After nearly a full month of persistent outflows, Ethereum ETFs delivered their strongest weekly performance in November, marking a significant and noticeable shift.

New data indicates cumulative net inflows every single day this week, culminating in $312 million added to Ethereum ETF products. This firmly reverses the heavy downward trend that characterized the first three weeks of the month.

Ethereum ETFs Flip the Script

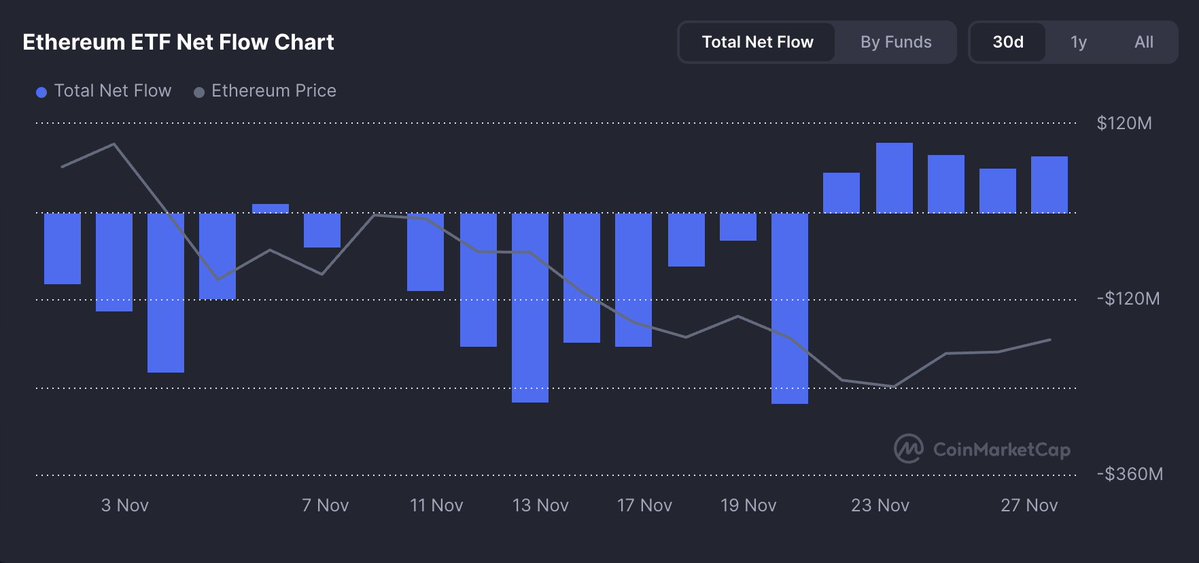

From November 1 to November 20, outflows were relentless. Charts show extended periods of negative net flow, with several days dipping below the $120 million mark. During this time, ETF buyers largely stepped aside as ETH struggled to maintain stability above the $3,000 territory.

This dynamic changed sharply this week. Beginning on November 23, the trend shifted from deep red to steady blue as buying pressure returned. Each trading session posted positive inflows, ranging from modest amounts to significant buys exceeding $100 million. By November 27, cumulative inflows reached $312 million, representing the largest weekly reversal since ETF trading commenced.

Factors Driving the Sudden Turn

Several converging forces appear to be contributing to this shift:

- •Returning Risk Appetite: Investors are positioning themselves early in anticipation of December's macroeconomic catalysts, including U.S. inflation reports and renewed expectations for interest rate cuts in the first quarter.

- •ETH Resilience Around $2,900–$3,000: Ethereum stabilized at a psychologically important level, which encouraged institutional investors to re-enter the market.

- •ETF Market Structure: Following three weeks of selling pressure, many funds reached oversold positions, increasing the likelihood of a significant rebound in flows.

- •Anticipation of Ethereum Upgrades: Continued demand for staking and the upcoming roadmap milestones are influencing long-term ETF positioning.

Price Action Trails Inflows

Despite the strong rebound in inflows, the price of ETH has not yet fully reflected this change. The price line remained relatively muted while inflows increased, a pattern that historically precedes an expansion in volatility. Evidence suggests that ETF flows tend to lead price movements rather than follow them.

If inflows persist through early December, a sustained move above the $3,050–$3,150 range becomes increasingly probable.

Potential Bottom Formation Hinges on Sustained Inflows

ETF flows serve as a clear indicator of institutional conviction. After a multi-week decline that dominated November, the abrupt shift to consistent inflows may signal the market's attempt to establish a local bottom.

The critical question now is whether this positive trend will continue into the following week.

If the inflows hold, Ethereum could begin December with renewed momentum and a substantially stronger foundation compared to earlier in the month.