Key Developments in Brief

- •Bitmine has acquired an additional 63,539 ETH, increasing its total holdings to $13.07 billion, representing 2.73% of the total Ethereum supply.

- •Ethereum ETFs experienced net outflows of $145.7 million on October 20, with significant outflows from BlackRock and Fidelity.

- •Ethereum's price has been rejected at the $4,100 resistance level and is currently testing crucial support near $3,800, indicating rising market volatility.

Whale Accumulation Activity

Ethereum has witnessed significant activity from large holders, commonly referred to as whales. Bitmine, a notable entity, acquired 63,539 ETH, valued at approximately $251.6 million, according to data from Lookonchain. This substantial acquisition involved the movement of ETH into three new wallets, originating from Kraken and BitGo, which suggests a strategic accumulation phase by major players.

Following this acquisition, Bitmine's total Ethereum holdings now amount to 3,299,553 ETH, with an estimated value of $13.07 billion. This represents a significant 2.73% of the total circulating supply of Ethereum. In a separate but related development, another wallet, identified as 0xAeA5, withdrew an additional 7,527 ETH from the OKX exchange. This particular wallet has withdrawn a total of 11,860 ETH, equivalent to $46.26 million, over the past week.

The observed trend of large-scale withdrawals and purchases indicates a strong accumulation sentiment among significant market participants. This behavior could signal their positioning for potential long-term price appreciation of Ethereum. However, it is important to note that such divergence between whale activity and the current price action can sometimes precede short-term market reversals.

ETF Outflows and Price Rejection

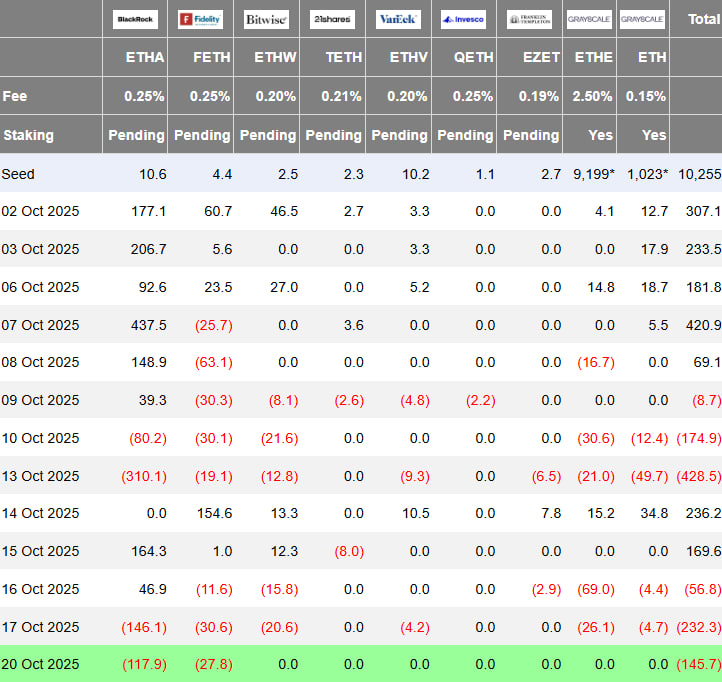

In contrast to the confident accumulation by whales, Ethereum-based Exchange Traded Funds (ETFs) recorded substantial net outflows totaling $145.7 million on October 20. This data, compiled by analyst Ted, highlights a shift in institutional sentiment. BlackRock's Ethereum ETF (ETHA) experienced the largest outflow, amounting to $117.9 million, while Fidelity's ETF saw outflows of $27.8 million. These figures represent one of the most significant single-day outflows observed in recent weeks.

The rise in outflows suggests a weakening institutional confidence in Ethereum's short-term prospects. While whales continue to accumulate, these outflows indicate that some institutional investors are reducing their exposure to ETH, possibly due to prevailing macroeconomic uncertainties and strategic positioning related to Federal Reserve policies.

