Key Market Indicators for Ethereum

- •Ethereum is testing a significant resistance zone, with analysts predicting a potential reversal.

- •Declining spot trading volumes suggest an increase in market volatility for Ethereum.

- •Analysts are closely monitoring Ethereum's price action amidst current market uncertainty.

Ethereum is currently at a critical juncture as it tests a key resistance zone. Analysts are closely observing for signs that could indicate a potential market reversal. The decline in spot trading volumes for Ethereum suggests that the cryptocurrency's price could experience increased volatility in the near future.

Ethereum Faces Resistance Amid Market Shift

Ethereum (ETH) has recently encountered a critical resistance zone, a development forecasted by analyst More Crypto Online. This specific zone has historically served as a key area for potential price reversals, and Ethereum is now exhibiting initial reactions to this resistance.

$ETH is showing a first reaction to our resistance zone – pretty much where it is expected.

— More Crypto Online (@Morecryptoonl) December 5, 2025

It is possible that wave 4 has formed at top. I am watching closely. https://t.co/kGgotcuSyUpic.twitter.com/BNxHAFeKf5

The analyst has indicated that the recent price peak might represent the formation of wave 4, which could signal a shift in market dynamics. Considering this possibility, Ethereum's price movement might be setting the stage for a potential downturn.

More Crypto Online has stated that the cryptocurrency's price behavior is consistent with prior projections. The identified resistance zone is considered crucial for determining the subsequent phase of market activity. At the time of this report, Ethereum (ETH) is trading at $3,030.62, reflecting a 3.6% decrease over the past 24 hours.

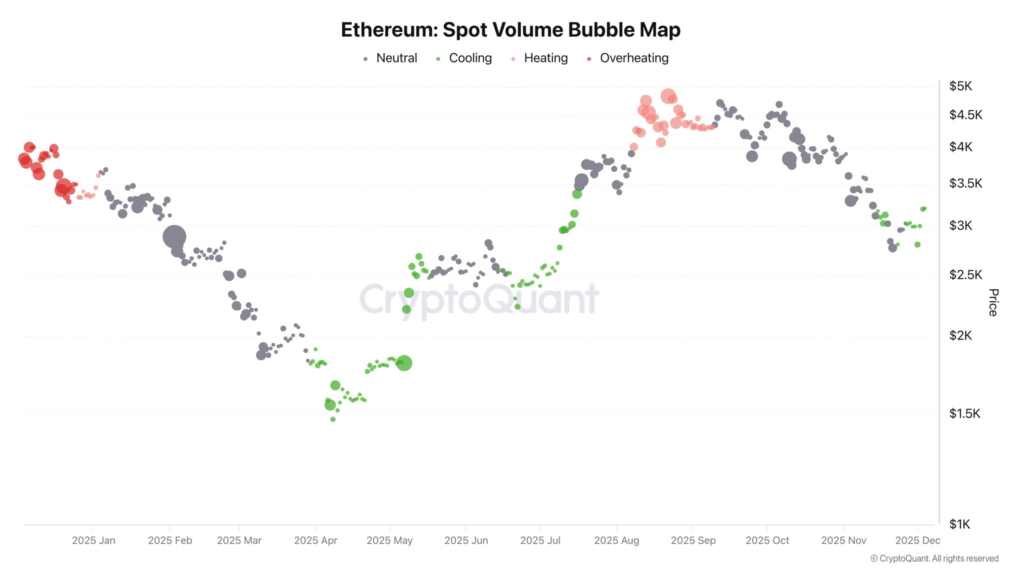

Spot Volumes Decline, Risks of Increased Volatility

In contrast, prominent analyst Darkfost has highlighted a change in Ethereum’s market structure. Over the past few days, Ethereum has experienced a reduction in spot trading volumes, even as its price saw a minor recovery.

Darkfost observes that this trend diminishes the influence of buying and selling activity on the asset's price, allowing futures markets to exert a more significant role in dictating price direction.

A weakness in spot volume amplifies the risk of heightened volatility. The analyst explains that with a reduced number of buy and sell orders available, sudden market movements become more challenging to absorb. This situation creates an environment where futures-driven momentum can have a more substantial impact on price fluctuations.