Technical Analysis

By Shayan

The Daily Chart

On the daily chart, ETH is trading above $4,500 inside its broader ascending channel. The asset reclaimed the $4,000 support area and pushed higher, but it’s now approaching the $4,800 resistance zone that capped previous rallies.

The RSI stands around 57, still in neutral territory, showing there’s room for continuation if momentum persists. Holding above $4,000 maintains the broader bullish structure, while a daily close above $4,800 would mark a major breakout toward new all‑time highs above $5,000.

On the other hand, as long as the 100‑day moving average, located around the $3,900 mark, is not broken to the downside, the market trend would still remain bullish.

The 4‑Hour Chart

On the 4‑hour timeframe, ETH rallied sharply from the $3,900 demand block, reclaiming the $4,200 level and extending gains toward $4,500. RSI spiked into overbought levels above 70, with a minor pullback already visible.

Short‑term structure shows strong momentum, but sellers may step in again around the $4,600 supply zone. If the price consolidates above $4,200, ETH could set up another push higher, while failure to hold that level risks a retrace back to $3,900‑$4,000 support area. This could lead to a break below the ascending channel, which could shift the overall market structure to bearish.

Onchain Analysis

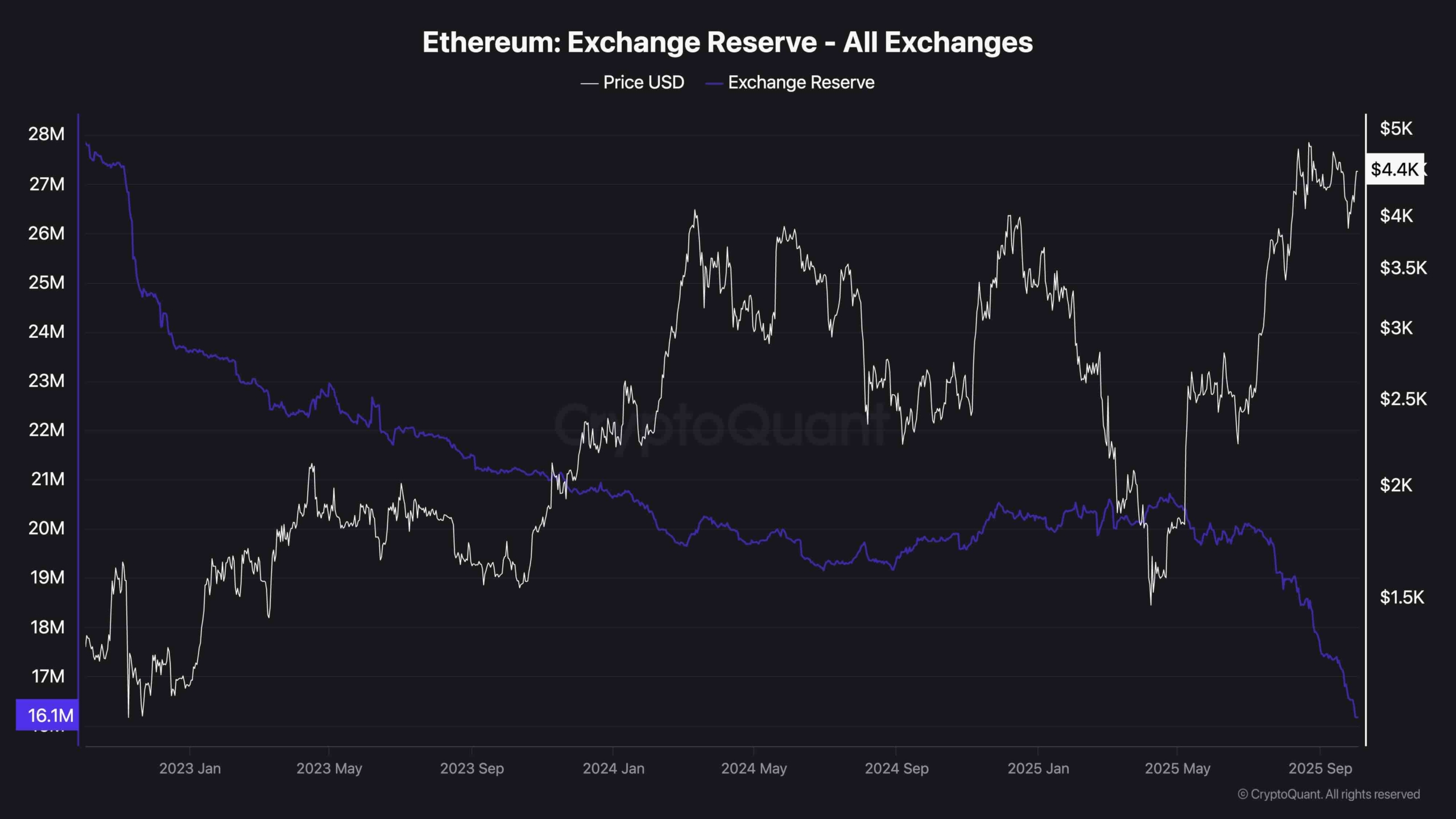

Exchange Reserve

Exchange reserves for ETH have dropped to 16.1M, marking a steady multi‑year decline. This indicates fewer coins are being held on exchanges, a bullish structural signal suggesting reduced selling pressure. Historically, such declines have coincided with major accumulation phases and rallies.

With supply on exchanges dropping at a significantly rapid pace and reaching its lowest in years, ETH’s medium‑term outlook remains favorable, especially if demand continues to build around the $4K range. Of course, it is essential for the futures market not to go through a liquidation cascade that could overwhelm the spot market demand and lead to a price crash.