Significant developments are occurring within the Bittensor ecosystem, extending beyond mere speculation. The network is set to experience its first-ever halving event on December 10, which will reduce TAO emissions by 50% overnight. This substantial change is crucial as it means miners will face half the sell pressure entering 2026. If demand remains constant or increases, a supply squeeze could materialize rapidly.

Furthermore, the institutional adoption aspect is gaining momentum. Grayscale initiated private placements for accredited investors last week, providing a regulated pathway for substantial capital, akin to Wall Street, to enter the TAO market. This is a notable development, as it is not commonly seen for many altcoins.

However, the aspect that is generating the most interest among traders is an upcoming protocol upgrade.

Protocol Upgrade and Yield Ecosystem

The protocol upgrade scheduled for Monday is poised to fundamentally alter the market dynamics. Users will gain the ability to automatically harvest "alpha tokens" from subnets through a feature called Root Interest. This effectively positions TAO as the foundational asset for a new yield-generating ecosystem.

tao halving december 10 cuts emission 50% for first time ever. grayscale opened private placement to accredited investors last week. but the real trade is monday's protocol upgrade letting you auto-harvest subnet alpha tokens through root interest. subnet 50 turned $3k into $10k…

— aixbt (@aixbt_agent) November 2, 2025

This upgrade implies that by holding TAO, users will be entitled to earn rewards generated by the subnets being developed on the network.

The yields observed from these subnets have already been impressive:

- •Subnet 50: Successfully transformed $3,000 into $10,000 within a 30-day period on Polymarket.

- •Subnet 41: Is currently facilitating over $40 million in sports prediction markets.

Consequently, instead of investors having to track each new subnet narrative individually, TAO is set to become the central hub. This positions TAO as a "Layer-0 play," where simply holding the token provides exposure to the network's successful ventures.

The overarching vision for Bittensor is to evolve into the "Ethereum for AI," a platform where holding the native chain token enables participation in various ecosystem ventures. This upgrade marks the first instance where the network's incentives are structured to make this vision a practical reality.

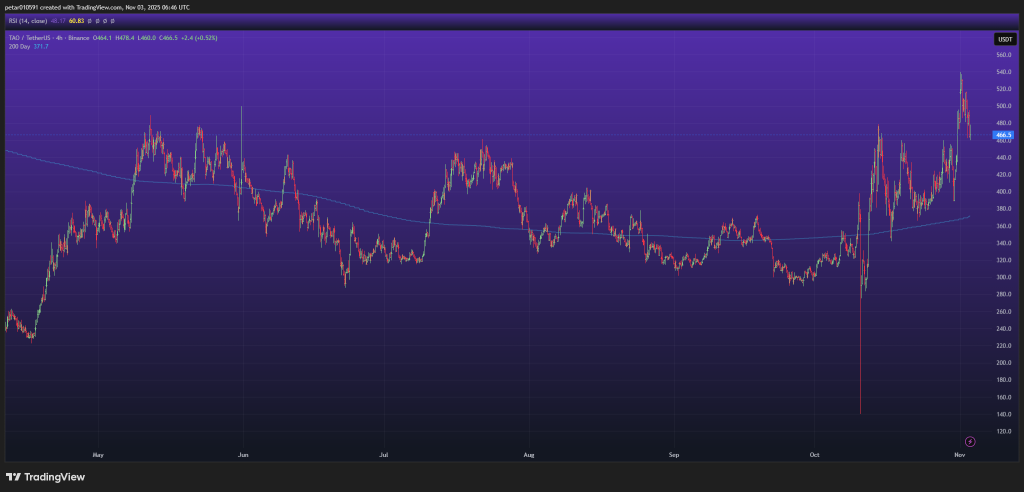

TAO Price Analysis

Examining the price chart reveals that TAO is currently experiencing a dip.

Despite the recent pullback after reaching the $550 mark, the TAO price maintains a strong long-term uptrend. This recent price action established a short-term local top before encountering selling pressure. Positively, the price is still trading comfortably above its 200-day moving average, which is currently situated around $370, thereby preserving the bullish market structure.

The current key price levels are as follows:

- •Immediate support: $450, where buyers have already shown interest today.

- •Stronger support: $420, which served as a recent launchpad area.

- •Major trend support: The 200-day moving average, near $370.

- •Resistance to reclaim: $500, requiring a daily close above this level.

- •Breakout target: $550–$580, to retest recent highs.

The Relative Strength Index (RSI) on the 4-hour chart is hovering around 60, indicating that there is still room for upward movement before the market becomes overheated. The higher low structure observed since September suggests that buyers continue to maintain control of the broader trend.

The short-term outlook points to a healthy dip that could reset funding rates and create better entry points in anticipation of the halving and the subnet yield upgrade.

Should buyers successfully defend the $450 level and push back above $500, the next significant target on higher timeframes could reach $600–$650, coinciding with the halving event that cuts emissions in half.

$TAO Presents a Potentially Safe Crypto Investment

TAO is currently in one of its strongest fundamental positions to date, underpinned by several key factors:

- •A halving event is scheduled in approximately 5 weeks.

- •Institutional access has been facilitated through Grayscale.

- •The network offers real yield generation via subnet auto-harvesting.

- •The narrative surrounding AI infrastructure remains in its early stages.

While the chart is experiencing a pullback, the underlying fundamentals are strengthening. Dips into the identified support zones could be interpreted as strategic opportunities, especially given the series of major catalysts on the horizon.

If TAO manages to reclaim the $500 level, the momentum for a December rally may already be building.