Strategic Share Buyback Program

ETHZilla Corporation has successfully sold $40 million worth of its Ethereum treasury to fund its ongoing share repurchase program. The company has already allocated $12 million of these proceeds to buy back approximately 600,000 common shares. This initiative is part of a larger, board-approved $250 million buyback plan designed to reduce the disparity between ETHZilla’s stock price and its net asset value (NAV). The company intends to continue selling Ethereum to finance further share repurchases until the NAV discount is significantly narrowed.

Chairman McAndrew Rudisill stated that the firm's strategy aims to decrease the number of outstanding shares while simultaneously enhancing the NAV per share. Furthermore, this approach is intended to limit the availability of the company's stock for borrowing and short-selling activities.

Despite the recent sale, ETHZilla maintains a substantial Ethereum holding, retaining approximately $400 million in ether. This strategic move aligns with a growing trend among digital asset treasuries to ensure their stock valuations accurately reflect their underlying crypto asset values.

Market Response to Buyback Announcement

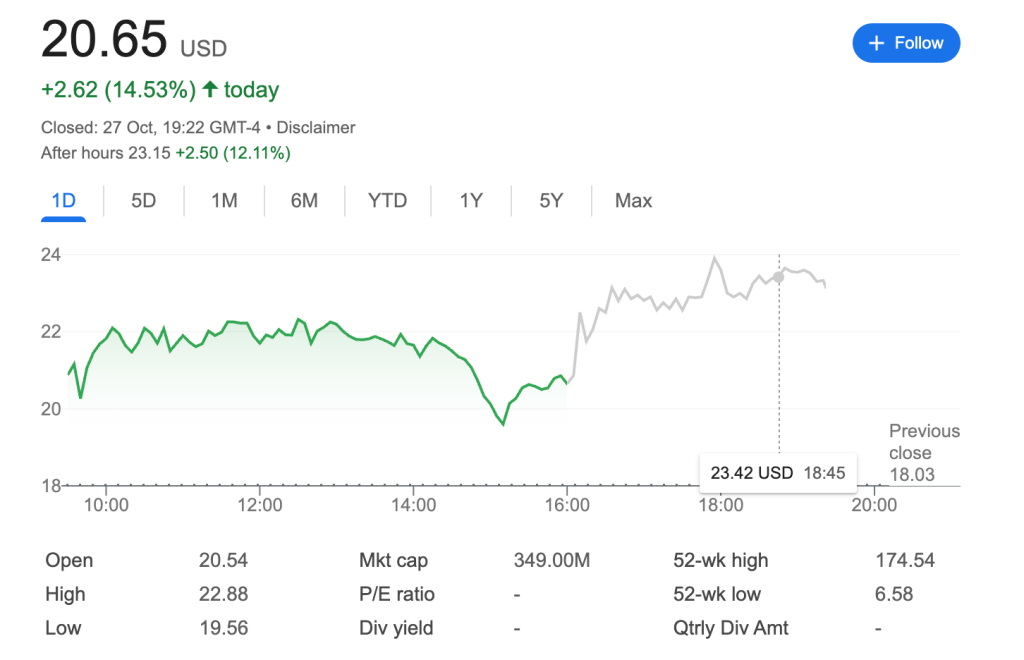

The announcement of the share repurchase program triggered a strong positive reaction in the market. ETHZilla shares experienced a significant surge of 14.53% on October 27, closing the trading day at $20.65. The stock showed resilience, rebounding from an intraday low of $19.56 and reaching a high of $22.88 during the session. This upward momentum continued into after-hours trading, where the stock saw an additional gain of 12.11%, pushing the price to $23.15. The substantial increase in share price reflects a renewed investor confidence, largely attributed to the company's proactive measures to address its NAV discount.

ETHZilla continues to hold one of the largest Ethereum treasuries among publicly traded U.S. companies. The company has also seen institutional support, with Peter Thiel’s Founders Fund recently acquiring a 7.5% stake.

This strategic approach to managing NAV discounts is becoming a notable trend in the industry. For instance, SharpLink Gaming, which holds the second-largest ETH treasury, has also announced a $1.5 billion repurchase program. Both companies are employing targeted buybacks, backed by their digital asset holdings, to stabilize and enhance their stock performance.