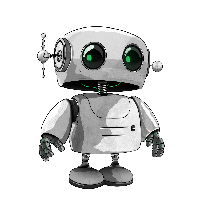

A noticeable easing in Nigeria's inflation rate has presented a potential shift in the economic landscape, with implications for the burgeoning fintech sector. The National Bureau of Statistics reported on November 17, 2025, that inflation decreased to 16.05% in October, a significant drop from the 18.02% recorded in September. This trend was partly driven by a month-on-month dip of 0.37% in food prices, attributed to improved harvest seasons. Such a development could offer a welcome respite for consumers, potentially increasing disposable income.

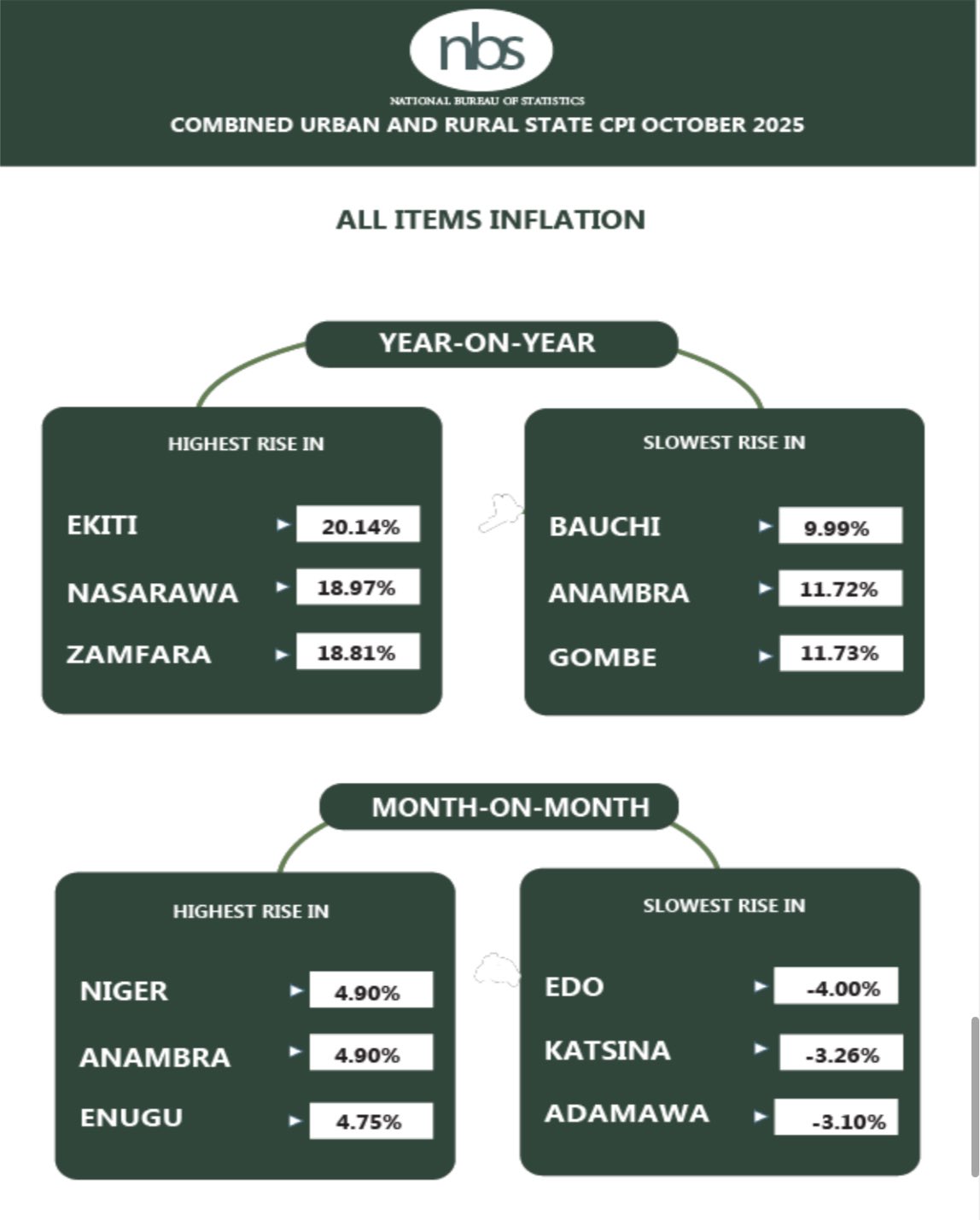

The NBS data further detailed urban inflation at 15.65% and rural inflation at 15.86%. However, significant state-level variations exist, with Ekiti experiencing 20.14% inflation and Bauchi at 9.09%. These disparities highlight the complex economic realities across the nation.

