Exchange-Traded Funds (ETFs) have cemented their place in mainstream investing, with 16.9 million U.S. households now holding ETF positions as of 2024, according to data from the Investment Company Institute and the U.S. Census Bureau. This marks a record 12.8% household participation rate, underscoring the growing appeal of low-cost, diversified investment options.

Two decades ago, ETF ownership was limited to institutional traders and sophisticated investors. Today, thanks to retail-friendly apps like Robinhood, Fidelity, and Charles Schwab, ETFs have become a staple in personal finance, allowing households to gain exposure to equities, bonds, and even crypto-related sectors at minimal cost.

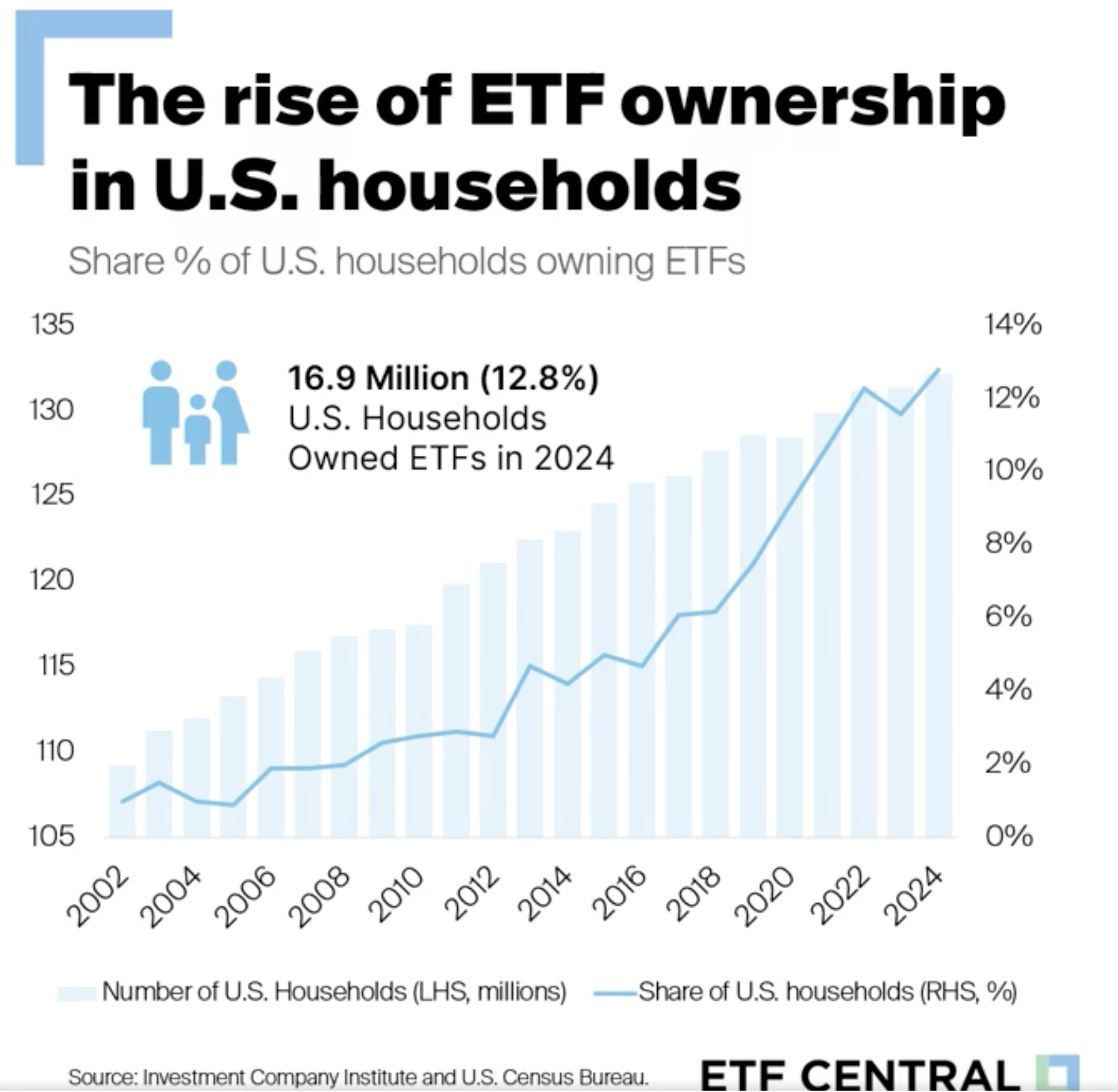

Chart Analysis: 20-Year Climb in ETF Popularity

The chart shows a steady rise in both the number of U.S. households and the percentage owning ETFs from 2002 to 2024. Between 2016 and 2020, ETF adoption began accelerating sharply, coinciding with a retail trading boom and the rise of zero-commission investing.

The trend intensified after 2020, when pandemic-era market volatility and stimulus-driven savings pushed millions of new investors toward ETFs for stability and long-term growth. The chart’s right axis shows ETF ownership nearing 13%, up from roughly 4% in 2012, an increase that reflects both broader financial literacy and trust in passive strategies.

Why Investors Are Choosing ETFs Over Mutual Funds

Several key factors explain the surge:

- •Lower fees: ETFs typically have lower expense ratios than mutual funds, appealing to cost-conscious investors.

- •Liquidity and transparency: ETFs trade on exchanges like stocks, allowing real-time buying and selling.

- •Diverse exposure: From the S&P 500 to niche themes like AI, green energy, and crypto, ETFs give investors access to multiple sectors without needing stock-picking expertise.

Financial advisors note that ETFs have become the “default building blocks” of modern portfolios, ideal for both passive investors and institutions seeking diversification.

Outlook: The ETF Revolution Is Just Getting Started

With ownership approaching 13% of all U.S. households, analysts predict ETF participation could exceed 20% by 2030. The next wave of growth may come from tokenized ETFs, fractional investing, and the continued rise of Bitcoin and Ethereum-based funds, which are drawing in a new generation of digital investors.

As households increasingly favor simplicity, transparency, and accessibility, ETFs appear poised to remain the backbone of retail investing for years to come, redefining how Americans build wealth in an age of automation and decentralized finance.