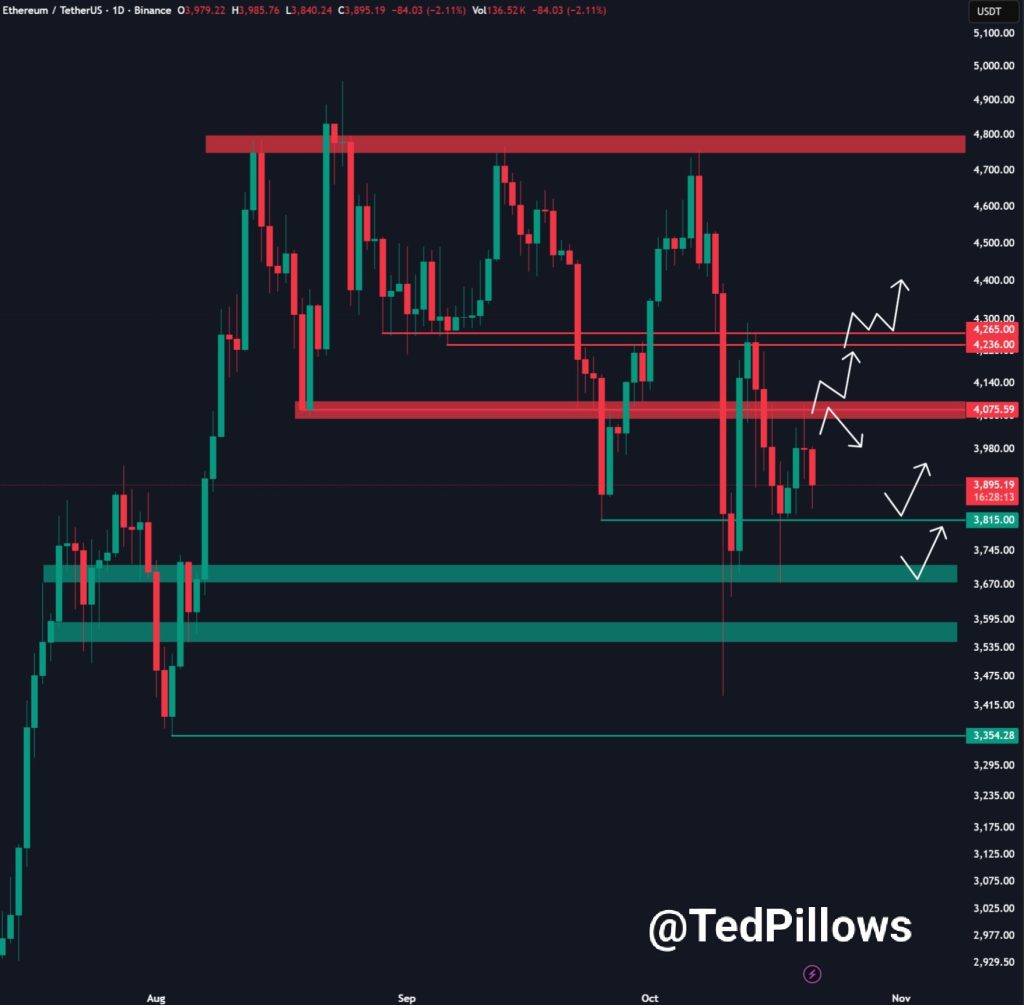

From a price perspective, Ethereum recently encountered resistance at the $4,100 level, leading to a rejection. The cryptocurrency is now approaching a critical support zone around $3,800. According to Ted, a successful retest of this support level could potentially trigger a price bounce. Conversely, a breakdown below this key support could lead to further bearish price action, with the potential for a decline towards lower price levels.

As of October 21, data from CoinMarketCap indicates that ETH is trading at approximately $3,873.27. This price reflects a slight decrease of 0.56% in the last hour, a more significant drop of 4.28% over the past 24 hours, and a 3.03% decrease over the last week. This ongoing price weakness underscores a period of market indecision, even in the presence of substantial whale-led accumulation activity.