Ethereum (ETH) has experienced a significant rebound over the past 24 hours, with its price climbing 4.94% to trade at $3,590 at press time. This surge has boosted its market capitalization to $433 billion. Trading volume also saw a substantial increase of 58.34%, reaching $35.83 billion, which indicates heightened investor activity across the broader altcoin market. The positive momentum appears to be driven by an improving macroeconomic outlook, particularly as the U.S. government approaches the resolution of its 40-day shutdown, thereby reducing investor uncertainty and increasing appetite for risk assets.

Price Action and Market Dynamics

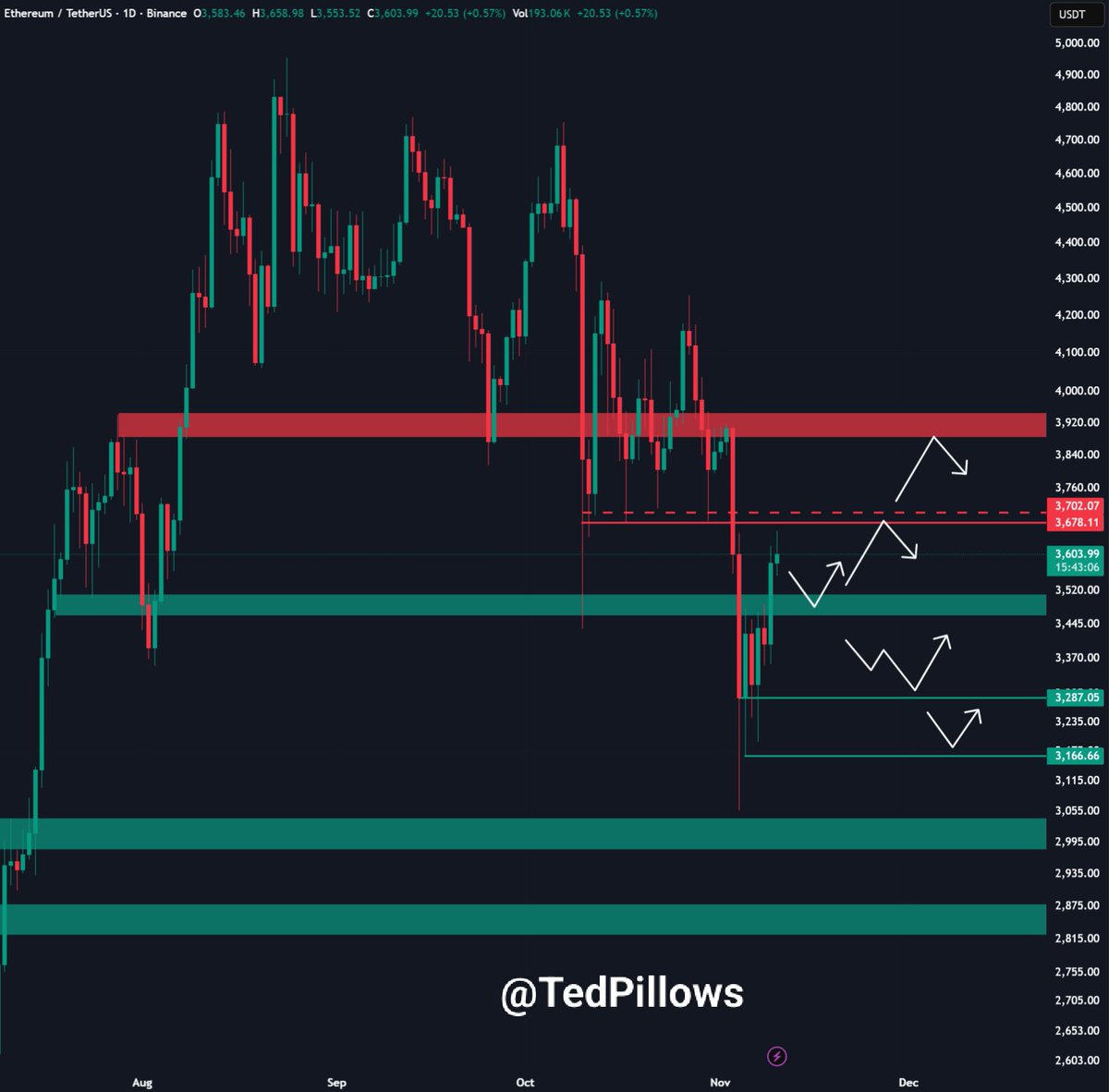

On the Binance exchange, ETH has been trading around the $3,580 mark this morning, demonstrating steady consolidation above the $3,500 support level. Technical analyst Ted Pillows has noted that Ethereum is currently approaching a critical resistance zone near $3,700. A sustained daily close above this level could potentially trigger a rally towards the $4,000 mark. Conversely, a rejection at this resistance could lead to a short-term correction, with prices potentially falling back to the $3,400 support area.

