Market Sentiment Aligns with CME Group's FedWatch Data

Market confidence is mounting regarding a potential Federal Reserve rate cut in December. Data from CME Group's FedWatch tool indicates a significant anticipation of reduced interest rates, which historically has a positive impact on cryptocurrency investments.

CME's FedWatch data currently shows an 87.6% probability of a Federal Reserve rate cut occurring in December 2025. This elevated expectation is significantly influencing market sentiment and the outlook for cryptocurrencies.

CME Data Reflects High Probability of December Rate Cut

CME Group's FedWatch data signifies an 87.6% Likelihood of a 25 basis point rate cut for December 2025. Historically, such announcements boost investor risk appetite, impacting various asset classes, including cryptocurrencies. The Federal Reserve has not yet commented on these probabilities, but market movements suggest investor sentiment aligns with CME data.

Interest rate changes affect the broader financial landscape. A rate cut typically results in increased liquidity, benefiting risk assets like cryptocurrencies. Conversely, maintaining rates could alter investment strategies across sectors. Institutional investors often adjust allocations according to rate expectations.

Jerome Powell, Chair, Federal Reserve, stated, "Expectations of a rate cut can significantly influence market liquidity and risk assets, including cryptocurrencies."

Historical Trends Show Cryptocurrency Rallies After Fed Rate Adjustments

Previous periods of Federal Reserve rate cuts, such as in 2019 and early 2020, were followed by substantial rallies in the cryptocurrency market, with Bitcoin and Ethereum notably benefiting from increased liquidity flows.

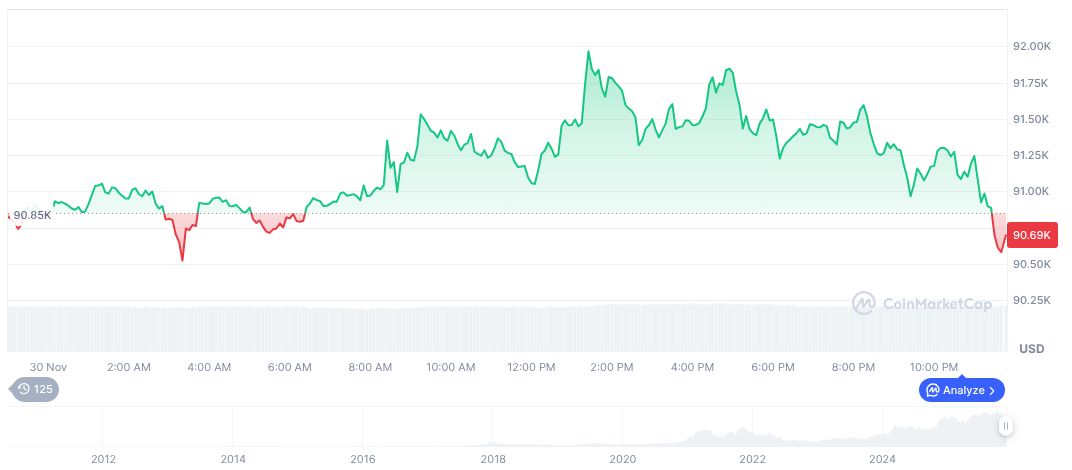

Bitcoin (BTC) is currently priced at $86,476.19, with a market cap of 1725756149157.91 and dominates 58.75% of the market. Over the past 24 hours, it saw a 4.95% decrease, with a trading volume of $88.66 billion, marking a 134.48% increase. Data from December 1, 2025, outlines a 21.37% downturn over 30 days, reflecting the asset's volatility amid macroeconomic uncertainty.

The Coincu research team indicates that expected rate cuts could enhance liquidity in the crypto market, encouraging investment in decentralized finance (DeFi) ecosystems. This potential boom aligns with historical trends, where reduced rates often lead to increased speculative interest and asset inflows.