Anticipation of Federal Reserve Monetary Policy Shift

According to CME's "FedWatch" data, there is a 96.7% probability that the Federal Reserve will implement a 25 basis points rate cut in October. The likelihood of maintaining current interest rates stands at 3.3%.

Federal Reserve Governor Chris Waller, speaking at the Federal Reserve Bank's Payment Innovation Conference, highlighted the central bank's commitment to innovation in financial services. He announced that the Federal Reserve proposed the introduction of a new type of restricted master account, which would allow all legally compliant entities to directly access the Federal Reserve payment system without the need for partner banks.

This anticipated rate adjustment signifies a strategic shift that could create more favorable conditions for risk assets, including cryptocurrencies. Such changes may stimulate increased investment activity within the crypto sector, mirroring historical patterns where lower interest rates have historically fostered asset growth.

Financial analysts and community leaders in the cryptocurrency space are observing these developments with cautious optimism. Industry experts anticipate that potential changes in Federal Reserve policy could influence the accessibility of stablecoins to official payment systems.

Potential Impact on Cryptocurrency Market Liquidity

Historically, Federal Reserve rate cuts have bolstered risk asset markets, leading to increased investments in cryptocurrencies like Bitcoin and Ethereum during the 2020-2021 period.

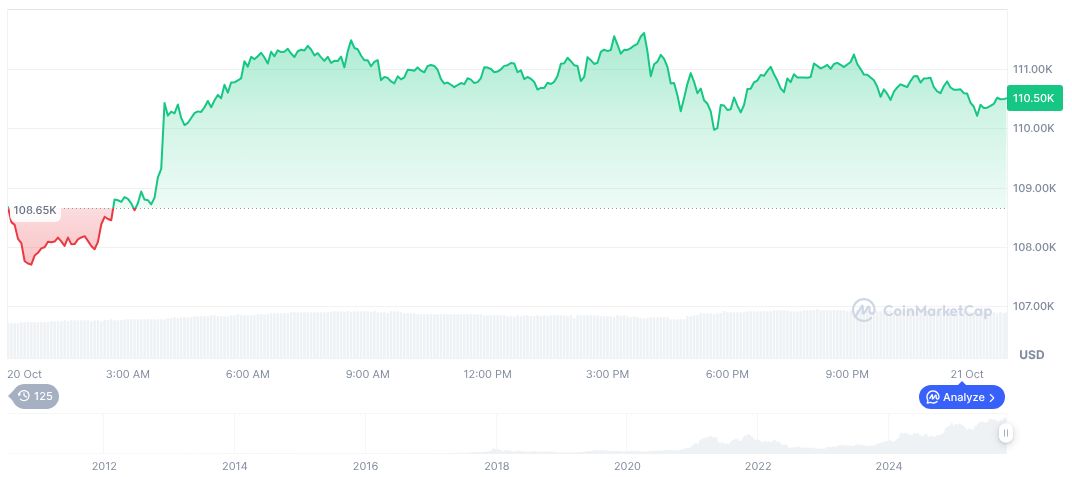

Bitcoin (BTC), currently valued at $112,383.46, holds a market capitalization of $2.24 trillion. Its 24-hour trading volume stands at $81.62 billion, representing a 36.05% increase. Bitcoin maintains a strong market presence, commanding 59.48% dominance. While short-term price fluctuations are evident, Bitcoin's long-term resilience remains a significant factor.

Financial analysts suggest that the Federal Reserve's potential rate cut could lead to increased liquidity and investor interest in the cryptocurrency market. This aligns with historical data that indicates rate reductions often stimulate asset appreciation, creating a favorable environment for market expansion and innovation.