Ethereum is entering a phase of long-term growth driven by staking expansion, Layer 2 adoption, and ETF inflows. All these structural factors lead to reduced liquid supply and stronger price appreciation. Forecasting models by different sources indicate alignment toward higher valuations.

On-chain indicators show that staking ratios are improving and fee burns remain consistent during high periods of activity. This sets up a self-reinforcing cycle of supply reduction, which in turn lifts long-term price expectations. Ethereum continues to operate as a strong settlement layer in the crypto industry.

If Ethereum continues to hold key support levels and the network grows, long-term projections across analytics platforms converge in a range from 4,222 to 7,766 USD. This band reflects increased institutional adoption and maturing demand structures. ETH remains a high conviction long-term asset.

| TL;DR: – ETH might reach 2,873–3,470 USD in 2025 if it breaks above and sustains at 4800 levels. – 2026 is likely to be a consolidation year with a trading band between 3,182–3,341 USD. – 2027–2028 could trigger the big expansion phase that pushes ETH to 2,700–3,441 USD (2027) and 4,500–6,000 USD (2028). – 2030 fair-value projections converge near 11,800 USD depending on ETF adoption and staking supply reduction. – ETH remains deflationary and strengthens long-term bullish structure. |

ETH Price Prediction 2025–2030

2025 Price Prediction: 2,873 to 3,470 USD

Ethereum may head to 2,873 to 3,470 USD in 2025, if it confirms the breakout above 4800 USD. This would follow continuation patterns that appear after major structural upgrades. ETF inflows offer strong fundamental support.

On-chain data reflects decreased liquid supply, increased staking participation, and higher fee burning. Exchange reserves continue to dwindle, creating supply compression, a key driver for upside acceleration.

CoinCodex models project a range of 2,873 to 3,470 USD, with an average of around 3,200 USD. This is supported by measurable supply reduction and rising network activity for 2025.

2026 Price Prediction: 3,182 to 3,341 USD

In 2026, the market might develop a consolidation range as conditions cool down after the prior expansion. This is a typical cycle reset where ETH stabilizes before entering the next leg upward.

Staking reduces circulating supply and softens retracement pressure. This creates an environment for controlled correction and higher lows across the cycle.

Kraken’s model puts ETH between 3,182 and 3,341 USD. This stage provides a stable accumulation base for the next expansion.

2027 Price Prediction: 2,700 to 3,441 USD

The 2027 cycle should see the revival of strong upside momentum once the implementation of Danksharding, Layer 2 scaling, and throughput upgrades is done, considerably increasing the capacity of the network.

With the expansion of AUM, ETFs’ institutional participation also increases. Ethereum’s role as a global settlement infrastructure is enhanced, raising its structural demand.

CoinDataFlow estimates put the upper band at about 3,441 USD and a mean near 3,000 USD. This is an expression of both scaling efficiency and increased institutional reliance on Ethereum.

2028 Price Prediction: 4,500 to 6,000 USD

Ethereum, in 2028, reaches a phase of institutional maturity where ETFs and enterprises begin deeper integration with ETH. Demand becomes more structured and less dependent on speculative waves.

Aggressive expansion of Layer 2 ecosystems ramps up activity on Arbitrum, Optimism, Base, and zkSync. The greater throughput leads to consistent fee burning, thus reducing supply.

Changelly estimates that ETH may range from 4,500 to 6,000 USD, averaging around 5,200 USD, while transitioning from speculative cycles into institutional-led adoption.

2029–2030 Price Prediction: 9000 to 15000 USD

Long-term models converge to valuations centered around 11,800 USD by the year 2030, reflecting upgraded scaling, rising staking ratios, and sustained ETF inflows.

The institutional-grade valuation model by VanEck puts ETH at 11,800 USD by 2030. It shows long-term stability with conservative, fundamentals-driven projections.

