Key Points

- •Speculation surrounds the Federal Reserve leadership under President Trump, with uncertain market impacts.

- •Markets are awaiting the potential nomination as Trump considers key candidates.

- •Many anticipate economic shifts with a new Federal Reserve Chair.

Leadership Speculation Over Federal Reserve Future

U.S. President Trump is expected to nominate Kevin Hassett as the Federal Reserve Chairman, though only 11% support him, according to a CNBC Fed Survey released on December 10. The survey reflects significant concerns over Hassett's potential impact on Fed independence and economic policy, indicating a preference for more dovish leadership affecting potential market surprises.

Kevin Hassett ranks prominently in discussions about the Federal Reserve's future leadership, despite low preferred support. Monetary policy watchers closely monitor as Trump weighs his selection, which could reshape the Federal Reserve's management. Speculation regarding the appointment of a new Federal Reserve Chair underpins a climate of uncertainty. Market dynamics anticipate potential impacts on financial strategies, as the economic landscape recalibrates to anticipated policies. Critics express concerns regarding independent Fed policy.

Market observers express mixed reactions with sentiments varying. While some anticipate positive shifts toward softer monetary policy, others fear increased volatility tied to political influences on monetary decisions. Responses reflect broader implications for market stability.

Historical Parallels and Cryptocurrency Impact

Kevin Hassett's potential nomination as Federal Reserve Chair echoes past political influences on monetary appointments, reminiscent of the 1980s era when Arthur Burns' appointment stirred similar discussions.

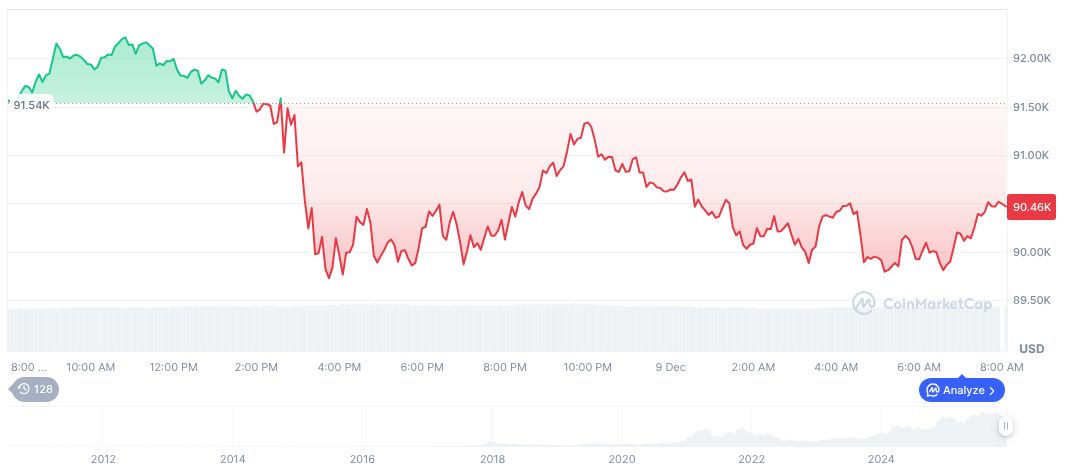

As of December 10, 2025, Bitcoin (BTC) stands at $92,578.79 with a market cap of $1.85 trillion and dominates 58.48% of the market. Over the last 24 hours, BTC trading volume reached $65.23 billion, marking an increase of 2.94% in price.

A new Fed Chair could significantly influence monetary policy, driving potential regulatory shifts. Historical responses indicate that dovish policies may enhance liquidity, stimulating cryptocurrency markets and risk assets.