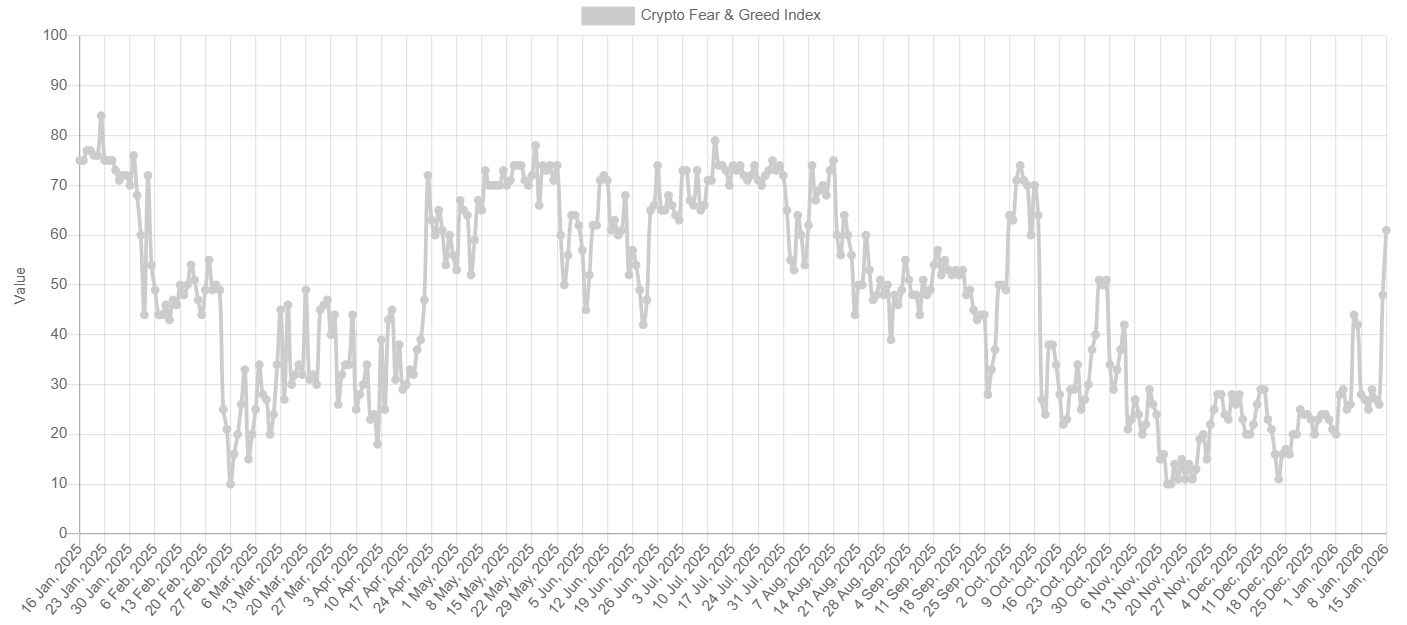

The Bitcoin Fear and Greed Index, a metric reflecting general investor sentiment towards the leading cryptocurrency, has finally entered the "greed" territory. This comes after spending the past three months predominantly in the "fear" or "extreme fear" zones. This development suggests an increase in confidence and a growing appetite for Bitcoin, though it could also precede a potential short-term pullback.

Return to ‘Greed’ Territory

Recent days have been highly positive for Bitcoin bulls, with the asset's price briefly surging to a two-month peak of nearly $98,000. This surge followed heightened geopolitical tensions, including a US military operation in Venezuela and threats of intervention in Iran amidst widespread protests against the regime.

More recently, US President Donald Trump moderated his tone, stating that violence in Iran had ceased and he would not order an attack. This announcement had minimal impact on Bitcoin's volatility, with the cryptocurrency currently trading around $96,000, marking a 7% increase over the past week.

As expected, Bitcoin's rally has influenced the popular Bitcoin Fear and Greed Index. This index analyzes various factors, such as price volatility, survey results, and social media commentary, to gauge momentary investor sentiment toward the cryptocurrency.

The index has now risen to 61, entering the "greed" zone for the first time since early October of the previous year. While this may appear as further positive news for bulls, indicating stronger confidence and demand, it also raises concerns.

It's possible that some investors are acting on FOMO (fear of missing out) rather than fundamental analysis, which could indicate a market becoming overheated. In certain situations, reaching the "greed" or particularly the "extreme greed" zone can signal that the price has hit a local top and may be due for a correction.

Further Price Increases on the Horizon?

Many market observers remain optimistic, anticipating that Bitcoin's price will continue to rise in the near future rather than decline. One prominent X user, Jelle, expressed belief that a jump to $100,000 could occur in the coming weeks. Additionally, analyst Ali Martinez had previously predicted that an ascent above $94,500 might be followed by a spike as high as $105,921.

In parallel, addresses holding between 10 and 10,000 BTC, often referred to as whale and shark addresses, have collectively accumulated over 32,600 BTC since January 10. Concurrently, wallets holding less than 0.01 BTC, known as shrimp wallets, have been actively selling. According to the analytics platform Santiment, this market dynamic could be a favorable setup for a bull run.