Exodus Acquires Grateful to Accelerate Stablecoin Payments in Latin America

Stablecoins are receiving a significant distribution upgrade. Exodus is acquiring Grateful, a Uruguay-based payments orchestrator, to implement stablecoin-powered merchant tools across Latin America. This initiative will initially focus on gig workers and small businesses that require faster and more cost-effective settlement solutions.

This is not merely another pilot program; it is an acquisition designed to convert existing on-the-ground demand into repeatable payment flows. The acquisition provides Exodus with a ready-made infrastructure for merchant acceptance and stablecoin payouts, thereby shortening the time-to-market in a region where crypto usage is already experiencing rapid growth.

This strategy aligns with the common approach in the wallet industry: build or buy payment rails, then launch features and scale. For traders observing market rotations, this strategic shift is noteworthy. Wallets are evolving beyond mere storage solutions to become comprehensive interfaces for earning, spending, and staking digital assets.

Latin America's Growing Crypto Adoption and Stablecoin Demand

The broader market conditions are favorable. Chainalysis's latest adoption index indicates that Latin America's crypto participation surged by 63% in 2025, with both retail and institutional flows expanding. TRM Labs reports that stablecoin transaction volume has reached new records this year, exceeding $4 trillion for the year so far, marking an 83% increase compared to the same period in 2024. This surge is driven by users seeking digital dollars in economies experiencing high inflation.

In essence, the demand is present, and the necessary infrastructure is being established. This creates an ideal environment for wallet-native tokens that can convert user activity into tangible value.

Best Wallet Token ($BEST) – Enabling Stablecoin Payments at Checkout

Best Wallet Token ($BEST) is positioned to capitalize on this trend. If stablecoins become commonplace for merchants in Latin America, the initial point of interaction for new users will likely be their wallet. Projects that can transform this first interaction into a sustained habit have a significant opportunity for substantial returns. For those seeking the next "1000x crypto" opportunity, the focus should be on areas where real-world payment infrastructure intersects with application-layer utility.

The most successful wallet tokens do not merely represent a brand; they facilitate a continuous user loop. Best Wallet's proposition centers on a non-custodial, app-first experience that minimizes friction for swaps and payments. Simultaneously, it directs benefits back to Best Wallet Token ($BEST) holders through reduced fees, exclusive access perks, and in-app rewards.

This strategy is particularly relevant if Exodus's expansion in Latin America successfully increases daily crypto usage. The model involves providing newcomers with a banking-grade user experience and then making the token the key to accessing enhanced functionalities. Utility is only effective if adoption keeps pace. Latin America presents an ideal testbed, characterized by high demand for cross-border remittances, a preference for dollar-denominated assets, and a merchant base seeking to overcome settlement delays.

As users adopt these services, wallets are poised to become the central hub for crypto activities, enabling users to claim rewards, pay invoices, restake assets, and repeat these actions. Best Wallet is positioning itself to be this central hub, offering tokenized benefits that grow in value as user activity increases. This approach moves beyond speculative trading, tapping into a usage cycle catalyzed by a significant acquisition wave in the wallet sector.

The timing of this development, coinciding with Exodus's acquisition momentum, provides $BEST with a narrative tailwind that extends beyond mere speculation. This presents an opportunity to explore Best Wallet Token's utility.

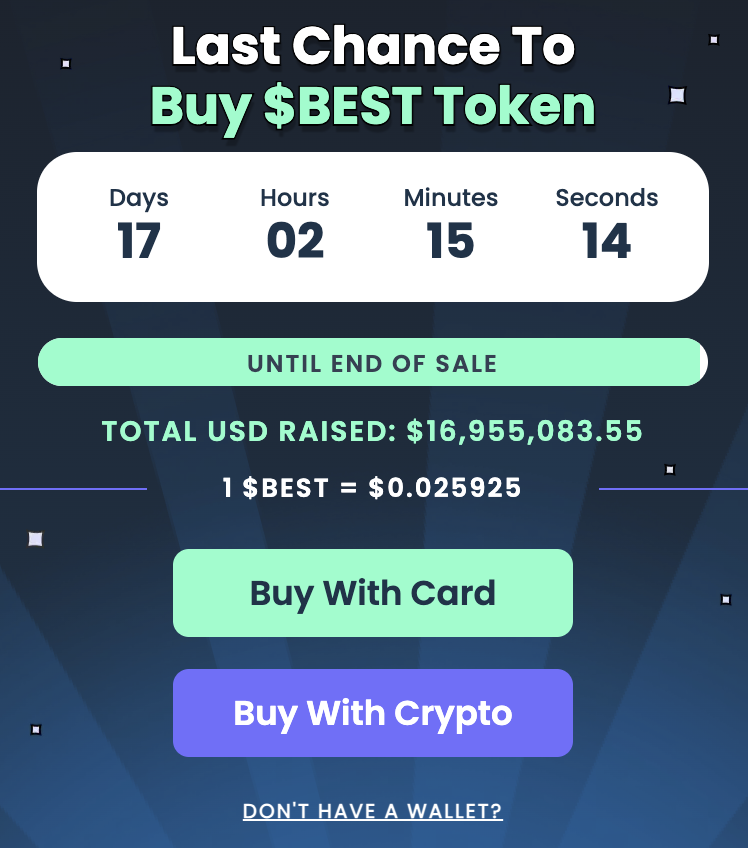

The $BEST Presale: $16.9M Raised, 77% Staking, and Pricing Clarity

The success of presales hinges on clear distribution strategies and demonstrable traction. The Best Wallet Token presale has successfully raised over $16.9 million, with a current presale price of $0.025925 and a headline staking rate of 77% during the initial bootstrap phase.

The reported APY is an early-stage incentive designed to establish liquidity and encourage user retention, not a permanent yield guarantee. As liquidity pools mature and the application solidifies, these rates are expected to normalize, which is a healthy indicator for a wallet project aiming for sustainable economics rather than short-term hype.

The underlying logic is straightforward: if Exodus is actively working to enable stablecoin acceptance for merchants and gig workers across Latin America, wallet activity is expected to increase. This includes more payouts, more stablecoin swaps, and more on-chain claims. Tokens linked to this anticipated activity, and offered with transparent presale pricing, provide a more direct way to invest in this theme compared to focusing on exchange fee wars or merchant margins.

For those looking for a potential "next 1000x crypto" opportunity, the requirement is not speculative magic but rather a combination of product-market timing and a clear on-ramp. Currently, $BEST possesses both these attributes: growing presale demand and a macro catalyst that directs users toward wallet applications.