ETF Holdings and Market Performance

Franklin Templeton's spot XRP ETF, launched on NYSE Arca and managed by Coinbase Custody, has rapidly accumulated holdings totaling nearly 63 million XRP within its initial week of trading. This swift accumulation highlights significant investor interest and positions the ETF as a notable participant in the cryptocurrency investment landscape.

The ETF has achieved a market capitalization of approximately $127.84 million, with its net asset value reaching $125.63 million. The number of outstanding shares has increased to 5.7 million, reflecting strong demand from investors seeking exposure to XRP through a regulated financial product.

The launch has garnered considerable market attention, with industry observers closely monitoring its potential impact. While major industry figures have not yet issued formal statements, the fund's rapid growth suggests a positive reception to Franklin Templeton's approach to cryptocurrency investments.

XRP Price Dynamics and Regulatory Outlook

The launch of Franklin Templeton's XRP ETF represents one of the fastest accumulations of digital assets within an ETF during its inaugural week, underscoring a robust institutional appetite for cryptocurrency-linked financial instruments. This development is seen as a positive indicator for the broader adoption of regulated crypto investment products.

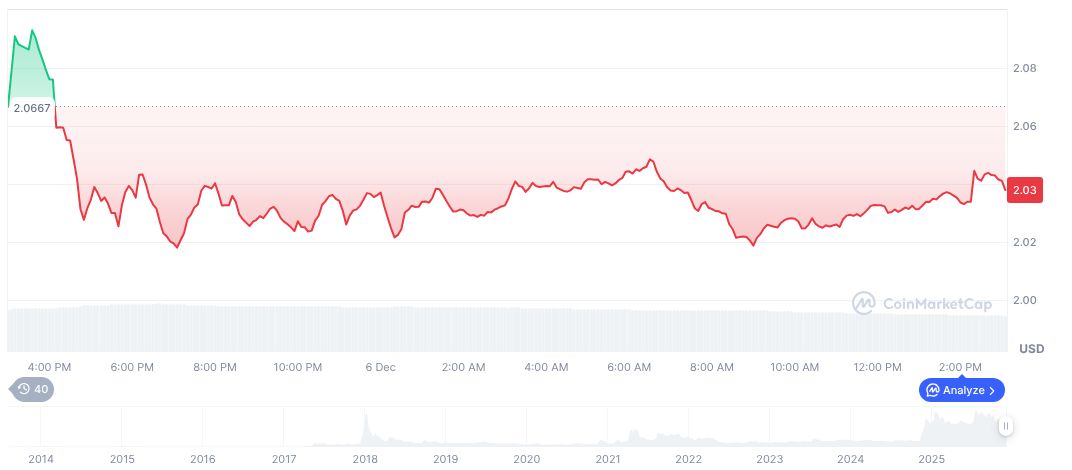

As of December 6, XRP is priced at $2.04, boasting a market capitalization of $123.13 billion and accounting for 4.02% of the total cryptocurrency market dominance. The circulating supply of XRP is 60.33 billion, with a maximum supply cap of 100 billion.

Analysts anticipate that structured ETF frameworks could lead to favorable regulatory outcomes, potentially boosting XRP's adoption. The ETF's initial success underscores the market's keen interest in such offerings, although ongoing regulatory adaptations are crucial for the wider acceptance of cryptocurrencies.