American Bitcoin Corp. (ABTC) announced on November 7, 2025, that it has acquired an additional 139 BTC, increasing its total holdings to 4,004 tokens. The company’s strategy blends large-scale Bitcoin mining operations with selective spot-market purchases to strengthen its long-term reserve position.

Eric Trump, co-founder and Chief Strategy Officer, stated that ABTC’s dual approach is designed to align shareholders directly with Bitcoin’s appreciation cycle while maintaining operational sustainability through self-mined supply.

Transparency and Nasdaq Growth

To reinforce investor confidence, American Bitcoin employs a proprietary “Satoshis Per Share” (SPS) metric that tracks Bitcoin ownership on a per-share basis, aiming to make reserve transparency measurable and investor-friendly.

The company made its Nasdaq debut in September 2025, following a merger with Gryphon Digital Mining. The listing marked a milestone for publicly traded Bitcoin miners, as ABTC positioned itself alongside industry peers like Marathon Digital and Riot Platforms.

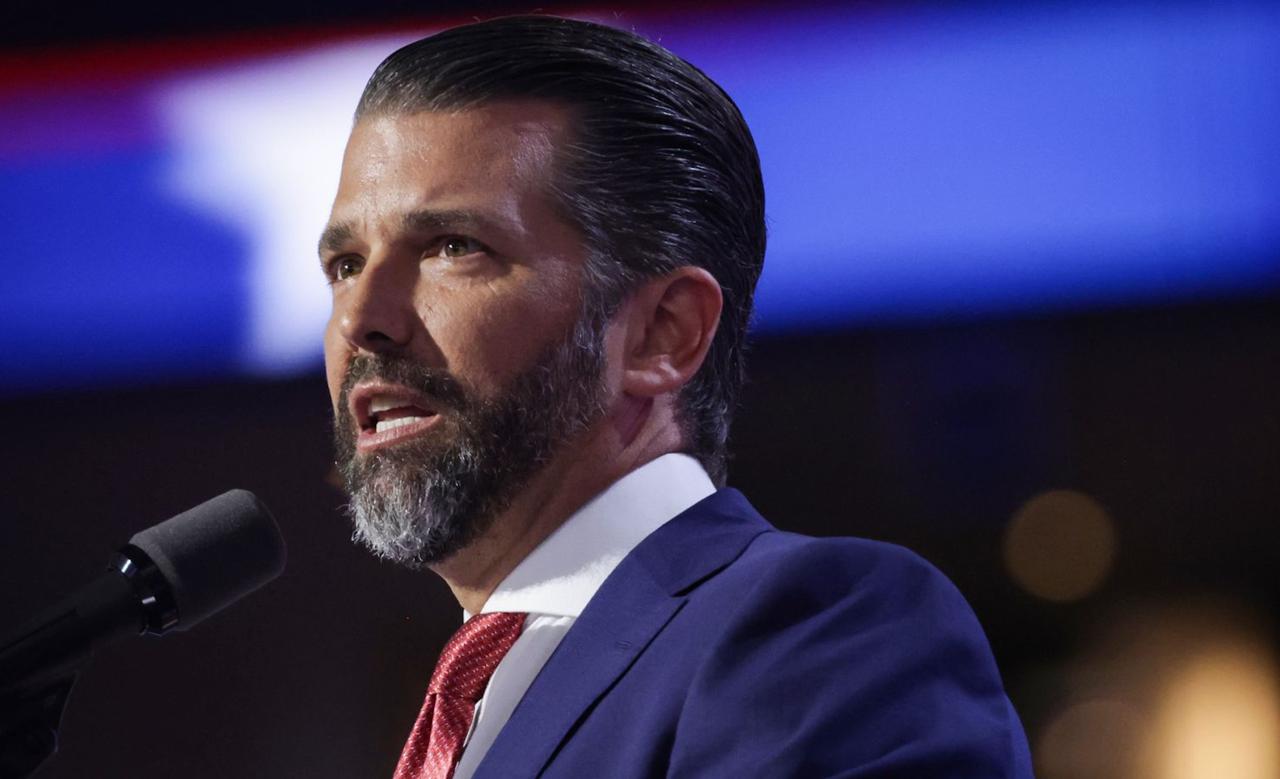

Trump Family Influence and Expanding Crypto Footprint

The Trump family’s active involvement continues to amplify the company’s visibility. Eric Trump’s leadership and ongoing endorsement from President Trump have fueled both institutional interest and media attention. However, their participation has also prompted discussions about potential conflicts of interest, given the family’s broader political and financial reach.

According to Reuters, the Trump family’s combined crypto-related ventures generated over $800 million in income during the first half of 2025. This includes stakes across Bitcoin mining, token infrastructure, and early-stage blockchain investments, underscoring their deepening exposure to the digital asset economy.