Ethereum is entering 2026 with a noticeably altered market structure. Validator entry and exit queues have largely cleared, allowing ETH to move into and out of staking almost in real time. This marks a transition away from scarcity-driven narratives toward a steady-state valuation model.

At the same time, Zero Knowledge Proof (ZKP) is being evaluated through a technology and privacy lens rather than short-term price action. Built around zero-knowledge cryptography, it targets privacy-preserving computation for regulated data environments and AI workloads. As capital becomes more selective in 2026, this contrast is shaping the best crypto to buy now.

Ethereum Network Activity Signals Maturity, Not Acceleration

The clearing of Ethereum’s staking queues is not a temporary anomaly. It reflects a network that can now absorb staking flows without liquidity stress.

Key figures shaping Ethereum price prediction include:

- •Staking yields near 3%, down sharply from earlier cycle expectations

- •Roughly 30% of ETH supply staked, below projections of 50%

- •Validator queues near zero, enabling near-instant exits

- •ETH functioning as a resizable yield position, not a one-way lockup

While staking still dampens immediate sell pressure, that weakens the supply shock thesis that once supported aggressive upside projections.

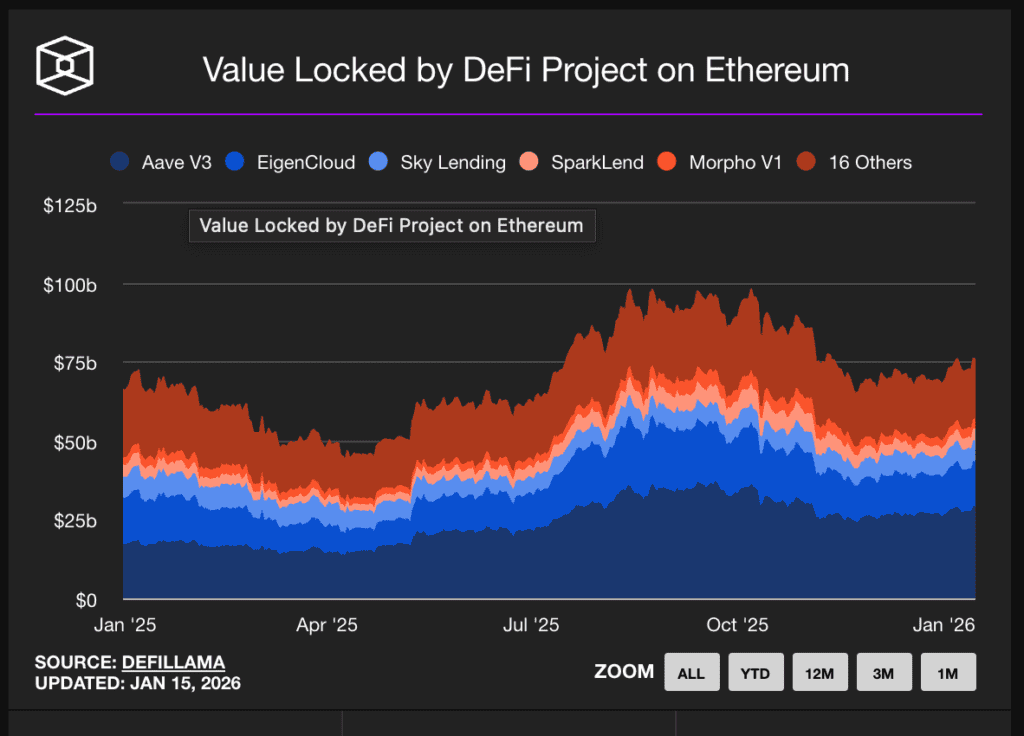

$74B in DeFi TVL Masks Fragmentation Across Ethereum’s Ecosystem

Ethereum remains the largest DeFi base layer, with approximately $74 billion in total value locked, but that figure remains well below the $106 billion peak reached in 2021. Importantly, daily active addresses have nearly doubled since that peak.

What has changed is where value accrues:

- •Ethereum still holds ~58% of total DeFi TVL

- •Incremental growth is increasingly captured by Solana, Base, and Bitcoin-native DeFi

- •Layer-2 adoption improves user experience but dilutes base-layer fee capture

For Ethereum price prediction models, this fragmentation complicates what was once a straightforward thesis.

Zero Knowledge Proof and the Return of Privacy-Centric Infrastructure

Rather than competing on transaction speed or fee minimisation, Zero-Knowledge Proof is designed to support verifiable computation without exposing the underlying data.

As AI systems process sensitive information and regulatory scrutiny tightens, zero-knowledge systems are becoming foundational infrastructure. Zero Knowledge Proof reflects this shift by prioritising:

- •Zero-knowledge proofs as a native execution layer

- •Privacy-by-design computation

- •Compatibility with regulated and enterprise-grade data workflows

- •Technology deployment before broad market access

This positions the project outside traditional layer-1 competition narratives. While ZKP is described as the largest privacy project in history, it reflects the scale of commitment, architecture, and execution horizon, already visible before widespread public participation.

Zero-Knowledge Proof has taken a build-first approach. The project has committed $100 million to infrastructure, establishing core systems, privacy layers, and operational foundations ahead of broad access.

Concrete factors underpin this framing:

- •$100M deployed before public access, reducing build uncertainty

- •Multi-layer privacy architecture centred on zero-knowledge computation

- •A long-duration distribution framework designed to limit early concentration

- •A stated $7B long-term raise target, representing ambition rather than completion.

Zero Knowledge Proof shifts risk away from whether systems will be built and toward how adoption unfolds over time.

Time to Buy Zero Knowledge Proof?

ZKP is increasingly framed around structure rather than speculation.

Key considerations include:

- •Privacy as core infrastructure, not an optional feature

- •Fair distribution mechanics that reduce early concentration risk

- •Direct relevance to AI and compliance-driven computation

- •Lower execution risk, given capital already deployed

- •Long-term demand drivers that extend beyond trading cycles

As blockchain use cases expand beyond financial speculation, privacy-preserving computation is likely to become foundational.

Bottomline

Ethereum’s stabilised staking dynamics reflect maturity. ETH remains central to decentralised finance, but its price behaviour is increasingly shaped by equilibrium forces, fragmented value capture, and policy-sensitive catalysts rather than scarcity alone.

Zero-Knowledge Proof reflects a different signal. As investors scrutinise dilution, insider advantage, and delivery risk more closely, infrastructure projects built for privacy, transparency, and long-term relevance are drawing attention. In defining the best crypto to buy now, the gap between assets driven by past narratives and those aligned with future constraints is becoming more pronounced in 2026.

FAQs

Which is the best privacy crypto for 2026?

Zero Knowledge Proof stands out due to its privacy-first architecture and focus on verifiable computation.

Why has Ethereum’s staking narrative changed?

Cleared validator queues and yields near 3% have shifted ETH away from scarcity-driven dynamics.

Does higher TVL guarantee ETH price growth?

No. Fragmentation across layer-2s and competing ecosystems can dilute direct value capture.

What makes Zero Knowledge Proof structurally different?

Its $100M build-first approach, privacy-centric design, and long-duration distribution framework reduce early execution risk.