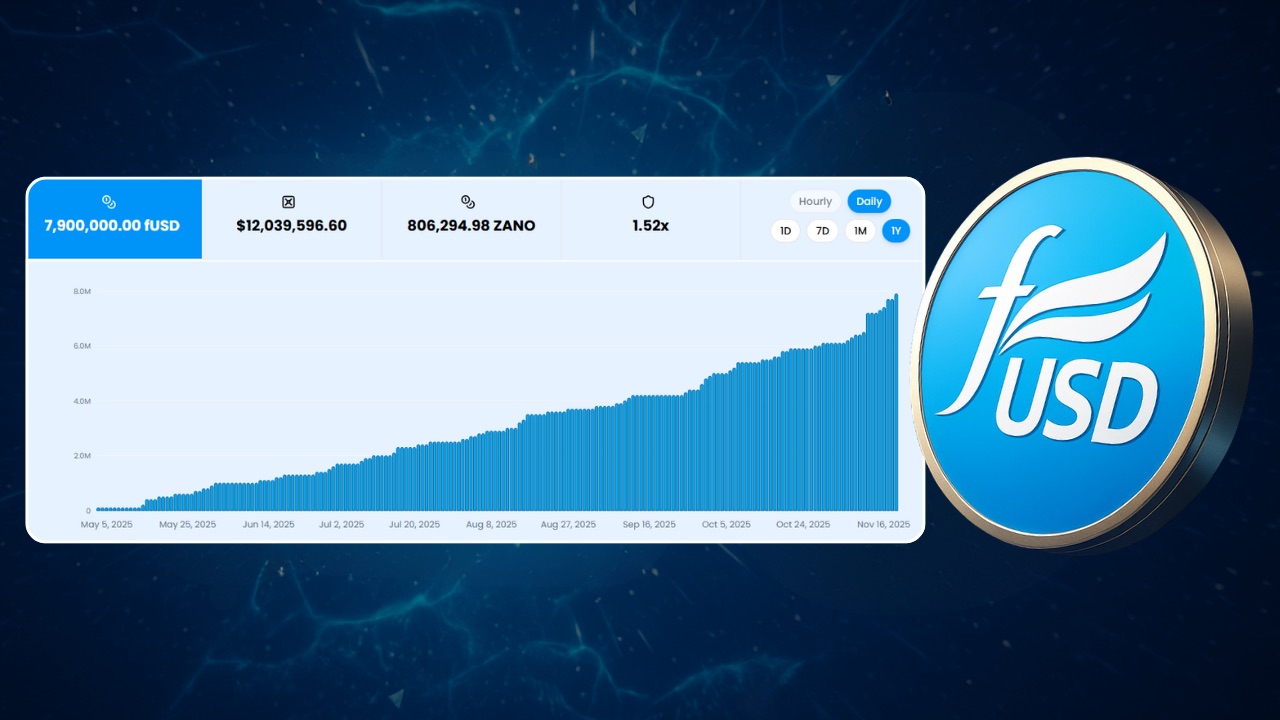

Freedom Dollar ($fUSD) has reached a significant new milestone, as evidenced by its impressive growth trajectory. Since its launch in early May, the circulation of fUSD has expanded to nearly 7,900,000 tokens, indicating a rapidly accelerating adoption rate.

This growth is distinguished by its organic nature, without the support of venture capital, presales, insider trading, seed rounds, or artificial market-making efforts. The expansion of fUSD has been driven solely by user demand and the inherent mechanics of its decentralized, overcollateralized protocol, which is built on the privacy-focused Zano blockchain.

The data clearly illustrates this remarkable ascent. Beginning from the initial blocks in May, the circulation figures showed modest increases, which then evolved into substantial growth, culminating in a parabolic curve by November. This trend suggests a strong market preference for a stable dollar that offers privacy, resistance to censorship, and freedom from potential freezes, with fUSD fulfilling these demands.

Underlying Reserve Strength and Protocol Design

The impressive growth in fUSD supply is supported by a robust collateralization. The 7.9 million fUSD in circulation is backed by over $12 million in decentralized ZANO collateral, equating to more than 806,000 ZANO. This collateral strengthens the system continuously. The current reserve ratio stands at 1.51x, highlighting the protocol's design principles. fUSD supply expands only when users voluntarily lock in new collateral, and every token is transparently verifiable on the blockchain.

This model represents an authentic stablecoin approach, independent of traditional banking systems, corporate issuers, or reliance on attestations. The protocol features no centralized control for freezing funds, no blacklists, no tracking mechanisms, and requires no permissions for operation. fUSD is inherently private, designed to be unfreezable, and governed by open-source code.

Shifting Stablecoin Landscape and Future Prospects

The recent surge in fUSD adoption signifies a broader shift in user preferences, moving away from conventional stablecoin models. Unlike USDT and USDC, which can be frozen at any time and function similarly to digital bank accounts, fUSD offers a fundamentally different approach. It integrates stable value with principles of financial freedom, contrasting with surveillance-oriented systems.

This growing momentum has garnered attention from exchanges, with several platforms preparing to list fUSD, and the first exchange listing anticipated shortly. The trajectory indicates that fUSD is emerging as a key stable asset for individuals prioritizing privacy, sovereignty, and control over their financial assets.

The historical significance of this period, marked by the emergence of the first truly private stablecoin, may be best represented by the growth chart of fUSD. This visual representation captures the transition from an initial concept to a significant and rapidly expanding financial instrument.