According to a recent report shared by CryptoQuant, Ethereum’s derivatives market on Binance is sending mixed but increasingly delicate signals. While momentum indicators suggest improving market strength, underlying order flow data shows that sell-side pressure is quietly building beneath the surface.

Derivatives Momentum Is Rising Again

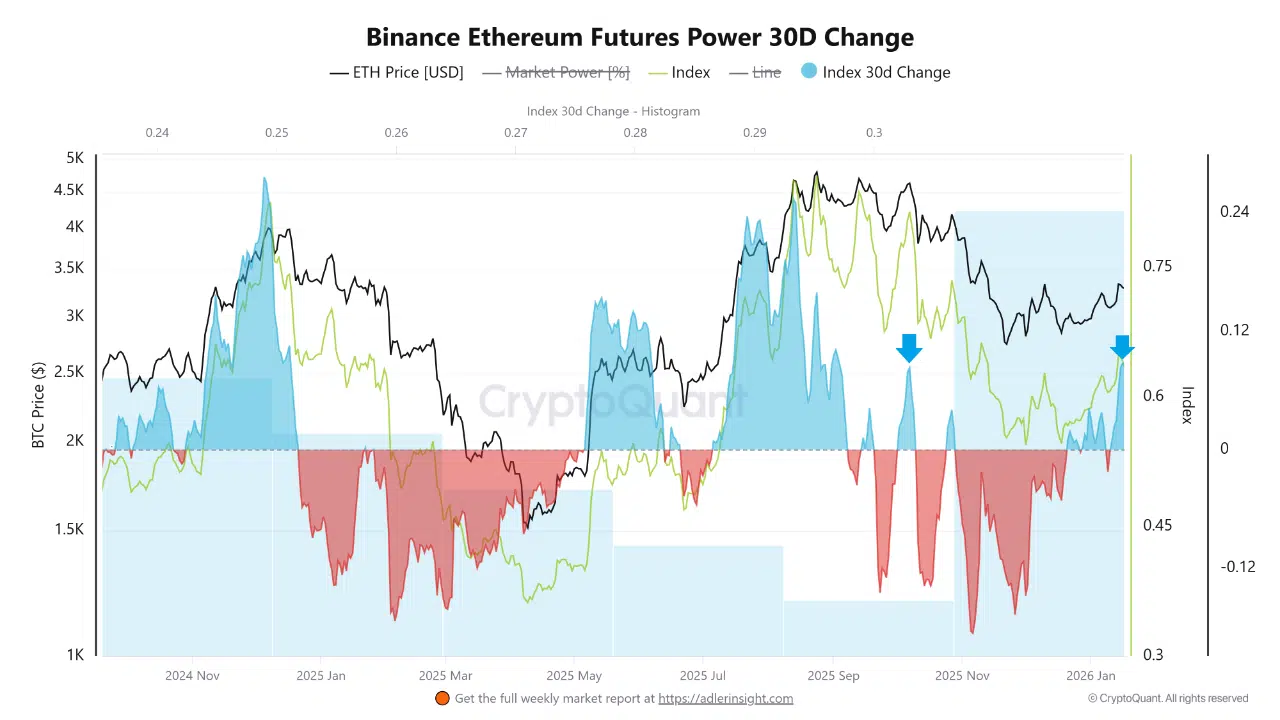

The Binance Ethereum Futures Power – 30D Change chart highlights a notable increase in Ethereum’s derivatives momentum. The composite index, shown in light green, blends price action with derivatives positioning to assess the real strength of the trend rather than surface-level price moves.

On January 16, the Index 30D Change reached +0.088, marking one of the strongest readings in recent months. The last comparable level occurred on October 7, when the index stood near 0.083 and Ethereum was trading above $4,600.

Historically, this context matters. Following the October signal, Ethereum’s price declined by nearly 40% in the weeks that followed, suggesting that sharp increases in derivatives power can sometimes precede periods of downside volatility rather than sustained upside continuation.

