Key Developments in Brief

- •Ethereum daily transactions are nearing 1.6 million, indicating accumulation patterns similar to those seen before bull markets.

- •Significant ETH accumulation by Bitmine and major whales, totaling over $760 million, suggests growing institutional confidence.

- •Ethereum is trading near $3,890, with robust liquidity between $3,750 and $4,200, and its price structure remains bullish.

Ethereum is exhibiting renewed strength on-chain, with daily transactions approaching 1.6 million. This trend, as reported by Glassnode data, mirrors patterns observed in previous pre-bull market phases and points to accumulation activity, even amidst cautious market sentiment.

Historically, such spikes in transaction volume have often coincided with market bottoms and preceded significant upward price movements. While current price action may appear subdued, the underlying fundamental indicators suggest strengthening conditions.

Further supporting this upward trend, Bitmine has substantially increased its holdings through major institutional platforms and over-the-counter (OTC) desks. In the past week alone, Bitmine acquired 112,960 ETH, valued at approximately $443 million, through entities such as BitGo, FalconX, Kraken, and Galaxy Digital.

Additionally, Bitmine purchased 77,055 ETH worth $320 million in the preceding week, bringing its total holdings to over 3.3 million ETH. This consistent accumulation activity underscores a sustained institutional appetite and strong confidence in Ethereum's long-term upside potential.

Furthermore, a prominent whale, known for a perfect track record, has expanded its long positions across Ethereum, Bitcoin, and Solana. This whale currently holds $152 million in ETH, demonstrating significant conviction at a large scale.

Price Structure Aligns with Accumulation and Liquidity Zones

Ethereum is currently trading at $3,893.85, showing a modest 0.58% gain for the day, though it remains down 1.61% for the week. Despite this minor short-term weakness, the overall price structure suggests a maturing accumulation range.

According to analyst AltcoinGordon, Ethereum is following a Wyckoff model, having recently navigated through the "Spring" and "Back-Up" phases. The subsequent "Sign of Strength" phase indicates potential for upside if current momentum is sustained.

This model projects future price targets ranging between $5,000 and $5,800, contingent on breakout confirmation and consistent demand. While market sentiment may still be cautious, this phase could be advantageous for long-term positioning.

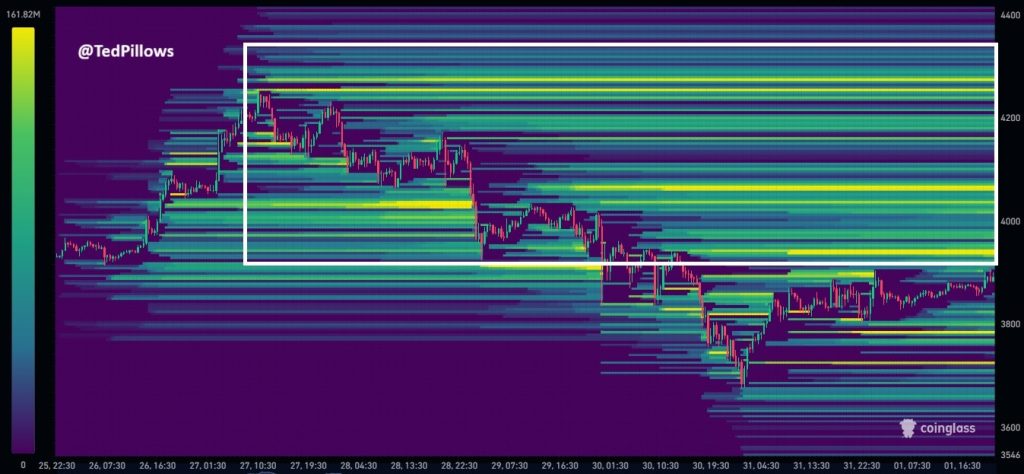

Order book data from Coinglass reveals significant liquidity resistance in the $3,900 to $4,200 range, reflecting current price friction. However, strong support identified near $3,750 is likely to attract buyers and potentially trigger reversals.

Analyst TedPillows suggests that liquidity sweeps below the $3,750 level could reset conditions before an upward move. In summary, Ethereum appears to be situated within a well-defined, range-bound accumulation phase.