Ethena’s ENA token is entering a tense week as price action slips toward a critical support level that has repeatedly defined its market structure.

While most sentiment indicators have turned sharply bearish, analysts argue that ENA may still be positioned for a meaningful recovery, but only if buyers defend this zone.

At the same time, the token is approaching one of the largest unlock events of the week, intensifying volatility and pressure across the market.

ENA Drops to $0.239 as Market Signals Turn Sharply Bearish

ENA currently trades at $0.2397, reflecting a market environment that has shifted decisively to the downside.

Volatility remains extremely elevated at 13.13%, showing how unstable price movements have become. The 14-Day RSI prints 37.78, a level that points to weakening momentum without yet reaching oversold conditions. ENA’s technical structure continues to deteriorate on longer timeframes as the token trades below both major moving averages: the 50-day SMA at $0.3508 and the 200-day SMA at $0.4836.

TradingView Chart Shows Heavy Drawdown Followed by Sharp Selloff

The TradingView chart illustrates ENA’s struggle to maintain upward momentum. After recovering toward the $0.29 region mid-week, the token was met with immediate rejection and quickly reversed lower. The decline accelerated in the final sessions, with heavy-volume candles accompanying a sudden breakdown that pushed ENA back beneath the $0.24 range.

The dual-color price overlay highlights how volatility widened significantly before the final selloff, a typical signal seen during liquidity sweeps and capitulation moments. The retracement brings ENA back to a familiar support zone that has played a decisive role several times earlier in the year.

ENA Retests a Major Multi-Month Support Zone

Crypto analyst Ali Martinez emphasizes this exact support level in his latest chart. According to his analysis, ENA has once again returned to a long-standing demand zone that has repeatedly triggered strong reactions in the past. He notes that ENA is “back at support,” and that holding this area could create the conditions for a move toward $0.50.

Ethena $ENA is back at support. Holding this level could set up a move toward $0.50. pic.twitter.com/spH7M5fdy6

— Ali (@ali_charts) December 1, 2025

His chart outlines two main trajectories. The first shows a controlled rebound followed by a period of consolidation before a potential climb toward the $0.47–$0.50 range. The second anticipates a deeper wick below support, a final shakeout, before a stronger reversal emerges. In both cases, the support line is the critical level that must remain intact for any bullish scenario to unfold.

Token Unlock Pressure Adds Fuel to Volatility

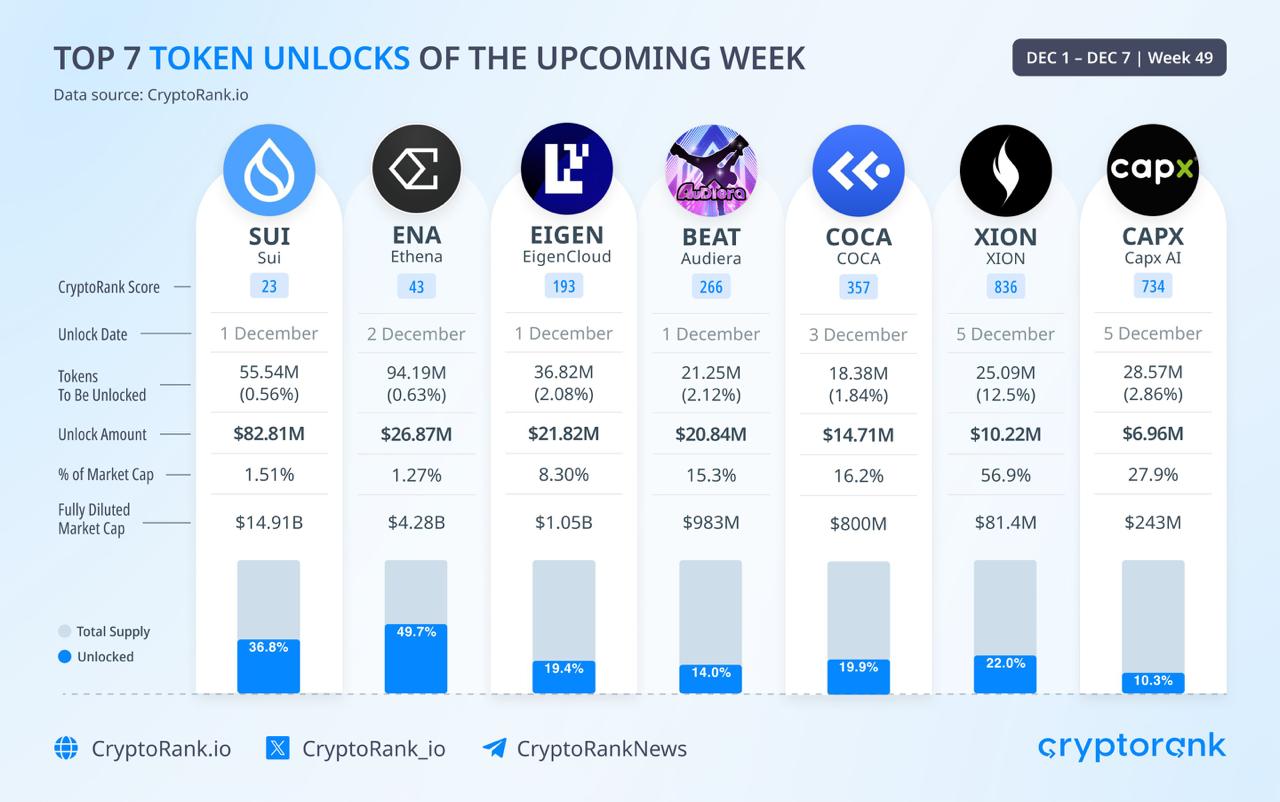

The CryptoRank data reveals that ENA faces a significant unlock event on December 2, when 94.19 million tokens will be released into circulation. This unlock is valued at $26.87 million and represents 0.63% of the token’s supply. Nearly half of all ENA tokens, specifically 49.7%, are already unlocked, meaning supply expansion remains meaningful but not excessive.

Historically, ENA has shown sensitivity to unlock cycles, and the timing of this release adds additional pressure as the token already grapples with elevated volatility and bearish sentiment. Traders are monitoring this event closely, understanding that unlocks often cause short-term fluctuations even when long-term fundamentals remain intact.

What Happens Next? ENA at a Make-or-Break Moment

ENA now stands at a decisive point where technical structure, investor psychology, and tokenomics converge. The token has reached a support level that has repeatedly served as the launch point for previous recoveries. At the same time, sentiment indicators and moving averages point clearly toward weakness, and the approaching unlock event threatens to add more supply-side stress.

Yet the bullish case remains possible. If ENA succeeds in holding this support, Ali’s projected path toward $0.50 becomes realistic. Failure to defend the level, however, could validate the more pessimistic forecast models and open the door to deeper declines.

For now, ENA trades in a high-risk, high-volatility environment, but one that still preserves the potential for a sharp and unexpected upside reaction, provided that buyers step in at this crucial moment.