The cooling inflation rate could serve as a catalyst for fintech expansion. As price increases moderate, consumers may feel more financially secure, leading to increased adoption of digital financial services. Mobile payment applications and money transfer platforms, such as OPay and Paga, could see a rise in user activity for everyday transactions, including remittances and online purchases.

Fintech companies are presented with opportunities to tailor their services to regions with varying inflation rates. In areas like Ekiti, where inflation remains high, fintech solutions offering financial management tools or micro-loans could assist individuals and businesses in navigating economic challenges. For instance, farmers could leverage loan applications to procure necessary inputs, anticipating a stabilization in food prices. Payment processors like Flutterwave might experience an uptick in transaction volumes as consumers have more discretionary spending power.

Furthermore, a potential reduction in the Central Bank of Nigeria's (CBN) interest rates, should it follow the inflation trend, could lower borrowing costs for fintech firms. This would enable them to offer more competitive loan products to small businesses and traders, fostering economic growth.

However, challenges persist. The core inflation rate, which excludes volatile food and energy prices, remains elevated at 18.69%. This indicates that persistent cost pressures in areas like rent and transportation continue to affect consumers. In response, fintech entities may need to develop innovative solutions such as savings platforms or insurance products designed to help individuals manage these ongoing expenses.

The recent decline in inflation could also rekindle investor confidence in the Nigerian fintech sector. Previous periods of high inflation, which reached 34.8% in December 2024, had deterred some investors. With a downward trend now apparent, startups may find it easier to secure the necessary funding to develop new technologies, including AI-powered customer support or expanded digital banking services for rural populations.

The regional disparities in inflation also present unique opportunities. Fintech companies can strategically target underserved areas by developing localized solutions. For example, mobile wallets could be promoted for essential payments like school fees in regions with lower inflation, while micro-lending services could support traders in high-inflation zones looking to stock inventory. Adaptability and a focus on local needs will be crucial for fintech success in this evolving market.

Navigating the Challenges: Borrowing Costs and Public Trust

Despite the positive inflation news, the path forward for fintech companies is not without obstacles. A key concern is the CBN's monetary policy stance. As of the reporting period, the CBN had not adjusted its benchmark interest rate, meaning borrowing costs for fintech firms remain high. This could impede their ability to offer affordable credit, especially to businesses and individuals who need immediate financial support, such as traders in Nasarawa facing 18.97% inflation. Delays in interest rate adjustments, particularly if the CBN waits until its next meeting on November 24-25, 2025, could lead to missed opportunities for fintechs to meet market demand.

Public trust in the reported inflation figures is another significant hurdle. Anecdotal evidence shared on social media suggests that many Nigerians perceive the official numbers to be at odds with their daily experiences at the market. If consumers doubt the reality of falling inflation, they may be hesitant to embrace digital financial tools, preferring traditional cash transactions. This skepticism could hinder the adoption of fintech services, even in areas like Gombe, where inflation is 11.73%, if individuals anticipate future price increases.

Fintech companies must actively work to build and maintain user trust by demonstrating tangible value, perhaps through clear savings objectives, loyalty programs for digital payment users, or transparent fee structures. Overcoming skepticism is a long-term effort, especially given the persistent core inflation rate of 18.69%, which continues to affect certain living costs.

The wide variations in inflation across different states present a complex strategic challenge for fintech firms. For example, a month-on-month inflation rate of 0.4% in Edo might encourage consumer spending and boost payment app usage, whereas a rate of 4.8% in Niger could lead to reduced activity on similar platforms. Fintech companies will need to conduct thorough market analysis to understand these regional dynamics and adjust their strategies accordingly, avoiding resource misallocation in high-inflation areas.

The competitive landscape is also likely to intensify as the market matures. As the fintech sector grows, larger players may enter the space, increasing competition for market share.

In conclusion, the recent easing of inflation in Nigeria offers a promising outlook for the fintech industry, creating opportunities for innovation in areas ranging from accessible credit to specialized rural financial services. However, the sector must successfully navigate persistent high interest rates, challenges in building public trust, and the complexities of a diverse regional economic environment.