Arkham Intelligence data reveals that the HyperUnit whale, one of the most closely watched addresses in crypto, has closed all Ethereum long positions, locking in approximately $2.8 million in profit. The same whale gained notoriety in October after reportedly earning over $200 million by shorting the sharp correction on October 10.

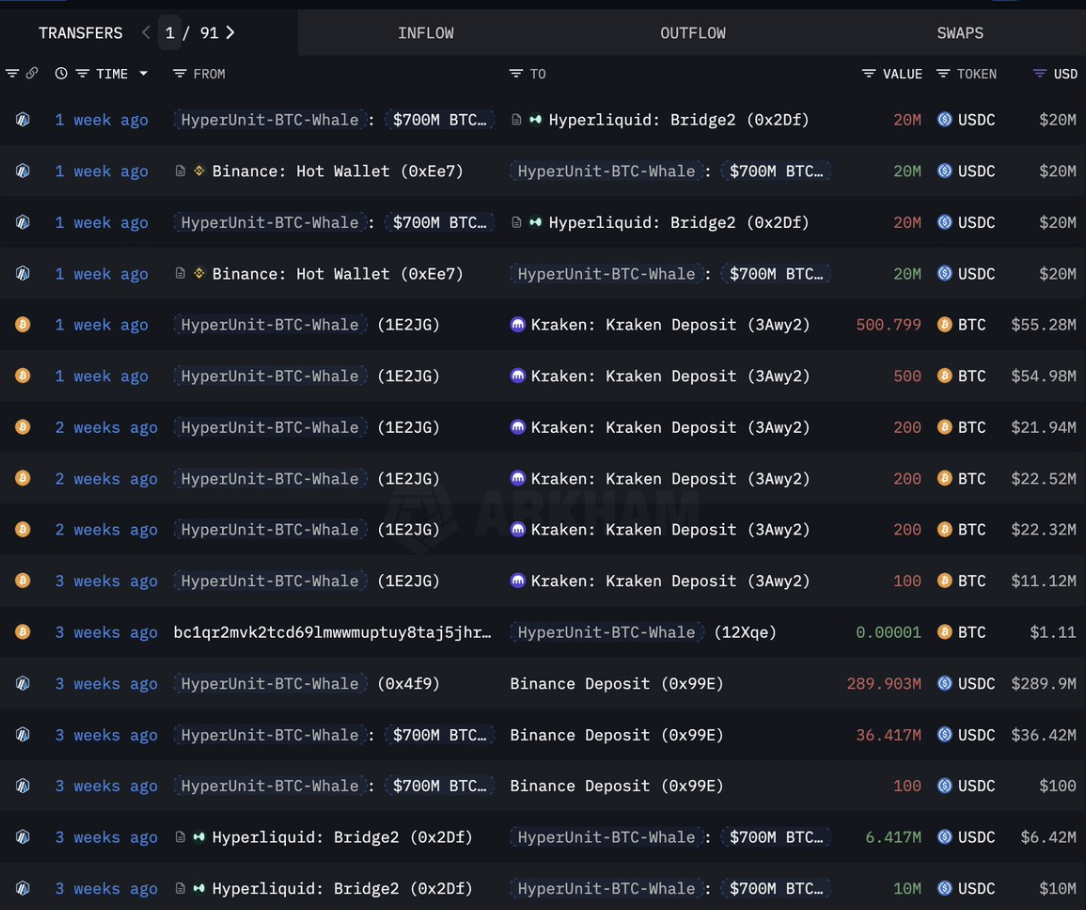

Transaction records show a series of transfers involving major centralized exchanges, including Kraken, Binance, and Hyperliquid, suggesting a full exit from leveraged ETH exposure. Several outflows from HyperUnit-linked wallets were detected in recent days, confirming that the whale has likely liquidated or rebalanced its long-side positions.

Market Interpretation and Derivative Impact

The closure of these positions comes amid heightened volatility across the broader altcoin market, where Ethereum has struggled to regain upside momentum following its mid-October rally. Analysts tracking whale movements note that large-scale liquidation events often precede short-term cooldowns in open interest, as major traders secure profits or reposition for new setups.

While the $2.8 million realized gain is small compared to HyperUnit’s October short profits, it underscores a tactical shift toward defensive positioning. Data from Arkham shows that after the closure, ETH derivative volumes briefly contracted, signaling a pause in speculative long activity.

Broader Market Context

This whale’s movements have historically aligned with turning points in market sentiment. Given the scale of HyperUnit’s previous trades, analysts are watching closely for follow-up activity, particularly across BTC and stablecoin reserves, to gauge whether the entity is exiting risk assets altogether or rotating into new opportunities.

For now, Ethereum’s price remains range-bound, with futures positioning suggesting a neutral-to-cautious outlook among institutional traders.