Airdrop Manipulation and Market Impact

An entity, utilizing 900 connected wallets, sold $4.00 million worth of tokens after claiming 20% of an IRYS airdrop, according to data from Bubblemaps on November 28th. This incident exposes vulnerabilities within cryptocurrency airdrop mechanisms and has the potential to undermine trust in token distribution processes. The rapid sell-off by the entity has also exerted significant downward pressure on the IRYS token's market value.

Authorities are investigating the incident, which involved the manipulation of the IRYS airdrop through the coordinated use of 900 wallets. This strategy allowed the entity to secure a 20% share of the airdrop rewards, translating into $4 million in token sales. The airdrop, which represented 8% of the total token supply, was initially designated for early users of the IRYS platform.

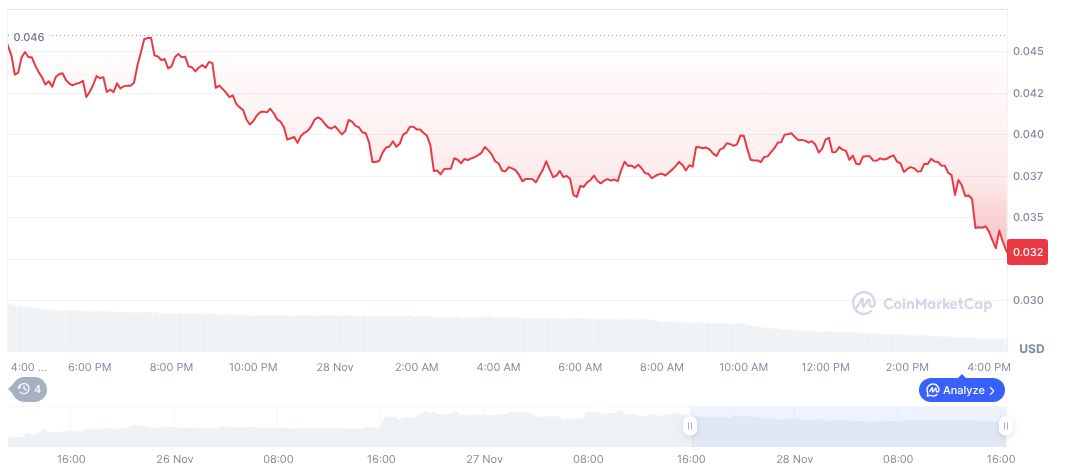

The immediate aftermath of the airdrop claim saw substantial price pressure and increased market volatility for the IRYS token. Concerns have been voiced by community members regarding the broader implications of such manipulative practices on the integrity of token distributions. As of now, neither the IRYS team nor the Bitget exchange has issued an official statement regarding the event. Key Opinion Leaders within the cryptocurrency space have also remained silent on the specific incident, contributing to ongoing discussions and analysis within the community and among industry experts.

Potential Regulatory Scrutiny and Market Standing

The tactic of wallet clustering to manipulate airdrops is a recognized strategy that has been observed in previous cryptocurrency events. Such occurrences often lead to heightened community skepticism and can attract regulatory attention. This pattern suggests that the IRYS airdrop manipulation could prompt further scrutiny from regulatory bodies, potentially influencing future strategies for token distribution.

As of November 28, 2025, IRYS was trading at $0.03, with a market capitalization of $66.16 million, according to data from CoinMarketCap. The token's 24-hour trading volume stood at $45.26 million, indicating a decrease of 68.06%. The price of the IRYS token experienced a 24-hour decline of 25.45%, continuing a downward trend observed over recent months.

The lack of immediate response from key leadership figures in the wake of this airdrop manipulation could exacerbate issues of confidence among investors. The situation underscores the importance of robust anti-manipulation measures in token distribution events.

"The cluster consists of 900 wallets that acted as a single coordinated group, pre-funded by Bitget prior to the airdrop."