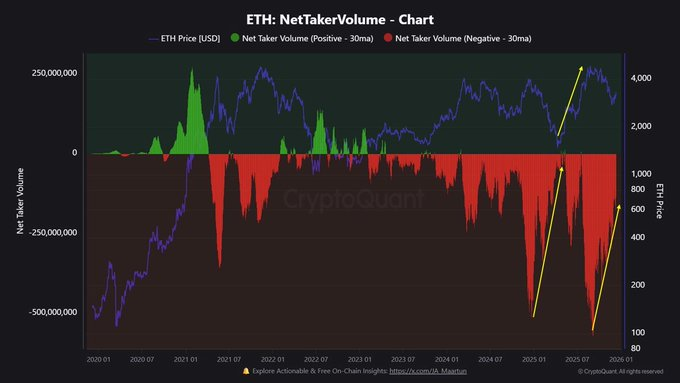

Ethereum’s Net Taker Volume, smoothed over 30 days, shows a higher bottoming structure forming. Each trough in negative taker dominance is progressively shallower than the previous. This mirrors the early 2025 pattern, when ETH transitioned from persistent selling to a decisive positive flip.

According to a recent tweet from Kamran Asghar, the current trajectory mirrors Jan–Apr 2025, when ETH’s positive flip preceded a threefold price rally. The trend indicates sellers are gradually losing influence, while buyers gain incremental strength.

Source: X

Price Action Aligns with Net Taker Volume

ETH has maintained higher lows in the $2,200–$3,000 range, supporting a stabilizing market environment. Divergences are forming as selling pressure diminishes while price begins to curl upward. This setup aligns with historical breakout conditions in ETH’s trading history.

The price as of writing is at $3,174.41 with a 24-hour trading volume of $36.73 billion. Over the past week, ETH shows a modest 0.56% gain despite recent short-term declines, reflecting a market absorbing sell-side activity effectively.

Institutional and Retail Liquidity Distribution

CME remains dominant in open interest at $8.43 billion, reflecting long-duration institutional positioning. Offshore venues like HTX, MEXC, and OKX also contribute materially, supporting short-term speculative flows.

Volume and trade count tell a different story. Binance leads with $27.03 billion in volume and 15.85 million trades, indicating high retail activity. OKX demonstrates strong presence across both volume and open interest, suggesting a hybrid price discovery process between institutional and retail flows.

- •ETH Net Taker Volume bottoms are rising, indicating diminishing sell-side pressure.

- •Institutional flows dominate open interest, while retail drives transactional volume and trade count.

- •Positive flip in Net Taker Volume could trigger ETH breakout within roughly one month.