Net Taker Volume Signals Growing Distribution

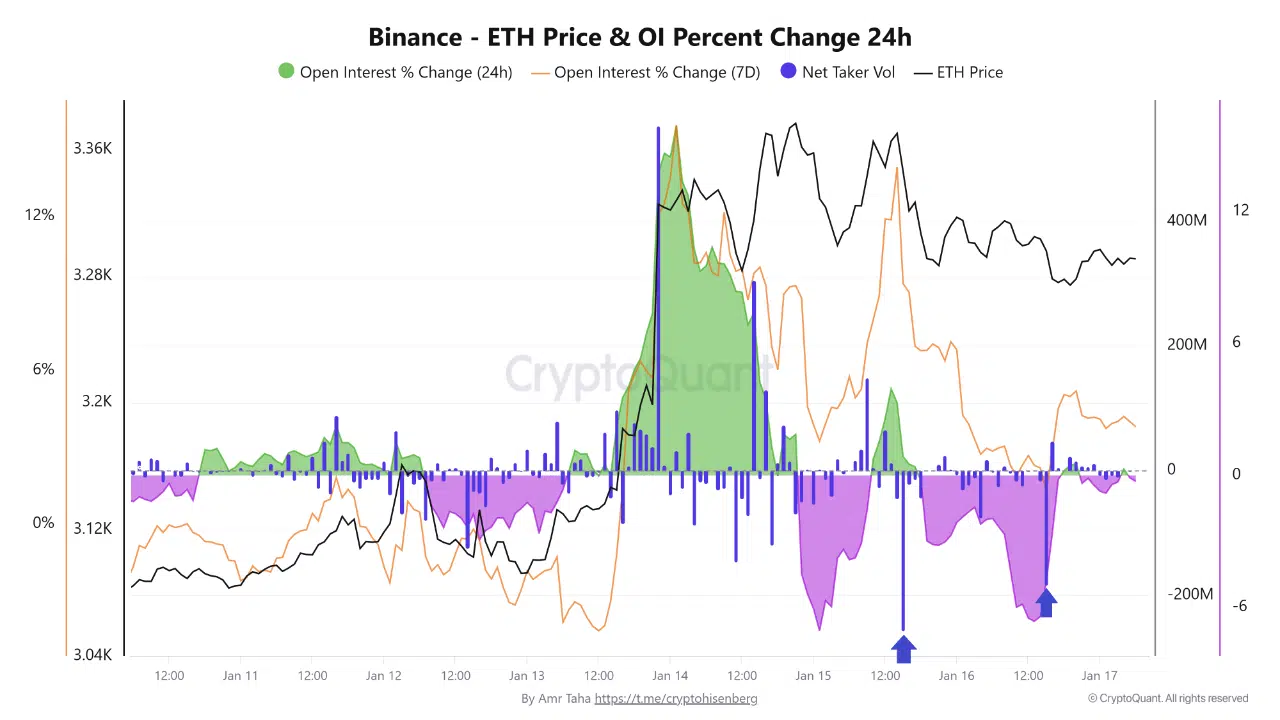

A second CryptoQuant chart tracking ETH price, open interest changes, and net taker volume adds further nuance. Despite stable price action, Binance derivatives data shows a clear deterioration in aggressive buying pressure.

- •On January 15, net taker volume fell to -257 million USD

- •On January 16, it remained negative at -183 million USD

Negative net taker volume reflects dominance of sell-side market orders. In practice, this often signals that larger players are either opening short positions or closing long exposure to lock in profits after a strong move. While this behavior does not guarantee an immediate price drop, it indicates that conviction on the buy side is weakening.

A Fragile Balance Between Momentum and Risk

Taken together, the data paints a cautious picture. Ethereum’s derivatives momentum has improved meaningfully, but this strength is increasingly accompanied by rising sell pressure rather than fresh demand. Historically, similar conditions have preceded corrective phases, especially when price struggles to break higher despite improving momentum indicators.

For now, the structure does not confirm a breakdown. However, CryptoQuant’s data suggests Ethereum is entering a phase where derivatives strength alone may not be enough to sustain upside without renewed spot demand. If negative net taker volume persists while momentum indicators remain elevated, volatility risks are likely to increase in the short term.

In short, Ethereum’s derivatives market is stronger than it was weeks ago, but that strength is starting to attract distribution rather than aggressive accumulation.