Leverage and Whale Activity

Data from CryptoQuant, as reported by Maartunn, indicates that Ethereum's open interest has risen by $1.9 billion, a 10.2% increase in the last 24 hours. This jump suggests that the current rally may be influenced by leverage. Historically, approximately 75% of such open interest spikes tend to revert, which serves as a caution for traders to be aware of a potential cooldown if long positions become excessively crowded.

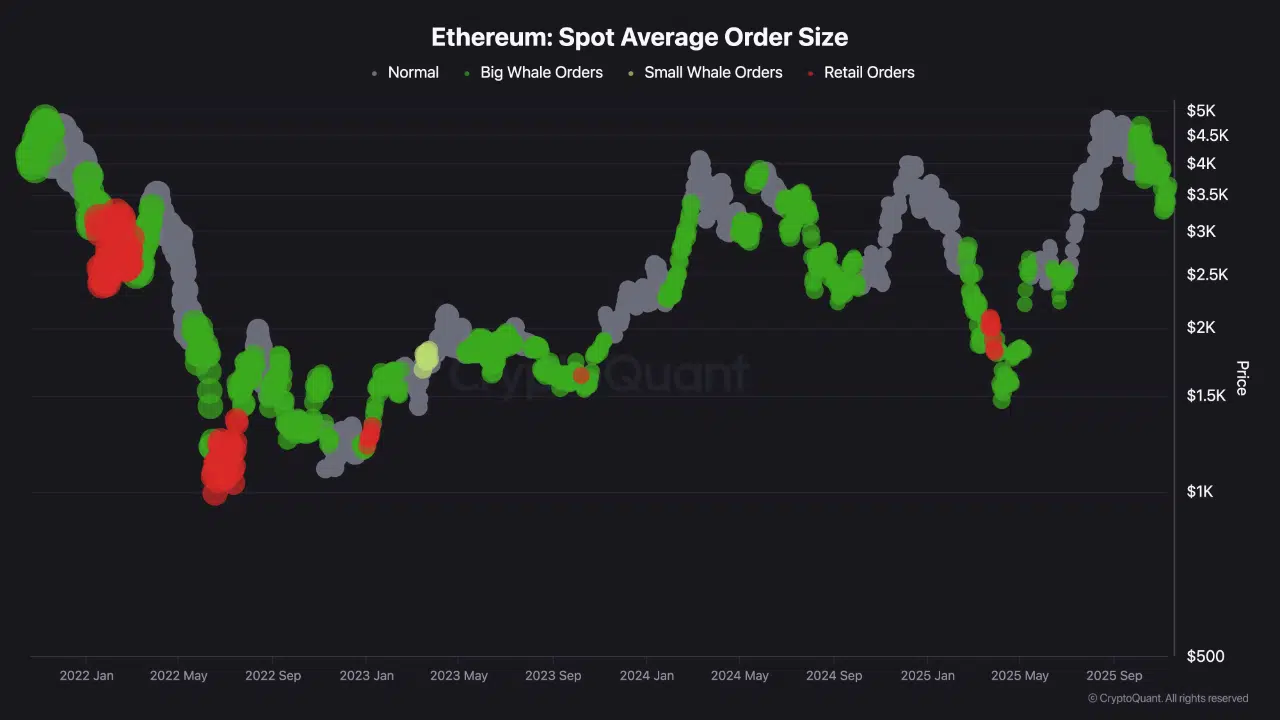

Furthermore, on-chain data from CryptoQuant reveals a notable increase in whale activity concentrated around the $3,200–$3,400 price range. This suggests that significant institutional investors and large individual holders have been actively accumulating Ethereum at these lower levels.

This pattern of accumulation by whales often precedes the development of stronger breakout trends and can signal the early stages of a new bullish phase.

Outlook and Future Price Targets

If Ethereum successfully maintains its support above the $3,400 level and manages to break through the $3,700 resistance, analysts are projecting that it could enter a new bullish leg. This potential advance could target price levels between $4,500 and $4,800 in the medium term. For the present, ETH is situated in a critical price zone, and the trading activity over the next few daily periods will be crucial in determining whether this current upward movement signifies the beginning of Ethereum's next major price advance.