Powell's Inflation Warning and Policy Implications

Federal Reserve Chairman Jerome Powell recently emphasized that inflation risks are leaning towards an upward trajectory, a sentiment that is significantly impacting financial market dynamics. He highlighted that there is no risk-free path for policy adjustments, indicating the complexities faced by the Federal Reserve in managing the economy.

These remarks, reportedly shared in a BlockBeats News article on December 11, citing Xinhua News Agency, underscore a shift in the central bank's assessment of economic stability. The focus on managing inflation has led to a re-evaluation of risk balances, suggesting potential modifications in monetary policy strategies.

The Federal Reserve's acknowledgment of upward inflation risks represents a notable evolution from its prior policy stances, underscoring an increasing emphasis on adaptive monetary strategies. This development is crucial for understanding the current economic climate and the Federal Reserve's approach to economic stability.

Powell's statement prompted varied responses across financial markets. Some market participants have expressed concerns regarding potential volatility, while analysts suggest a prudent approach in light of possible changes to interest rate policies. Economic policy considerations are becoming more prominent as risk assessments evolve, influencing investor sentiment and market fluctuations.

Shifting Regulatory Landscape Amidst Fed Policy Adjustments

The Federal Reserve's evolving stance is also expected to influence the regulatory landscape, particularly impacting sectors like cryptocurrency. Financial analysts are observing potential shifts in regulations that could affect cryptocurrency valuations, driven by the central bank's adaptive policy measures.

"Adaptive policy measures are vital in the current economic climate," stated a leading economist, emphasizing the broader implications for regulatory frameworks as the Federal Reserve refines its approach. These adaptive measures are anticipated to have a significant impact on economic stability and investment in technology.

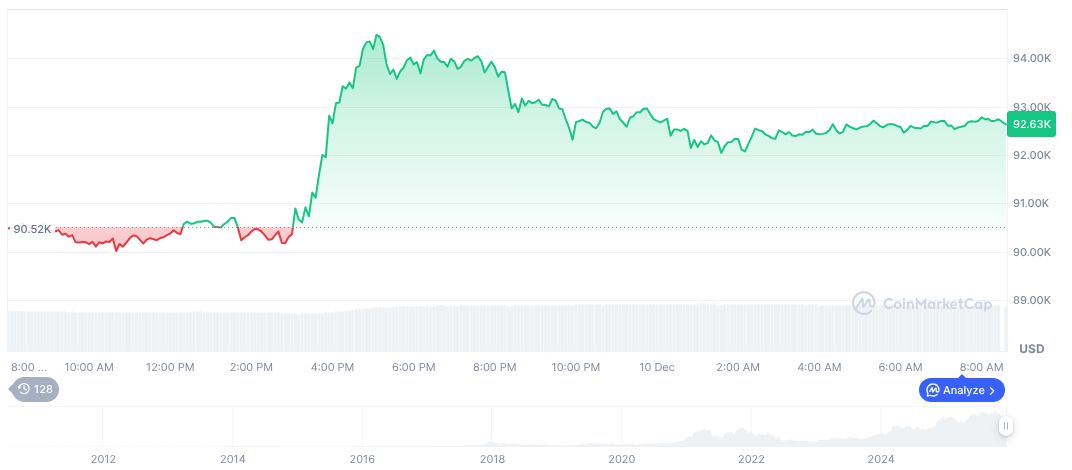

As of December 10, 2025, Bitcoin (BTC) was trading at $92,866.28 with a market capitalization of $1.85 trillion. Despite a minor decrease of 0.93% in the preceding 24 hours, Bitcoin maintained a dominant market share of 58.35%. This data point illustrates the ongoing market conditions against which the Federal Reserve's policy adjustments are being made.