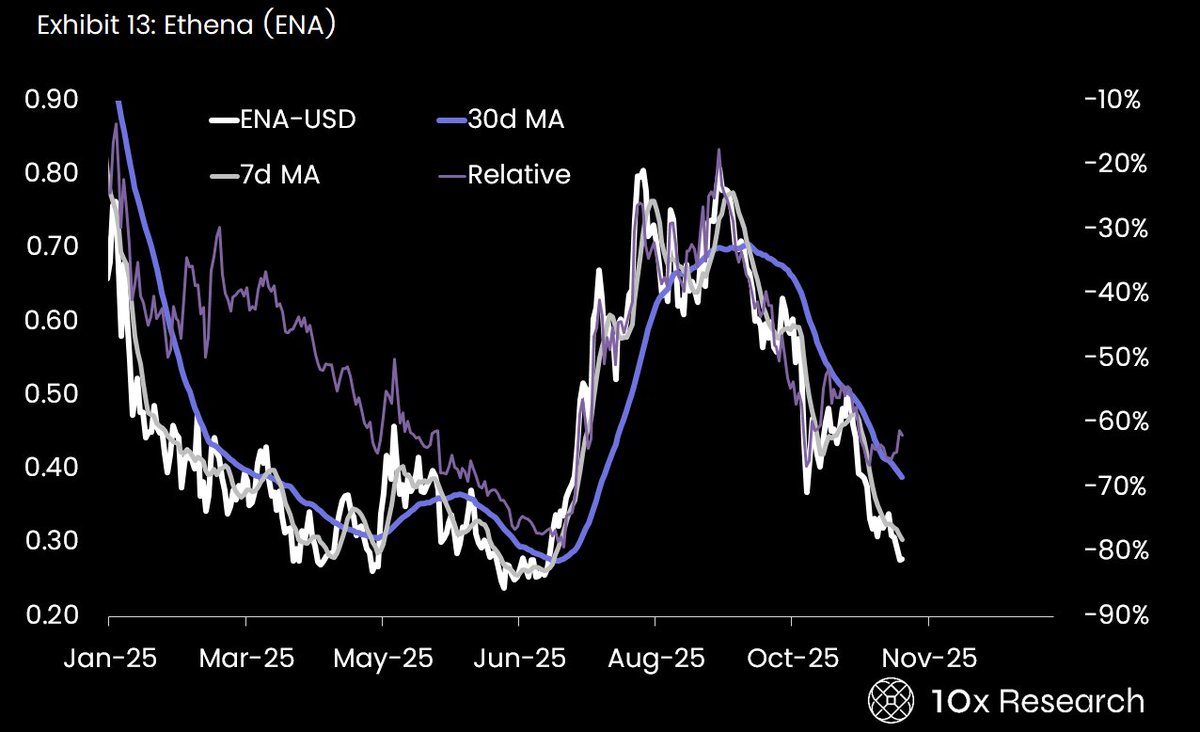

Ethena (ENA) continues to struggle in the market, sliding beneath both its 7-day and 30-day moving averages and confirming a reinforced bearish structure. Over the past week, ENA dropped roughly 13%, reflecting persistent downward pressure and the unwinding of its late-summer rally. Charts from 10x Research show a clear deterioration in trend: ENA’s strong August peak has fully reversed, with the asset now forming consistent lower highs and lower lows into mid-November.

