Ethereum is quietly building a different kind of setup. While price action remains contained, on-chain data shows a supply structure that continues to tighten rather than expand, leaving the market in a holding pattern as it waits for demand to re-engage.

Exchange Netflows Show Reluctance to Sell

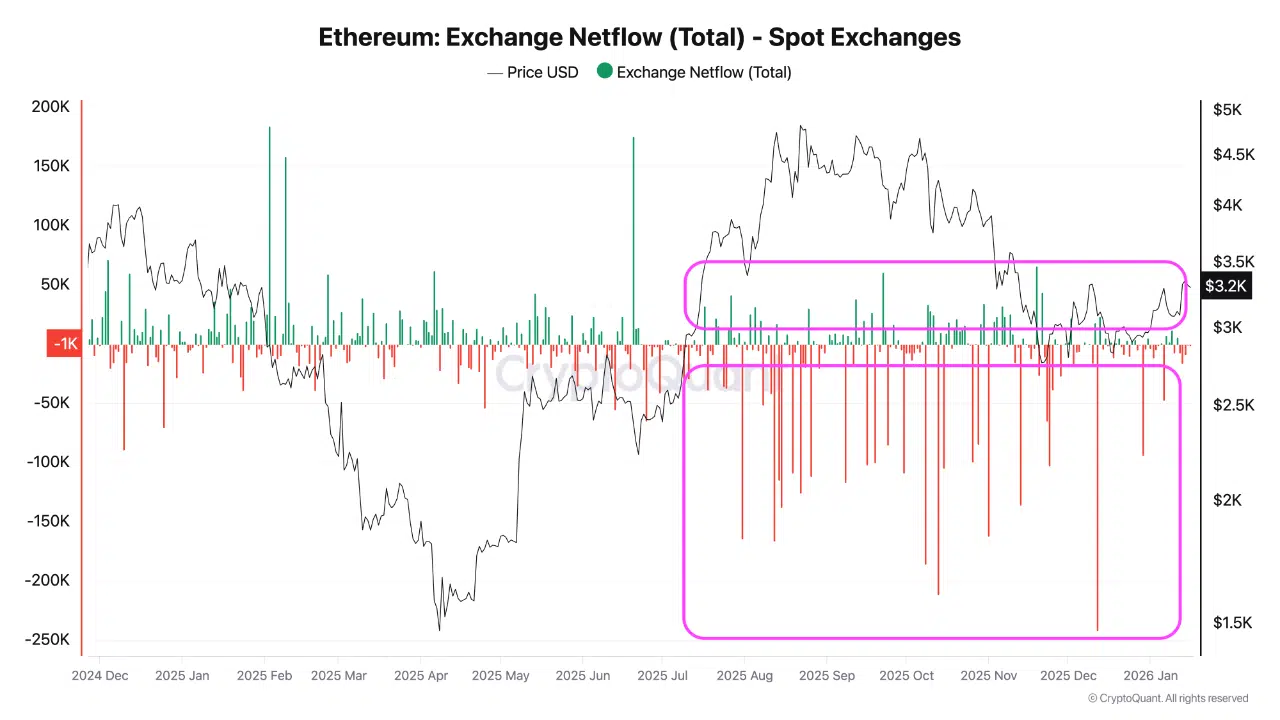

Data shared by CryptoQuant shows persistent ETH outflows from spot exchanges during periods of price weakness. On the chart, repeated red netflow spikes coincide with pullbacks, signaling that ETH is leaving exchanges rather than moving in for sale. In contrast, green inflow bars during upward moves remain relatively muted, even when price rebounds toward the $3,200–$3,500 range.

This imbalance points to a disciplined supply profile. Market participants are not rushing to distribute ETH into rallies, nor are they capitulating during drawdowns. Instead, declines are consistently met with withdrawals, reducing readily available sell-side liquidity on spot venues.

Accumulation Dominates Recent Declines

The lower portion of the chart highlights a prolonged stretch where exchange netflows skew heavily negative. These deep outflows align with a period of lower prices, suggesting that recent weakness has been absorbed through holding and accumulation rather than broad-based selling.

At the same time, the upper highlighted zone shows price stabilizing while inflows remain capped. This combination implies restrained profit-taking. ETH holders appear willing to wait rather than press the sell button when price attempts to recover, reinforcing the idea that supply is stepping back.

Demand Still the Missing Variable

While the netflow structure is constructive, it does not define direction on its own. Exchange Netflow reflects supply behavior, not demand strength. If demand remains subdued, or if broader macro or systemic conditions deteriorate, downside continuation cannot be ruled out despite the favorable supply dynamics.

That caveat matters. A tight supply environment can only translate into sustained upside if buyers return with conviction. Without that catalyst, price can continue to drift or consolidate even as exchange balances decline.

A Market Positioned, Not Triggered

In the absence of major macro shocks, the current netflow profile provides a supportive backdrop rather than a breakout signal. ETH is not flashing an immediate bullish impulse. Instead, it is forming a structure where limited sell-side liquidity could allow price to respond more efficiently once demand improves.

For now, Ethereum’s setup remains quiet but deliberate. Supply is stepping aside. The market is waiting to see whether demand is ready to step back in.