The Ethereum Foundation (EF) has confirmed a fresh move to liquidate a portion of its treasury. On Friday, the foundation announced it would convert 1,000 ETH into stablecoins using CoWSwap’s TWAP feature.

The conversion, aimed at supporting research, grants, and donations, underscores the group’s ongoing funding strategy. Last month, it carried out a much larger sale, swapping 10,000 ETH worth $43.6 million into stablecoins on centralized exchanges.

1/ Today, The Ethereum Foundation will convert 1000 ETH to stablecoins via 🐮 @CoWSwap's TWAP feature, as part of our ongoing work to fund R&D, grants and donations, and to highlight the power of DeFi.

— Ethereum Foundation (@ethereumfndn) October 3, 2025

This latest ETH sale is part of the foundation’s plan to manage its spending and keep enough cash on hand. Recently, it slowed down or paused some grant programs to save money. Some users on X suggested smarter options, like borrowing against ETH using decentralized finance (DeFi) lending platforms or making private deals with big crypto treasuries.

Balancing treasury policy and DeFi growth

According to its treasury policy, the Ethereum Foundation seeks to balance returns with its stewardship role. “EF seeks to balance between seeking returns above a benchmark rate and extending EF’s role as a steward of the Ethereum ecosystem, with a particular focus on DeFi,” it explained.

Besides treasury adjustments, the foundation also paused open grant submissions under its Ecosystem Support Program. It cited an overwhelming influx of applications and pledged to prioritize projects addressing Ethereum’s most pressing needs.

Earlier this year, EF also made some big changes to improve how it runs. In April, it named Hsiao‑Wei Wang and Tomasz K. Stańczak as Co‑Executive Directors to strengthen leadership. Then in June, it reorganized its main development team and let go of some staff to make operations more efficient.

Ethereum’s continued DeFi dominance

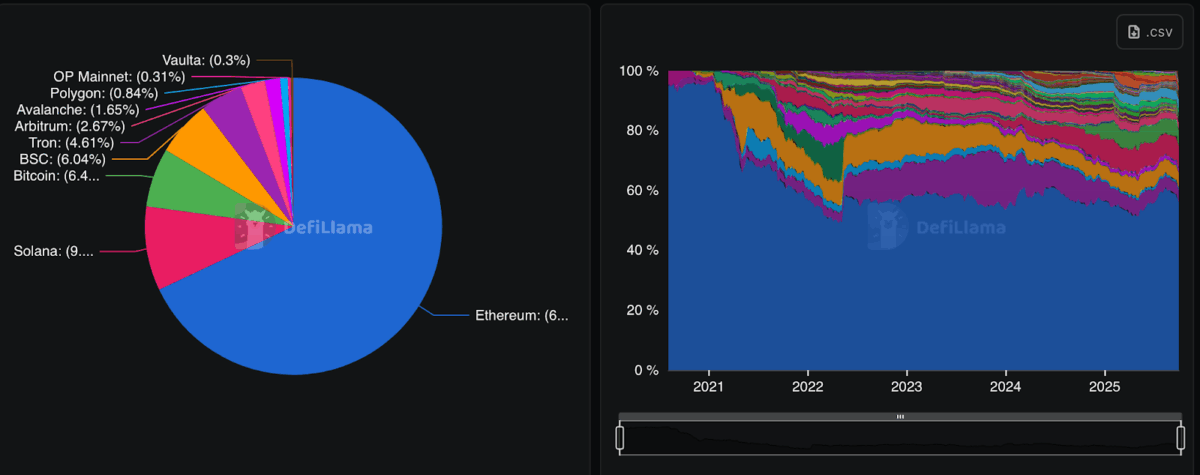

DeFiLlama data shows Ethereum is the top platform in the DeFi space. It holds around 61 % of all funds locked in DeFi. Solana comes next with about 9 %, followed by Bitcoin at 6.4 %, and Binance Smart Chain at 6 %. Other platforms like Tron, Arbitrum, and Avalanche have smaller shares, but they are slowly growing.

Since 2020, Ethereum has remained the top player in DeFi. Still, platforms like Solana and Arbitrum are slowly gaining ground, proving the DeFi space is getting more varied.

EF’s ETH-to-stablecoin move and team reshuffle show it’s funding smartly and backing DeFi. Ethereum stays strong while focusing on key network needs.