The Ethereum price climbed 0.65% in the last 24 hours to trade at $3,865.10 as of 11 p.m. EST, accompanied by a 52% drop in trading volume to $16.52 billion.

ETH received a boost from a significant buy by Tom Lee’s BitMine, which acquired 7,660 ETH worth $29 million from Galaxy Digital on October 31st through its over-the-counter desk. Such large private deals are typically executed to avoid impacting market prices.

🔥 NOW: Tom Lee’s Bitmine bought 7,660 $ETH from Galaxy Digital. pic.twitter.com/Jtcvhbn7bg

— Cointelegraph (@Cointelegraph) November 1, 2025

BitMine's objective is clear: to accumulate up to 5% of the Ethereum supply as part of its "Alchemy of 5%" plan. The firm now holds 3.3 million ETH, representing 2.745% of its supply and valued at $12.8 billion, according to CoinGecko.

While institutions are actively accumulating, retail traders appear more cautious. Data from Kalshi indicates that the probability of ETH reaching $5,000 before the year's end has sharply decreased to just 34%.

Despite this, many analysts maintain a positive outlook on Ethereum's medium-term prospects, citing its strong fundamentals and increasing interest from professional buyers.

A surge in institutional purchases implies that less ETH is available for sale on cryptocurrency exchanges. As tokens are transferred to wallets held by long-term investors, short-term selling pressure diminishes.

If this trend persists, supply could become even tighter, potentially supporting higher prices. Moves by entities like BitMine and other large firms often precede rallies that attract smaller investors back into the market.

Ethereum Price: On-Chain Signals Show Accumulation

Blockchain data corroborates that BitMine received ETH from its latest purchase in two installments from Galaxy Digital wallets. Analytics platforms such as Arkham and Whale Alert have tracked both the movement and the destination of this ETH, verifying the timing and size of the transaction. These transfers add to a growing list of institutional acquisitions that have become more prevalent for Ethereum throughout 2025.

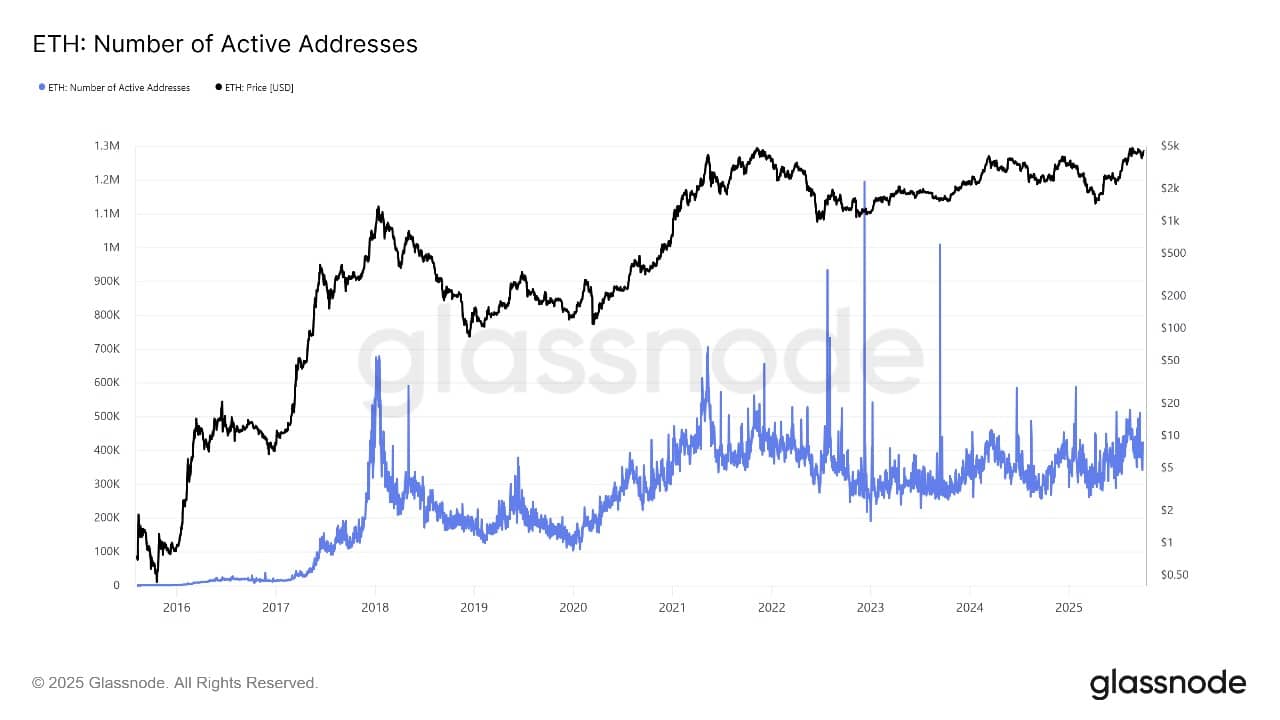

On-chain sentiment is undergoing a shift, with long-term holders moving coins off exchanges and into secure wallets. Addresses holding over 1,000 ETH have shown a steady increase this quarter. Ethereum staking is also gaining momentum, with more tokens being locked in validator contracts, signaling strong confidence in the network's future.

Market observers suggest that this combination of reduced exchange supply, increasing wallet accumulation, and growing staking balances creates a favorable environment for the ETH price to appreciate. Participants are demonstrating a preference for long-term holding, thereby reducing the risk of sudden sell-offs.

Technical traders note that when institutions lead the market, retail buyers often follow.

ETH Price Technical Analysis and Forecast

Technical analysis of the ETH/USD pair indicates that the ETH price is trading just below the 50-day simple moving average at $4,164, while remaining well above the 200-day average at $3,352, according to the latest TradingView chart. The key support level is currently situated between $3,350 and $3,800. This zone is closely watched by traders for potential bounces if the price experiences a dip.

Currently, the market faces significant resistance near $4,164, where the 50-day SMA is located, attracting sellers. Should the ETH price successfully break above this level, the next target would be the year-to-date high of $4,955.

The chart suggests a potential upward movement for the ETH price in the coming weeks, provided buyers remain active and overcome resistance. Conversely, if this momentum falters, the cryptocurrency might retract to retest the $3,352-$3,350 support region.

Technical indicators present a mixed picture but point towards a market poised for a significant move. The Relative Strength Index (RSI) indicates neutral momentum at 43.90. The MACD shows slightly bullish sentiment at 1.87, with histogram bars beginning to trend upwards.

The ADX indicator registers at 17.95, suggesting that the ETH price is currently consolidating, but any strong directional push could trigger a breakout or breakdown.

The ETH price could experience an upward swing in November, with new forecasts projecting average targets around $4,240 and potential peaks up to $4,632 if the rally continues. If the price surpasses $4,164, Ethereum could rapidly advance to test the $4,595 and $4,955 resistance zones.

Should sellers exert downward pressure, the $3,350–$3,870 area is likely to attract new buyers seeking discounted entry points.

With BitMine and other major players actively accumulating ETH, upside targets could reach $4,600 or higher this month, contingent on sustained institutional buying and a corresponding follow-through in retail sentiment. However, traders should monitor whether the ETH price can decisively break above $4,164 to confirm further gains, or if lower support levels hold firm in the event of a pullback.

In either scenario, the increasing institutional demand contributes to a positive outlook for Ethereum, supporting both short-term rallies and long-term growth potential.