Market Overview

Ethereum remains above the $3,000 zone as weekly price action forms a controlled support reaction. Ethereum shows sharp intraday swings while broader structure holds steady around a long-tested demand area. Ethereum is controlled on the market, and it will do without critical support when whales move it.

Eth is trading close to one of the important support levels, with the overall market responding to volatility. The weekly structure forms a steady base while short-term movements show sharp yet controlled liquidity shifts across the session.

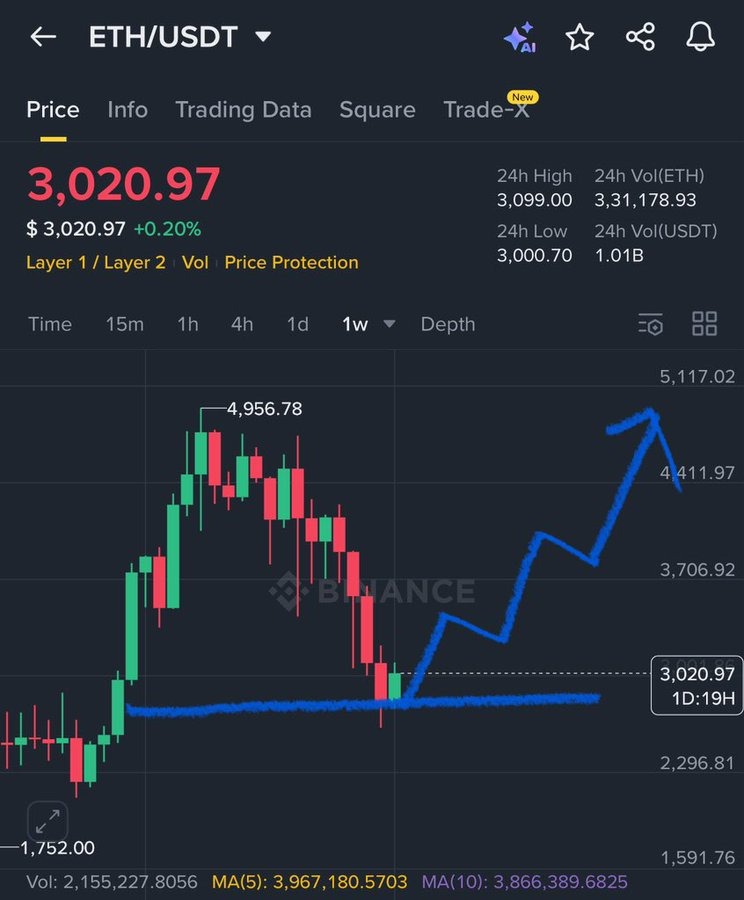

Ethereum Tests a Multi-Month Support Zone

Ethereum enters the week holding above the $3,000 region after a long corrective move from the $4,956 high. The support band between $2,900 and $3,000 remains one of the most active demand areas in recent cycles. Price has repeatedly reacted at this zone with long lower wicks showing strong buyer interest.

A weekly chart shared by Crypto GVR shows Ethereum following a projected path into this support line. The current candle forms with early signs of absorption as selling momentum slows. Volume behavior appears steadier than earlier phases where pressure created abrupt declines.

The outlined projection shows Ethereum reclaiming levels at $3,700 and $4,400 before testing near $5,117. That path relies on the formation of higher lows emerging from the present area. The current structure sits at a point where the next weekly move may define the trend.

Ethereum Faces Intraday Volatility but Holds Structure

The 24-hour chart illustrates that Ethereum had swings because it shot up the steep expansions and down the steep retrogressions. Market cap briefly reached the mid-$370B area before sharp pullbacks created wide intraday ranges. These movements point to active liquidity adjustments during the session.

Despite the fluctuations, Ethereum repeatedly returned to the core mid-range. That behavior shows a temporary balance between short-term buyers and sellers. Reactive flows shaped much of the session rather than directional conviction.

Late-session weakness pushed Ethereum toward the lower band of the range. The quick stabilization that followed kept price anchored near $3,000. This maintained the broader structure even as short-term volatility remained elevated.

Ethereum Reacts to Whale Transfers Without Losing Support

Whale activity reports added another layer to the session as an early holder moved 1,300 ETH to Wintermute. Total transfers reached 6,000 ETH since November. The wallet accumulated at $203 and now manages substantial gains through steady repositioning.

Movements from older addresses often draw attention due to their scale and timing. These transfers appeared structured rather than abrupt, suggesting systematic management. The sessions following the transfers showed volatility but no break of the long-term support zone.

Ethereum as at the time of writing trades at $3,003.86 with a 24-hour volume of $19.4B and minimal daily change. The asset maintains a 9.64% gain over the past week as the market waits for the next weekly candle to confirm trend direction.