Altcoin Price Movements Following Sentiment Flip

The cryptocurrency market witnessed a notable upswing today, with major altcoins experiencing sharp gains. This bullish sentiment appears to be crowd-driven, leading to double-digit increases across several large-cap tokens.

While some traders are hopeful that this rally might signify a turning point for altcoins, broader market metrics continue to favor Bitcoin. This suggests that the current rebound could be a temporary reprieve rather than a sustained altcoin comeback.

Among the notable performers were Ethereum (ETH), Solana (SOL), and Sui (SUI). ETH traded around $3,002, SOL hovered near $138, and SUI saw a surge of approximately 20%. Sentiment trackers indicated a significant shift from panic to optimism in social chatter, which many interpret as a "reversal rally" triggered by relief from recent corporate-related uncertainties.

Macroeconomic Signals Continue to Favor Bitcoin (BTC)

Despite the recovery in some altcoins, the overall performance of the altcoin sector remains weak. The broader altcoin market has experienced declines over the past week.

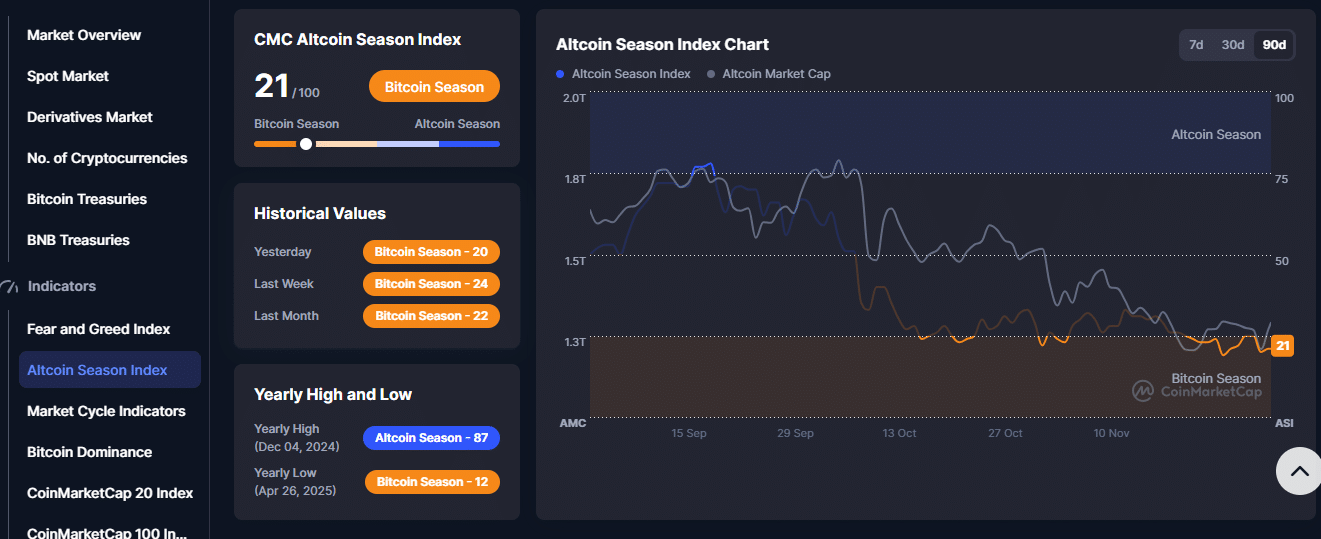

A key indicator of market sentiment, the Altcoin Season Index (ASI), is currently around 21 out of 100. This firmly places the market in "Bitcoin season," signifying that altcoins have been underperforming compared to BTC in recent weeks.

Market behavior appears cautious, with institutional interest still leaning towards Bitcoin. Capital flows into altcoins remain limited, and momentum seems to be driven by short-term traders rather than broad accumulation.

| Indicator | Latest Reading / Trend | Interpretation |

|---|---|---|

| Altcoin Season Index (ASI) | ~ 21/100 | Market still in Bitcoin season |

| Altcoin Market Cap (last 7 days) | Declining | Weak sector-wide demand |

| ETH, SOL, SUI prices | ETH ≈ $3,002 ; SOL ≈ $138 ; SUI up ~20 % | Relief rally on improved sentiment |

Conditions for Altcoin Strength Recovery

For a sustained altcoin rally to occur, two key signals need to align:

- •The market capitalization for altcoins must recover to previous highs, reclaiming a threshold of high-hundreds of billions or low-trillions of dollars.

- •The Altcoin Season Index must climb substantially, ideally surpassing the 25-30 level. Sustained readings above this range would indicate broad outperformance against Bitcoin.

Until these conditions are met, any gains may remain fragile. The current bounce appears to be driven by emotional shifts rather than deep structural changes in the market.

Key Watchpoints for Traders and Crypto Followers

The current market environment favors careful observation over aggressive trading. Traders interested in altcoins should await sustained improvement in key metrics before making significant moves. While occasional rallies present opportunities, they also carry elevated risk if sentiment reverses.

For long-term investors, Bitcoin remains the safer asset until altcoin demand shows consistent signs of returning. Monitoring market-cap data, the Altcoin Season Index, and capital flow trends will provide clearer signals than short-term price movements alone.

Conclusion

Analysis of the altcoin market reveals a landscape still heavily tilted towards Bitcoin, despite a sharp rebound in select tokens. While today's rally has injected optimism, broader metrics, market cap trends, and the Altcoin Season Index indicate the continued dominance of Bitcoin.

Altcoins are not currently experiencing sustained capital inflow; the recent bounce represents a tactical correction rather than a fundamental shift in market dynamics.

Glossary of Key Terms

- •Altcoin: Any cryptocurrency other than Bitcoin.

- •Market Cap: The total value of all coins of a cryptocurrency in circulation.

- •Altcoin Season Index (ASI): A gauge that compares altcoin performance to Bitcoin over a set period to indicate whether "altcoin season" is underway.

- •Bitcoin Dominance: The share of the total crypto market capitalization held by Bitcoin.

FAQs About Altcoin Market Analysis

1: Does the recent rebound confirm the start of an altcoin season?

No. A brief rebound does not confirm altcoin season. The Altcoin Season Index and market-cap trends still point toward Bitcoin dominance, indicating that the market has not yet shifted.

2: What signals should traders watch for a real altcoin recovery?

Traders should look for a steady rise in total altcoin market cap and a clear increase in the Altcoin Season Index above the 25 to 30 band. Broader capital inflow into altcoins is also a critical factor.

3: Why do sentiment swings impact altcoins so significantly?

Most altcoins tend to exhibit higher volatility and lower liquidity. This makes them more susceptible to crowd activity, social mood shifts, and rapid market turns.

4: Are short-term rallies safe to trade at this time?

Short-term rallies carry a higher degree of risk. Prices can reverse quickly if sentiment cools or if Bitcoin strengthens. Traders are advised to wait for consistent data signals rather than reacting solely to sudden price jumps.