Ethereum is trading sharply higher after a broad market surge lifted prices across major crypto assets.

ETH was last seen around $3,380, up roughly 6.2% over the past 24 hours, with market capitalization rising in step to about $408.5 billion. The move places Ethereum near the upper end of its recent range following a rapid intraday advance.

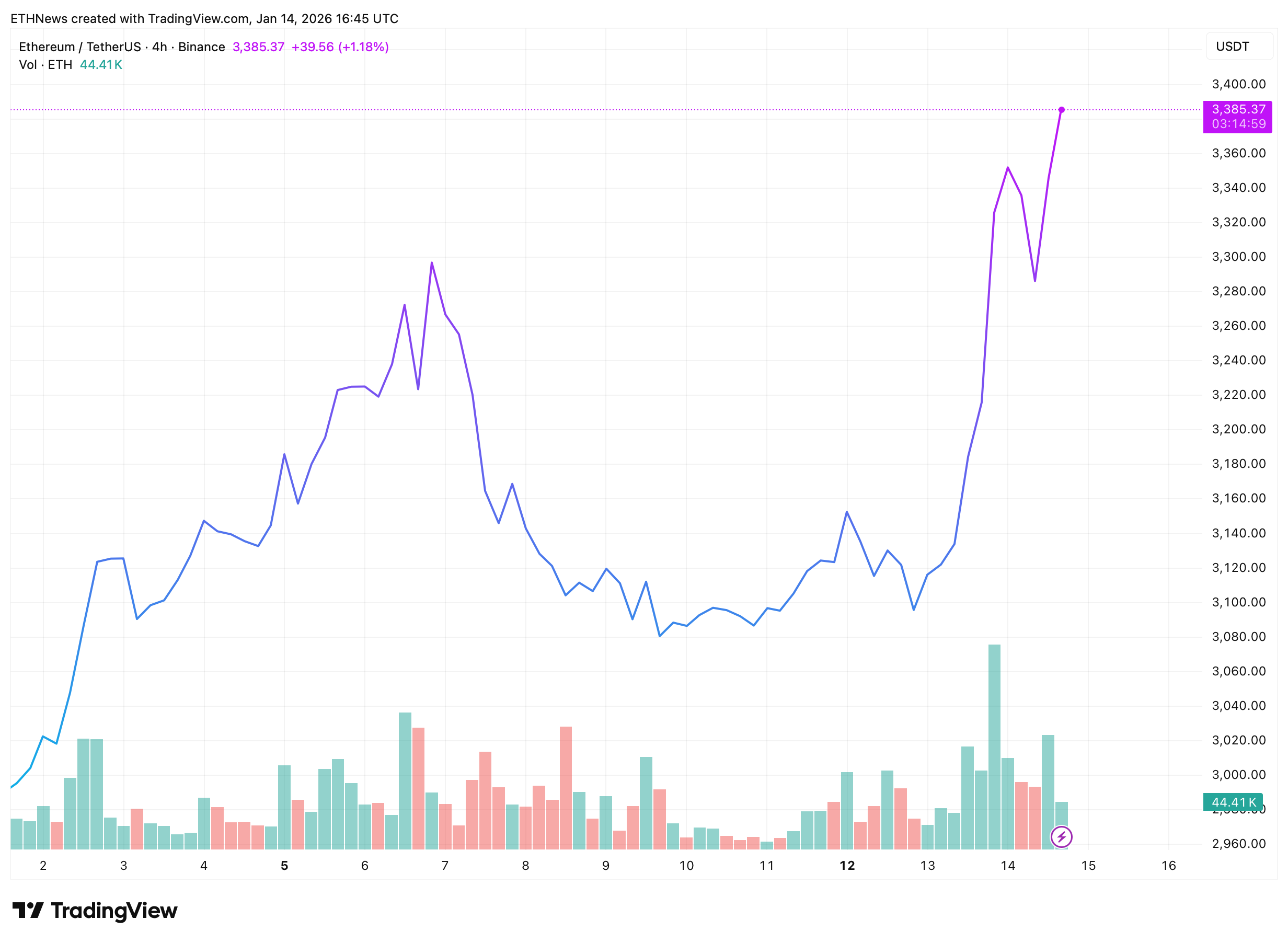

Price action turned aggressive late in the session. After consolidating near the low-$3,100 area, ETH broke higher with little hesitation, climbing through intermediate levels before pushing into the mid-$3,300s. Volume expanded materially during the move, with 24-hour trading activity jumping to $35.87 billion, up nearly 79%.

Price Structure and Technical Backdrop

The four-hour chart shows a clear momentum shift. Ethereum transitioned from a choppy base into a steep upside move, briefly pulling back near $3,290 before resuming higher toward $3,385. Rather than fading back into the prior range, price held elevated, signaling sustained demand at higher levels.

Technical readings reflect strength without extreme conditions. ETH is trading well above its 50-day simple moving average at $3,044, while remaining below the 200-day SMA near $3,582. The 14-day RSI stands at 64.58, still within neutral territory despite the sharp rally. Volatility is marked as medium at 3.28%, consistent with fast but orderly price expansion.

Macro Data and Forced Positioning Fuel the Move

A key catalyst behind the rally was fresh U.S. inflation data released earlier today. Core CPI came in at 2.6%, below expectations of 2.7%, reviving demand for non-sovereign risk assets as rate-cut expectations firmed. Ethereum reacted quickly as capital moved back into higher-beta exposure.

That macro impulse collided with heavy positioning. Nearly $591 million in crypto short positions were liquidated over the past 24 hours, accelerating upside momentum as bearish trades were forcibly closed. The speed of ETH’s move reflects that mechanical unwind rather than a slow, incremental bid.

Supply Tightening and Capital Rotation

Structural supply dynamics added further pressure. Staked ETH has climbed to a new all-time high of 36 million ETH, representing roughly 30% of total supply. With fewer coins circulating on exchanges, price movements have become more sensitive to demand shifts, amplifying the impact of sudden buying.

Ethereum also outperformed Bitcoin on the day, pointing to a clear rotation back into higher-volatility assets after a period of Bitcoin dominance. That shift was reinforced by continued institutional participation, with steady inflows reported into spot Ethereum ETFs, renewed activity from Fidelity and BlackRock, and a fresh filing from Morgan Stanley.

Together, tightening supply, forced liquidations, and supportive macro data have pushed Ethereum into a higher trading regime, with price holding near session highs rather than retreating after the initial surge.