Ethereum Price Prediction Table

| Year | Forecast Range | Mean | Source | Evaluation | Verdict |

|---|---|---|---|---|---|

| 2025 | 2,873 – 3,470 | 3,200 | CoinCodex | ETF flow + staking | Reasonable |

| 2026 | 3,182 – 3,341 | 3,260 | Kraken | Cycle cooling | Valid |

| 2027 | 2,700 – 3,441 | 3,000 | CoinDataFlow | Scaling maturity | Aggressive |

| 2028 | 4,500 – 6,000 | 5,200 | Changelly | Institutional demand | Plausible |

| 2029–2030 | 11,800 | 11,800 | VanEck | Long-term valuation | Realistic |

On-Chain and Flow Analysis for Ethereum Price Prediction

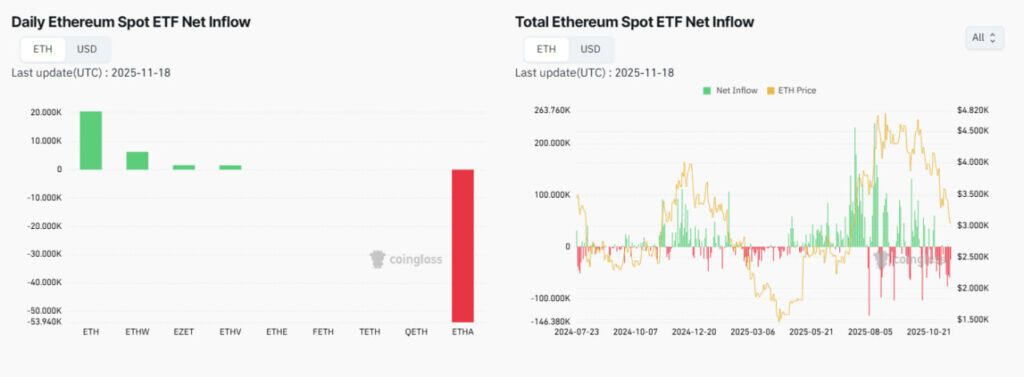

Net ETF inflows strengthen the accumulation narrative as CoinGlass data shows consistent positive netflow across major Ethereum spot ETFs. Daily flows highlight strong green inflows into core ETH products, while only one fund shows a large isolated outflow.

As a result, rising ETF inflows typically precede supply squeezes when price breaks back above key levels, especially the 4400 to 4600 zone. If this region flips to support, ETF accumulation increases the probability of a move toward 6500 to 7800. Failure to reclaim it may extend consolidation near 3800 to 4200.

KOL Insights

According to the series of tweets by KOL Benjamin Cowen, the 3800–4200 USD region is highlighted as Ethereum’s key cycle support area, containing the bull market support band, the 20-week SMA, and the long-term regression baseline.

Cowen further emphasizes that ETH needs to protect this area to maintain its macro uptrend into 2025. In his latest update on YouTube, Cowen pinpoints ETH’s rejection near 4800 at the top regression band.

The move was in line with a bearish weekly RSI divergence and weakening MACD momentum. He says that this is a textbook signal of a cooling phase before any continuation higher.

Why it matters: Reclaiming 4400 to 4600 confirms the next leg toward 6500 to 7800. Losing the 3800 to 4200 support zone risks a deeper revisit of 3200 to 3500. These levels define Ethereum’s breakout path and its multi-year direction through 2025 to 2027.

Conclusion

Ethereum benefits from liquid supply reduction, rising staking participation, expanding Layer 2 ecosystems, and increasing institutional demand. These secular drivers of price create a structural backdrop for higher prices over a multiyear horizon.

Combined models suggest ETH reaches 2,873 to 3,470 USD in 2025, expands into 2,700 to 3,441 USD in 2027, and ultimately enters the 11,800 USD valuation zone by 2030. Ethereum remains one of the most high-conviction assets in the digital asset space.

FAQs

1. Will ETH reach 10000 USD?

Yes. Most long-term models project ETH to surpass 10000 USD between 2027 and 2030.

2. Is ETH still deflationary?

Yes, fee burn and staking take away circulating supply during high activity.

3. What fuels long-term ETH growth?

Staking, ETF inflows, Layer 2 scaling, and real-world asset settlement.

4. What is the 2030 forecast?

ETH is projected around 11,800 USD based on VanEck’s institutional-grade valuation model.