The cryptocurrency market is currently in a phase of consolidation, with traders anticipating a potential Q4 rotation. Ethereum (ETH) and Chainlink are demonstrating resilience by holding strong support levels, suggesting a renewed sense of confidence in the market. Investors are actively seeking out promising altcoins that show early signs of potential growth before the next wave of capital inflows begins.

While market sentiment remains cautious, analysts are observing increasing accumulation in several high-potential projects. Hyperliquid, MAGACOIN FINANCE, and Avalanche are garnering significant attention due to their robust fundamentals, consistent growth trajectories, and active community participation. These cryptocurrencies are being identified as some of the best altcoins to buy before the anticipated shift in capital allocation intensifies.

Ethereum Price Analysis: Leading the Best Altcoins to Buy

Ethereum's price is currently facing pressure at a critical support level, with traders closely monitoring for any indications of a reversal. At the time of writing, ETH was trading at approximately $3,945, a notable decrease from its all-time high of $4,963. Despite this pullback, the current setup offers potential for upside as long as the support level holds firm.

The three-day chart indicates that ETH experienced a dip from $4,963 to $3,930 but remains in a bullish trend above the 50-day Exponential Moving Average. Furthermore, it is positioned above the pivot reversal level on the Murrey Math Lines tool, signaling that buyers are maintaining control of key territory.

ETH is presently trading near a significant swing level established in previous market cycles, just below $4,087, while still holding above the Supertrend indicator. A new bullish flag formation is developing, which could lead to a breakout towards $5,000. The bullish outlook would only be invalidated if the price falls below $3,500.

The underlying fundamentals of Ethereum remain strong. The network recently recorded over $1 trillion in stablecoin transactions within the current month. Transaction volumes have increased to 25.9 million, and revenue has grown to $16.8 million. These metrics underscore Ethereum's continued prominence as one of the best altcoins to buy in anticipation of the next market upswing.

Chainlink (LINK) Holds Support Before Q4 Rotation

Chainlink is currently trading within a descending channel and recently bounced off the lower boundary of this channel around the $16.60 mark. This pattern often signifies the conclusion of a corrective phase, with buyers beginning to re-enter the market. The price has been trending towards $18, with key resistance levels identified at $20.02, $23.75, and $27.81.

A breakout above $20 would confirm a bullish continuation. Conversely, rejection near this resistance level could lead to a period of short-term consolidation. Exchange reserves have decreased by 6.18% to approximately $2.88 billion, indicating that holders are moving LINK off exchanges, thereby reducing available supply.

Significant whale accumulation observed around the $16 price point, coupled with long-side dominance in futures data, suggests growing optimism. The tightening supply situation positions Chainlink as one of the best altcoins to buy before Q4 rotation starts to accelerate.

MAGACOIN FINANCE Sparks FOMO Among Early Buyers

Amidst expectations of a Q4 market rotation, MAGACOIN FINANCE is capturing considerable investor interest, with many positioning themselves ahead of the next market phase. Whale activity points to initial accumulation across multiple wallets, indicating a strengthening conviction in the project.

Retail traders are following suit, actively acquiring tokens before further price increases. The reduction in available supply has created evident signs of FOMO (Fear Of Missing Out) within the community, marked by a sharp rise in engagement and transaction volumes.

Analysts also highlight MAGACOIN FINANCE’s transparency, its early-stage development progress, and a clear roadmap for growth as factors making it an attractive option for investors seeking an early entry into the next market cycle. Those who position themselves early are likely to benefit from greater upside potential as liquidity and awareness increase throughout the rotation period.

