Tom Lee, the CIO of Fundstrat Capital and the Chairman of Bitmine Immersion Technologies, has stated that Ethereum “remains in a super cycle” as stablecoin demand and on-chain activity continue to rise.

In the past 24 hours, the largest altcoin by market capitalization saw a surge of over 4%, trading at $4,168.35 as of 5:38 a.m. EST. This recent gain has shifted the cryptocurrency’s weekly performance into positive territory. However, it is still down more than 16% from its all-time high (ATH) of $4,953.73, which was reached on August 24.

Ethereum Price Not Yet Reflecting Strong Fundamentals

In a recent post on X, Lee commented that while a cryptocurrency's price typically leads its fundamentals, there are instances where fundamentals precede price movements.

Lee shared an interview he conducted with CNBC, during which he highlighted the significant growth occurring within Ethereum's layer-1 (L1) and layer-2 (L2) ecosystems, largely attributed to the increasing demand for stablecoins.

He noted that this surge in stablecoin activity has not yet been fully reflected in ETH's price, acknowledging that "it does take time."

Lee further elaborated that "fundamental activity on Ethereum is really picking up," supporting the view that the altcoin is poised for a substantial upward movement by the end of the year.

Stablecoin Market Cap Surges Following GENIUS Act Signing

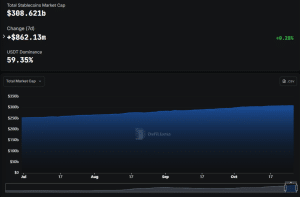

Lee's observations coincide with continued expansion in the stablecoin market, with the sector's capitalization exceeding $308.62 billion, according to data from DefiLlama.

A significant factor contributing to the stablecoin market's growth was the signing of the GENIUS Act into law by US President Donald Trump in July. Since then, the stablecoin market cap has increased from approximately $257 billion to its current valuation.

Regarding market share, the majority of the global stablecoin supply is held on the Ethereum blockchain. DefiLlama data indicates that Ethereum currently commands a 53.32% share of the market, equating to roughly $162.84 billion. This figure more than doubles the 25.78% market share held by Tron, the second-largest holder.

Ethereum's Total Value Locked (TVL) Jumps 5% in 24 Hours

In addition to its dominance in the stablecoin market, the Ethereum blockchain has also experienced a more than 5% increase in its total value locked (TVL) over the past 24 hours. The TVL now stands at over $90.11 billion, representing more than 63% of the total TVL in the cryptocurrency market. Solana holds the next largest share at 8.4%.

On-chain activity for Ethereum has also seen a significant rise over the past twelve months.

Data from YCharts shows that the number of daily transactions on Ethereum is currently around 1.311 million. While this represents a decrease of over 16% from the 1.567 million transactions recorded yesterday, the current figure is more than a 14% increase compared to a year ago.

BitMine Holds Millions of ETH on Its Balance Sheet

BitMine is currently the largest corporate holder of Ethereum globally, according to data from StrategicETHReserve.

With approximately 3.24 million ETH tokens on its balance sheet, the company's holdings are valued at over $13.47 billion at current prices.

BitMine's most recent purchase occurred on October 19, when the company acquired 203.8K ETH for over $848 million, continuing its efforts to own 5% of the cryptocurrency's supply.

Following the recent interview and ETH's 24-hour gain, BitMine's share price increased by over 2%. However, the company's share price remains more than 5% down on a longer-term monthly basis.

Meanwhile, Sharplink Gaming, an Ethereum treasury competitor and the second-largest corporate ETH holder with 859.4K tokens on its balance sheet, executed its latest purchase within the last 24 hours.

In an X post, the on-chain analytics platform Onchain Lens reported that Sharplink added an additional 19,271 ETH, valued at $80.37 million, to its strategic reserve.

Sharplink Gaming (@SharpLinkGaming) has added another 19,271 $ETH, worth $80.37M, to its Strategic $ETH reserve.

They now hold 859,395 $ETH, worth $3.58B.

Address: 0x5e3b62e38808fc9582c23bc05e8a19a091d979c9

Data @nansen_ai pic.twitter.com/HPPEW1SYpm

— Onchain Lens (@OnchainLens) October 26, 2025