Entrée Capital's New Investment Fund

Entrée Capital has announced the launch of a new $300 million fund dedicated to early-stage investments. This fund will primarily target innovations in Artificial Intelligence, deep tech, and cryptocurrency infrastructure. With this new fund, Entrée Capital's total assets under management will reach $1.5 billion. The investment firm plans to focus its efforts on key global tech hubs, including Israel, the United Kingdom, Europe, and the United States.

The fund's strategic focus on foundational technologies is expected to significantly bolster innovation across various tech sectors. This includes driving advancements in AI, supporting the development of robust crypto infrastructure, and attracting promising startup ecosystems in these crucial global markets.

Focus on Foundational Technologies and Crypto Infrastructure

Entrée Capital's latest $300 million fund is specifically designed for early-stage investments in significant technology centers worldwide. The primary sectors of interest for this fund are Artificial Intelligence, deep tech, and the infrastructure underpinning cryptocurrency.

A key area of emphasis for this fund will be crypto infrastructure and security. Entrée Capital intends to support the development of foundational technologies that are considered essential for the next phase of growth across various industries.

The announcement has been met with positive reactions from the industry, highlighting the fund's potential to attract exceptional founders in the technology space. Entrée Capital has consistently positioned itself as a key player in the early-stage technology investment landscape.

Entrée Capital's Investment History and Bitcoin Market Context

Entrée Capital has a history of investing in Web3 infrastructure and Bitcoin-based payment solutions. This past activity demonstrates a consistent emphasis on building foundational technologies rather than focusing solely on consumer-facing products.

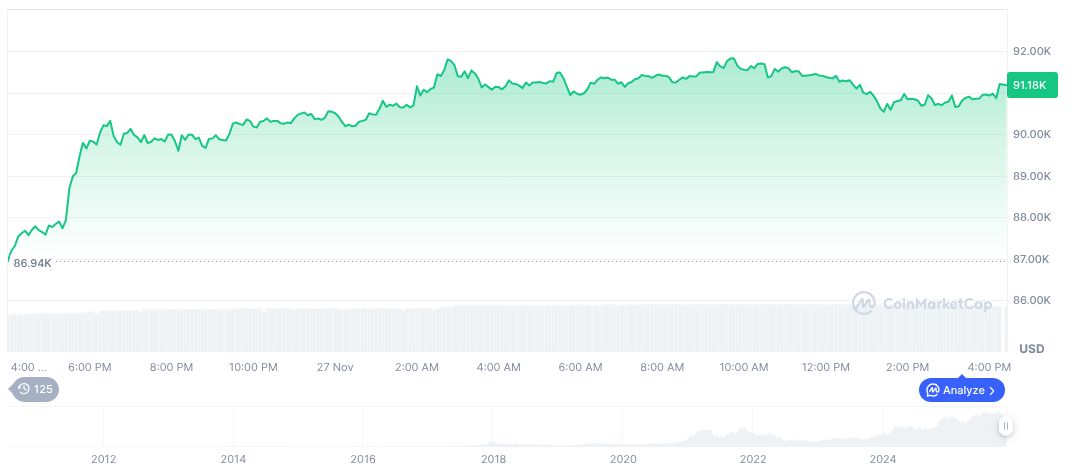

In the broader cryptocurrency market, Bitcoin is currently valued at $90,983.68, reflecting a slight increase of 0.34% over the past 24 hours. Its market capitalization stands at $1.82 trillion, with a dominance of 58.58% in the overall crypto market. These price fluctuations are often indicative of evolving investment trends and broader market dynamics.

Research from the Coincu team suggests that investments in foundational crypto infrastructure are likely to drive significant long-term growth. This investment strategy is considered less risky than direct token speculation, as it prioritizes resilience and technological advancements.

We are committed to backing exceptional founders building the impossible.