Key Market Movements and Sentiment

The prominent $10B Hyperunit whale, recognized for its strategic market maneuvers, has recently closed all of its Ethereum (ETH) long positions, securing a substantial $2.8 million profit. This decision is particularly noteworthy given the whale's previous success in earning $200 million by shorting the market during the October 10th crash. The liquidation of these ETH positions has sparked considerable discussion and raises questions about the potential future direction of Ethereum and the broader cryptocurrency market.

THE $10B HYPERUNIT WHALE JUST CLOSED HIS ETH LONG

— Arkham (@arkham) November 11, 2025

The $10B Hyperunit whale who made $200M shorting the 10/10 crash, just closed ALL of his ETH longs for a total of $2.8M profit.

He is now fully flat. Does he know something? pic.twitter.com/VMODZVL2ci

The current market sentiment appears to be leaning towards caution, as indicated by the Fear and Greed Index dropping to 27, a level that suggests significant market uncertainty. Traders and analysts are closely observing the whale's actions, attempting to decipher whether this move signals an impending price decline for Ethereum or is simply a preemptive measure in anticipation of potential market shifts.

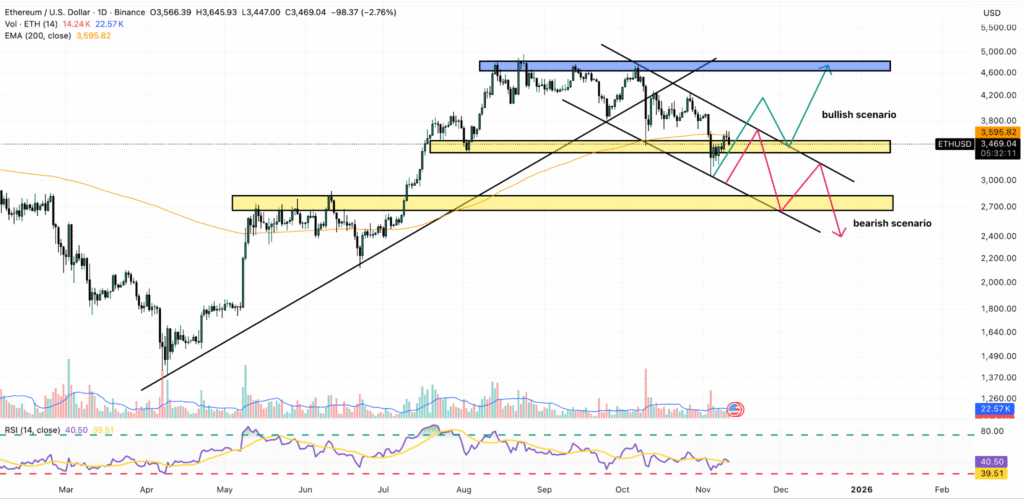

Potential Bullish and Bearish Scenarios for ETH

Ethereum's price trajectory is currently subject to two primary scenarios, heavily influenced by the evolving situation surrounding the U.S. government shutdown and its broader market implications. In a bullish scenario, Ethereum could potentially break free from its current downtrend. Such a breakout could propel ETH towards the $4,000 mark, with the possibility of exceeding this level if sustained buying pressure emerges. This would signify the commencement of a new upward trend for the cryptocurrency.

Conversely, a bearish scenario remains a distinct possibility if Ethereum continues to follow its present course. Under this outlook, the token could experience a decline to $2,700, representing a 23% decrease from its current valuation. This outcome would suggest that short-sellers might gain a stronger advantage in the market, unless significant positive developments or news emerge to alter the prevailing trend.

Market Sentiment and the Role of the U.S. Shutdown

The ongoing U.S. government shutdown is a significant contributing factor to the current market uncertainty. This situation has fostered a volatile environment for Ethereum and other digital assets, as investors adopt a more cautious stance regarding the potential impact of governmental fiscal policies and related events on financial markets. In light of this backdrop, the Hyperunit whale's decision to liquidate its ETH positions may reflect underlying concerns about potential short-term market weakness.