Ethereum’s market structure has taken a sharp turn over the past 48 hours, and the shift is written clearly across both liquidity maps and futures/spot ratios.

What looked like another routine pullback has instead revealed a silent but aggressive move from deep-pocketed buyers. Liquidity was drained, absorbed, and flipped into a reaccumulation phase, exactly the type of pattern that has preceded major expansions in previous cycles.

The charts gathered today show a coordinated sweep: sell-side liquidity was cleared, bid walls were hit, and whales quietly stepped in to reload while most traders focused on the noise. At the same time, futures positioning on Binance is rising relative to spot, suggesting traders are warming up for stronger short-term momentum. Combined, the data paints a more dynamic picture of Ethereum’s near-term path.

Whales Absorb the Dump as Liquidity Map Reveals a Classic Reaccumulation Pattern

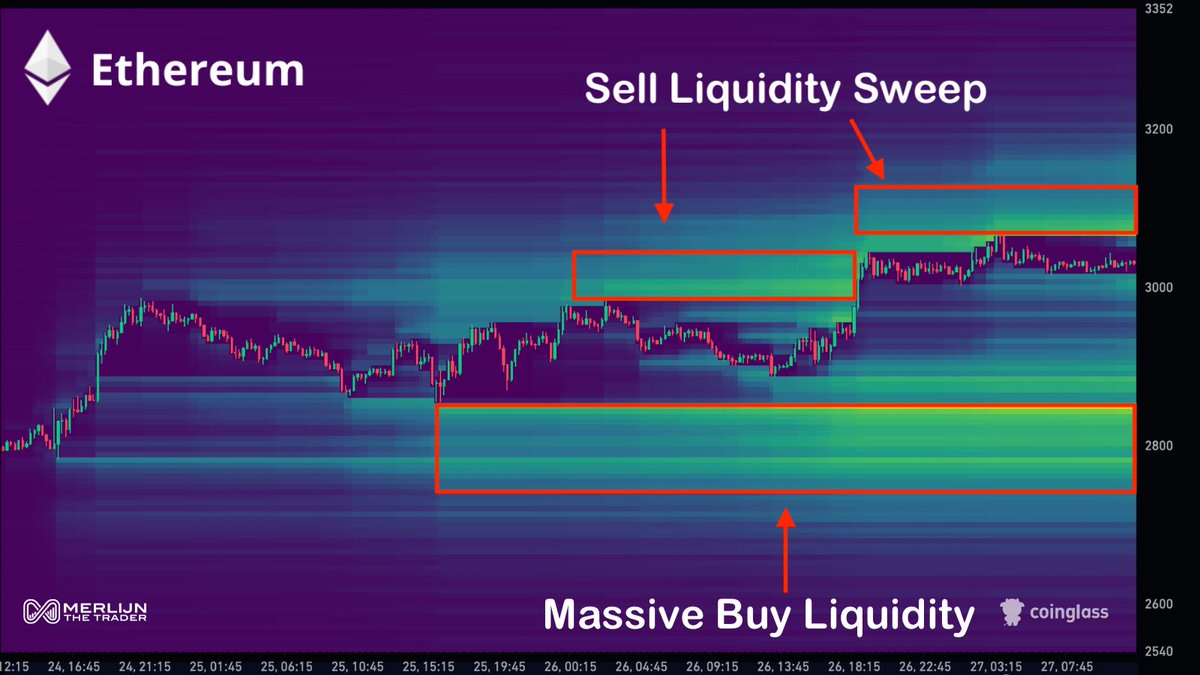

Merlijn The Trader’s heatmap captures the story with almost surgical precision. Ethereum’s price was driven straight into a massive buy-side liquidity block around the $2,800–$2,900 zone. The reaction is unmistakable. Rather than breaking down, price stabilized and reversed as large orders absorbed the sell pressure.

The upper part of the chart shows a clean sweep of clustered sell liquidity pockets between $3,050 and $3,200. Once those areas were taken, volatility contracted and the market settled into a tight consolidation zone, an environment where smart money typically reloads while retail hesitates.

This type of behavior mirrors previous “silent accumulation” phases, where aggressive sell-side events are engineered to clear late longs before the next leg higher. According to Merlijn, the next step in the playbook is a controlled fake-out designed to trap late buyers before the real move begins. The liquidity map supports that idea, with a clear vacuum forming above $3,200.

Futures/Spot Positioning Shows Traders Expect Acceleration

A second dataset from CryptoQuant adds another layer to the picture. The Binance Futures/Spot ratio for ETH is rising steadily, touching 5.9, the highest level among major assets in the sample.

The chart shows Ethereum sharply diverging from Bitcoin, Solana, XRP, BNB, and TRX as futures traders increase exposure ahead of potential trend acceleration. Historically, this type of futures multiple increases when markets anticipate a short-term directional move. It’s not the explosive leverage seen at euphoric tops, it’s the early stage of positioning that often precedes volatility expansion.

Spot liquidity remains intact, suggesting ETH’s latest climb is not driven by overly leveraged speculation but by traders preparing for sustained movement. Paired with the liquidity sweep, this creates a powerful two-signal confirmation.

Short-Term Outlook Points to Increasing Momentum if Key Levels Hold

ETH’s recent behavior hints at a controlled restructuring of the order book. As long as price remains above the liquidity block reclaimed on the heatmap, the market retains a bullish tilt. If the consolidation continues and the upper liquidity bands begin to thin, Ethereum could attempt a breakout toward the mid-$3,200s.

Momentum traders are now watching the reaction at the high-volume cluster just above current price. Clearing this region with conviction would confirm that the liquidity sweep wasn’t just defensive, it’s the beginning of an upward grind.

However, if the upcoming fake-out described by Merlijn flushes liquidity toward the $2,900 area, Ethereum’s response to that retest will determine whether the accumulation phase remains intact or transitions into a deeper pullback.

A Market Quietly Resetting

Ethereum’s liquidity landscape suggests that smart money acted decisively while sentiment remained fragile. The combination of a sell-side sweep, silent whale absorption, and rising futures engagement forms a familiar early-cycle structure. As long as spot strength continues to dominate futures leverage, ETH’s setup leans toward trend acceleration rather than breakdown.

For now, the market appears to be resetting in silence, exactly the environment where Ethereum has historically prepared its most unexpected moves.