Hyperliquid (HYPE): Buybacks Strengthen One of the Best Altcoins to Buy

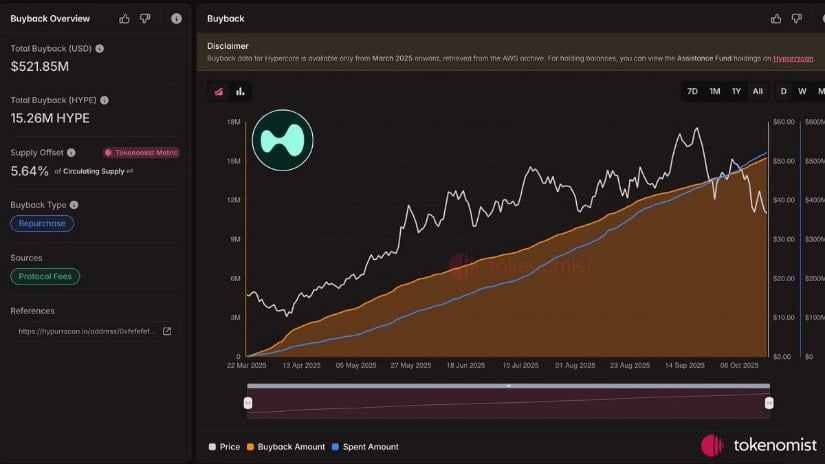

Hyperliquid is nearing a potential breakout, supported by consistent buyback programs, strong on-chain growth, and robust fundamentals that are bolstering market confidence. The project has repurchased over $521 million worth of HYPE, resulting in the burning of 5.6% of its circulating supply.

Source: Tokenomist

An additional $3 million was repurchased yesterday, bringing the total to $108 million within the past month. These ongoing buyback initiatives reduce the available liquidity in the market, contributing to price stability during potential corrections.

The recent activation of HyperEVM has further fueled optimism as the ecosystem continues to expand. Support levels between $34 and $37 have consistently held, providing a solid foundation for a potential breakout. Hyperliquid is considered one of the best altcoins to buy before the Q4 rally due to its strong fundamentals and sustained demand.

Avalanche (AVAX) Rebuilds Momentum Ahead of Q4 Rotation

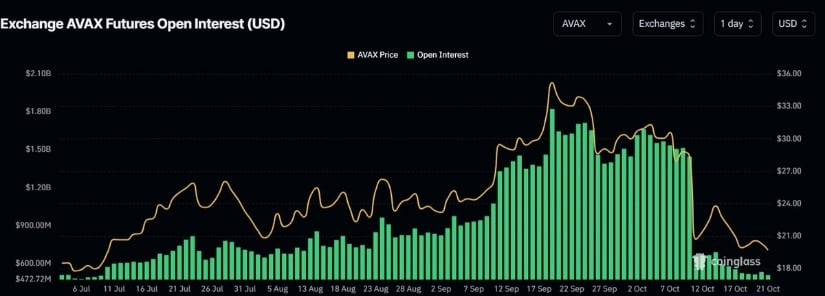

Following several weeks of sideways trading, Avalanche is demonstrating a resurgence in strength, supported by improving technical indicators and on-chain stability. Historically, AVAX has performed well towards the end of the year, a trend that may repeat itself as market sentiment continues to improve.

The narrative surrounding Decentralized Autonomous Treasuries (DATs) has injected new enthusiasm into the Avalanche ecosystem. AVAX has reclaimed the $20.7 level and is currently consolidating above the middle band of the Bollinger Bands, with the Relative Strength Index (RSI) trending towards 45.

Open interest has declined to $507 million, marking a three-month low. This indicates a cleaner market with fewer speculative positions, thereby increasing the likelihood of a sustainable uptrend. If AVAX maintains a trading price above $19.7, the next significant resistance levels to watch are $26 and $28.

Source: X

Conclusion

Ethereum and Chainlink continue to exhibit resilience, holding strong technical positions. Their ability to maintain key support levels is contributing to overall market sentiment stability in anticipation of the expected Q4 rotation.

Hyperliquid, Avalanche, and MAGACOIN FINANCE are currently attracting increased capital as investors strategically position themselves for the next phase of market growth. With an early accumulation phase underway and solid underlying fundamentals, these projects are identified as some of the best altcoins to buy before Q4 inflows accelerate.