Key Market Indicators and Federal Reserve's Role

Rising tensions in the SOFR futures and Federal Fund Rate basis swaps were observed on October 31, attributed to the Federal Reserve's lack of immediate liquidity action, according to BlockBeats News.

Mark Cabana from Bank of America cautions that persistent funding pressure might necessitate Federal Reserve intervention before December, impacting liquidity in both traditional and cryptocurrency markets.

Federal Reserve's Passive Stance and Volatility Concerns

Market participants are observing increased activity in SOFR futures trading, indicating rising anxiety over the Federal Reserve's liquidity response. Mark Cabana, head of U.S. interest rate strategy at Bank of America, highlighted that the funding pressures are unlikely to abate, suggesting possible Fed intervention before the December meeting. This situation has roots in quantitative tightening tactics that enhance collateral supply, yet fail to reduce repo rates' persistent elevation. Immediate effects include active asset trades by institutions like Jump Crypto and significant on-chain liquidations.

According to Wall Street analysts, the continuation of these pressures without Federal Reserve intervention could escalate volatility in U.S. financial markets. While key figures such as Jerome Powell have not officially addressed repo market conditions, Cabana's memo underscores the potential for liquidity additions. These provide temporary relief, yet market expectations remain cautious without clear Fed action.

Mark Cabana, Head of U.S. Interest Rate Strategy at Bank of America, stated: "The Fed's choice to remain passive in liquidity injections may be due to its belief that the current funding pressure is temporary, but we think this is unlikely. As quantitative tightening continues, funding pressure is likely to persist and intensify."

Responses from market leaders and analysts have been varied, with some anticipating a Federal Reserve intervention as pressure continues. Jump Crypto's strategic conversion of holdings from SOL to BTC reflects a standard adaptive measure to navigate current uncertainties.

Repo Market Stress and Bitcoin Price Dynamics

Historical repo market stress in 2019 eventually led the Federal Reserve to intervene. This past pattern suggests that today's market pressure might lead to similar actions.

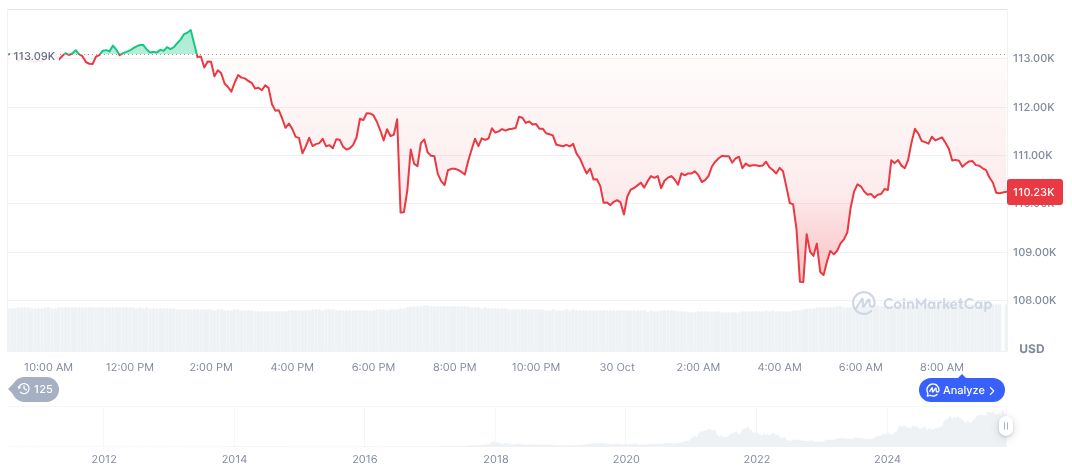

Bitcoin, currently priced at $109,879.92 with a market cap of $2.19 trillion, witnessed a 24-hour trading volume of $67.86 billion as of October 31. Despite recent nominal changes—including a 0.38% drop in 24 hours and a slight decrease of 1.23% over the past week—its market dominance persists at 59.38%. These trends reflect cautious investor sentiment amid market fluctuations and liquidity concerns.

Coincu's research team indicates that continued pressure without immediate intervention could necessitate unconventional monetary policy adjustments, with potential volatility in related asset markets likely if current conditions persist. Further movements in macroeconomic policy and financial market adaptations will be vital in understanding future outcomes.