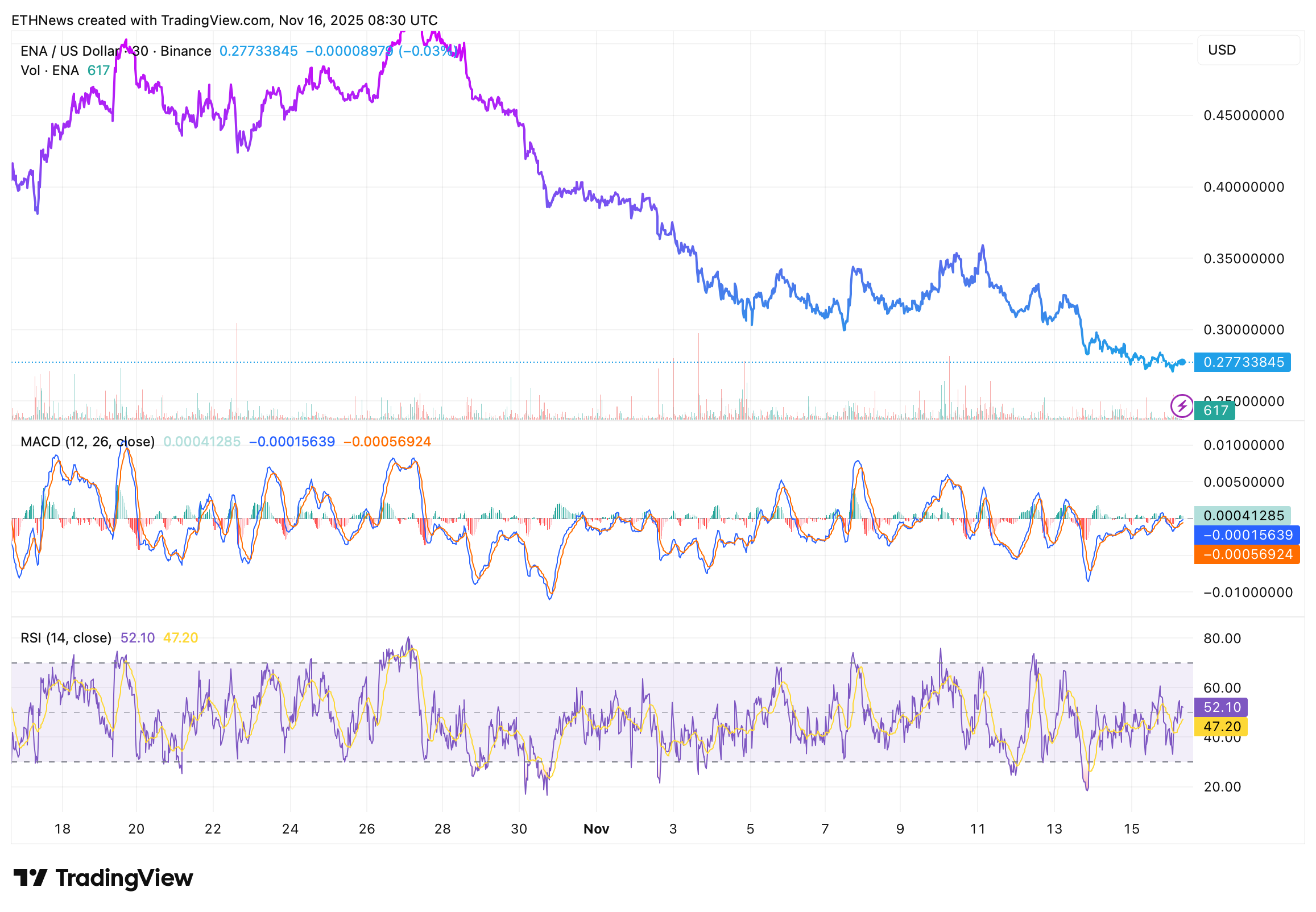

TradingView data reinforces the same picture. MACD momentum remains mildly negative and directionless, while RSI readings hovering between 47 and 52 indicate indecision rather than any oversold bounce potential. In short, ENA’s short-term structure is drifting sideways-to-lower, with no strong catalyst yet supporting a reversal.

Massive $5.7B Collateral Outflows Weigh on Sentiment

The most significant pressure point on ENA comes from approximately $5.7 billion in outflows from Ethena’s collateral pool. These withdrawals dramatically impacted the protocol’s TVL and placed immediate stress on ENA’s price throughout early November. The timing of the outflows, paired with broader risk-off behavior in the crypto market, accelerated selling and pushed ENA through multiple support levels.

Despite this, Ethena is not without institutional backing. Multicoin Capital confirmed a strategic investment into ENA, adding credibility to the long-term viability of the synthetic-dollar ecosystem. Yet, the short-term picture is still dominated by uncertainty and liquidity contraction.

Fee-Switch Activation Introduces Token-Holder Revenue Sharing

Ethena recently activated its fee-switch mechanism, a milestone that allows a portion of protocol revenue to flow directly to ENA token holders. This development introduces a sustainable monetization layer and aligns market performance with token-holder incentives. However, markets have not yet priced in the long-term benefits of the fee-switch, as broader sentiment remains dominated by the impact of outflows and weak market structure.

Technical charts still show ENA struggling beneath its key moving averages. The 30-day MA acts as firm overhead resistance, and relative-performance charts from 10x Research confirm that ENA significantly underperformed the wider altcoin sector throughout October and November.

ENA Price Levels to Watch in the Coming Days

With ENA trading near the $0.27 zone, bulls are watching for signs of stabilization. Short-term buy reactions have appeared around this level, but follow-through remains limited. For any meaningful recovery to take shape, ENA would need to reclaim the $0.32–$0.34 resistance band, an area where trend confirmation previously failed.

If the current drift continues, ENA risks retesting early-summer price levels, especially if outflows persist or if broader market weakness intensifies.

Outlook: Ethena Needs Momentum Shift to Recover

Ethena enters the second half of November with a weak technical foundation, pressured fundamentals, and cautious investor sentiment. A recovery remains possible, but it will require:

- •renewed TVL inflows,

- •a break above key moving averages,

- •and stronger volatility on the upside.

Until then, ENA’s momentum favors the sellers, and the token remains in a vulnerable position.