Ethereum and Dogecoin Recover After Flash Crash

The cryptocurrency market has begun recovering after the flash crash last week that caused losses worth double digits in major leading tokens. Ethereum and Dogecoin were first to recover, as both securities stabilized at critical support areas and began to exhibit initial signs of investor confidence.

Cup Pattern Points to Ethereum Price Rise

Ethereum price formation shows that the daily chart now has a cup formation, indicating a medium-term bullish reversal. The token rebounded off its support around $3,600 mark following the crash in the market and is currently consolidating around the $4,000 mark. Technical analysts said that breaking above $4,300 could reaffirm a new uptrend with a target of $4,800 within the next few weeks.

ETHUSD 4-Hr Chart:

This recovery outlook is also backed by volume dynamics. Post-crash, on-chain data recorded consistent accumulation by large addresses, supporting the perception that institutional buyers were taking the opportunity of the dip to re-enter the market. Ethereum’s good fundamentals keep drawing in flows from retail and institutional investors.

Additionally, with the softening of inflation data and the increase in expectations of Federal Reserve rate reductions, macro conditions might give risk assets an upper hand. This environment has long favored Ethereum, particularly when traders shift capital out of Bitcoin into high utility altcoins.

Analysts reckon that Ethereum could revisit its past annual highs, assuming this momentum continues in the next quarter.

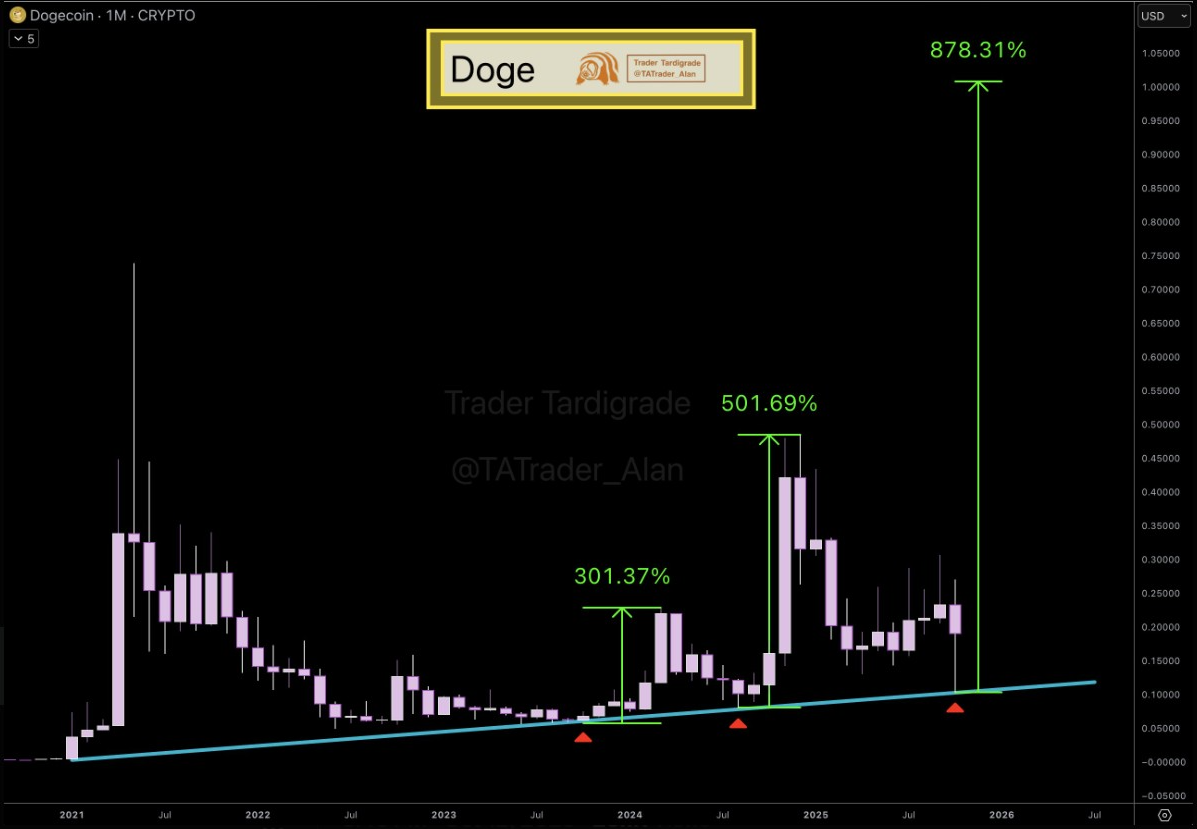

Dogecoin Price Prediction

Dogecoin price stabilized above $0.20 following a sharp correction earlier in October. Analysts identified $0.30 as the immediate resistance and noted that a sustained move beyond $0.40 could open the door for a broader rally. The price trend remains linked to Bitcoin’s direction, with historical data showing that DOGE often amplifies BTC’s movements during market cycles.

The broader market recovery reignited social interest in Dogecoin, with rising transaction volumes and community activity signaling growing optimism. Analysts noted that much of the recent accumulation appears to be spot-driven, indicating that investors are positioning for potential long-term gains rather than engaging in short-term speculation.

If macroeconomic sentiment continues to improve, Dogecoin could benefit from renewed liquidity in the altcoin sector. Analysts forecast that maintaining support above $0.20 could set the stage for a measured recovery toward $1 in the long term, provided that momentum aligns with Bitcoin’s broader cycle.

DOGEUSD 1-Month Chart |

The meme coin’s resilience amid volatility strengthened confidence among long-term holders. However, traders remain cautious, emphasizing that any move above $0.40 must be confirmed by strong volume and sustained retail participation. As the crypto landscape evolves, Dogecoin’s potential rebound continues to attract speculative inflows.

Conclusion

The rebound of the market after the flash crash highlights a new sense of optimism in the crypto industry. The cup shape of Ethereum is speculative in that it is an indicator of a potential boom, whereas the stability of Dogecoin at the major supports enhances confidence in the market.