTC since March, indicating sustained institutional positioning in the market.

Emory University's aggressive accumulation of Bitcoin ETFs suggests that institutional investors perceive current price levels as attractive. BlackRock's iShares Bitcoin ETF, for instance, attracted over $37 billion in inflows during 2025, representing 80% of the total flows into Bitcoin ETFs.

Despite this institutional interest, Bitcoin's substantial market size inherently limits its upside potential. Market sentiment remains extreme, with the Fear & Greed Index at 22, indicating extreme fear—a level that historically precedes market rebounds. However, ongoing retail exits continue to exert downward pressure on the price. At its current scale, Bitcoin's upward movement is constrained, and achieving a tenfold increase from current levels would require a market capitalization of $1 trillion, necessitating broad and sustained adoption.

The Bottom Line

The price prediction for Dogecoin shows potential if its utility continues to expand, but recovery from current levels will likely require years of sustained ecosystem growth. Dogecoin's future outlook improves with the maturation of institutional infrastructure, yet the token's significant size imposes limitations on its potential for dramatic price surges.

In contrast, DeepSnitch AI is operational, has undergone audits, and is already providing tools to users while major cryptocurrencies are consolidating. Its presale is priced at $0.02289, with 51% gains already realized, staking rewards currently active, and features being progressively released.

Institutions are strategically building positions amidst market volatility, while retail traders require advanced intelligence to compete effectively. In this environment, DeepSnitch AI's combination of utility, credibility, and timely market entry suggests clear potential for significant growth.

FAQs

What is the Dogecoin price prediction for 2026?

The Dogecoin forecast for 2026 is contingent on the expansion of its utility beyond payment functions and any updates related to Elon Musk's involvement. Analysts projecting a price of $0.25 often cite declining exchange supply and increasing institutional interest. However, reaching previous all-time highs is likely to require several years of sustained adoption.

Can Dogecoin reach $1?

While reaching $1 is theoretically possible during periods of extreme meme coin popularity, sustaining such a level would require utility-driven adoption rather than purely speculative trading. The Dogecoin price prediction indicates potential, but $1 remains a target likely achievable over multiple years.

Is DeepSnitch AI a better investment than Dogecoin?

DeepSnitch AI offers live intelligence tools, has passed audits from Coinsult and SolidProof, and provides staking rewards at a presale price of $0.02289, with a stated 100x potential. While the Dogecoin price prediction suggests possible recovery, DeepSnitch AI's deployed technology and smaller market capitalization present a higher potential for asymmetric upside for traders seeking significant returns.