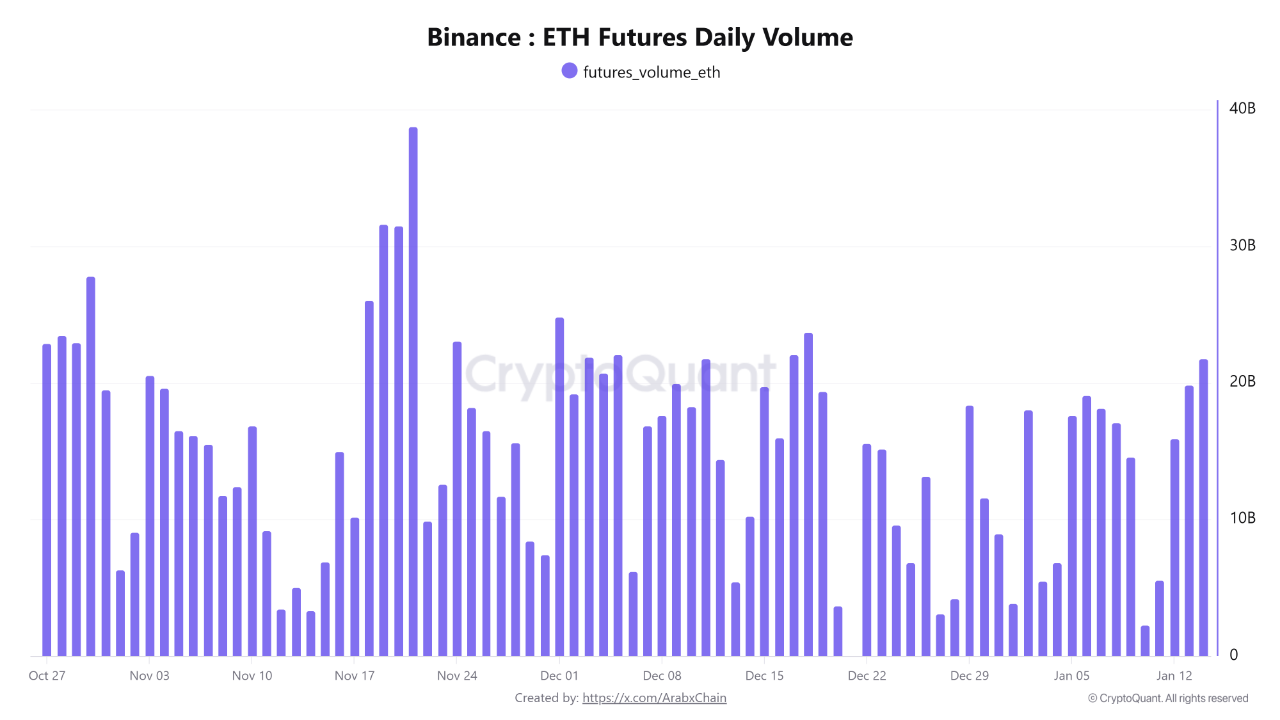

Ethereum futures trading activity on Binance has surged back to levels not seen since mid-December, marking a sharp shift in derivatives participation after several weeks of muted engagement.

According to data shared by Arab Chain and CryptoQuant, daily ETH futures volume climbed to nearly $21.7 billion, the strongest reading in over a month.

The pickup stands out after a period of declining volumes that followed mid-December, when price action stabilized and traders largely stepped back from opening aggressive positions. The latest data signals that market participants are once again positioning with size.

Binance Volume Reawakens After Weeks of Decline

The CryptoQuant chart shows a clear rebound in ETH futures volume through early January, reversing the downtrend that dominated the second half of December. During that earlier phase, reduced activity coincided with tighter price ranges and lower risk appetite across both short-term traders and larger market participants.

This recent expansion in volume reflects a change in behavior. Rather than waiting on the sidelines, traders are returning to futures markets, increasing leverage usage and hedging activity as price movement becomes more decisive.

What the Surge Signals for Market Structure

While elevated futures volume does not inherently point to a bullish or bearish outcome, it does highlight a rise in conviction. Periods of expanding derivatives volume typically accompany stronger participation, deeper liquidity, and a greater willingness to express directional views.

The current spike suggests that traders are preparing for wider price swings compared with the relatively compressed conditions seen in late December. Increased activity at this scale often appears when markets approach key technical or psychological levels, prompting positioning on both sides.

Participation Returns as Volatility Expectations Build

Arab Chain noted that the return to the highest futures volume since mid-December indicates renewed interest in Ethereum as a high-beta asset. The data reflects a shift away from the wait-and-see posture that characterized recent weeks, toward more active speculation and risk management.

As derivatives participation accelerates, the credibility of near-term price moves tends to strengthen, regardless of direction. For now, the standout development is clear: Ethereum futures traders are back in force on Binance, and market engagement is rising fast.