Galaxy Digital's Alex Thorn has revised the firm's year-end Bitcoin target to $120,000, acknowledging significant shifts in market dynamics. These shifts include evolving capital flows into assets like gold and artificial intelligence, as well as changes in the stablecoin landscape. The adjustment also considers the recent slowdown in institutional investment into Bitcoin Exchange-Traded Funds (ETFs), which has introduced new resistance levels within the market.

This revision reflects a more conservative outlook compared to previous estimates, signaling a potential recalibration of investment strategies for both institutional and retail participants in the cryptocurrency market. The evolving asset allocation priorities underscore the dynamic nature of financial markets and the need for continuous reassessment of investment theses.

Market Analysis and Historical Context

Alex Thorn, Head of Research at Galaxy Digital, detailed the multiple factors influencing the updated Bitcoin price target. The rotation of capital into gold and artificial intelligence, coupled with alterations in whale distribution patterns and corporate treasury strategies, have collectively contributed to a more tempered projection. These elements are indicative of a substantial resistance forming within the market dynamics that informed Galaxy's decision. Furthermore, institutional investments in Bitcoin ETFs have experienced a notable deceleration, with inflows decreasing by 40% month-over-month, according to Galaxy’s internal tracking data.

Mike Novogratz, CEO of Galaxy Digital, reaffirmed the fundamental strength of Bitcoin despite these cyclical market changes. He stated, "Market cycles change. The structural case for Bitcoin remains intact. We’re watching capital flows closely as investors rotate into new themes. Galaxy remains committed to digital assets as a long-term asset class." The market's response has remained cautious, with significant institutional entities, such as Standard Chartered, advising measured dip-buying strategies, anticipating a potential recovery contingent on specific market signals emerging.

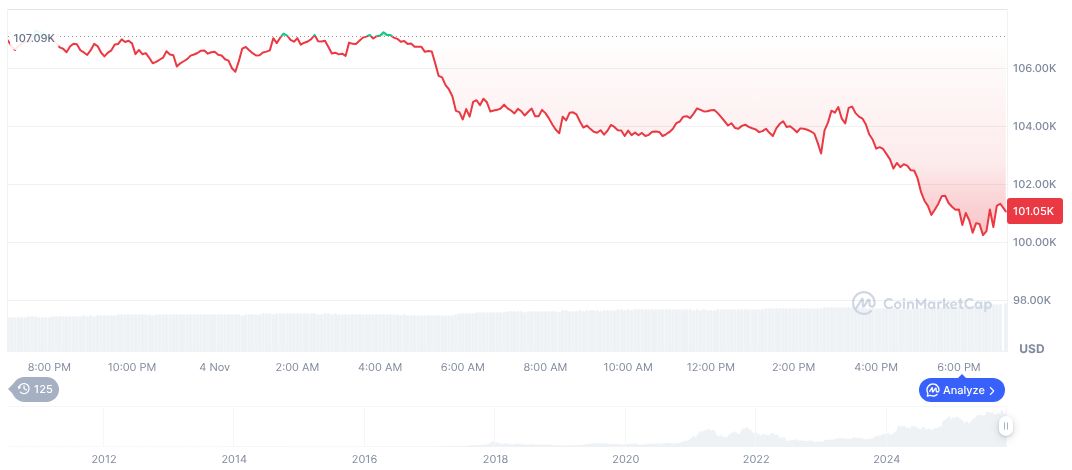

As of November 5, 2025, Bitcoin (BTC) is trading at $103,541.24, with an approximate market capitalization of $2,065,039,734,481.05, representing 59.94% market dominance. Over the preceding 30 days, Bitcoin's price has seen a decline of 17.23%, attributed to shifting market interests and fluctuating investor sentiment. The cryptocurrency's circulating supply is approaching its maximum cap, indicating increasing scarcity amidst ongoing market volatility. Research teams are identifying potential outcomes based on current trends, including impacts on liquidity within decentralized finance (DeFi) protocols and continued capital flows towards AI and gold. Technological advancements and regulatory oversight remain crucial determinants of Bitcoin's future trajectory, with historical data demonstrating its resilience against cyclical challenges.

Technological developments and regulatory oversight remain critical to Bitcoin’s trajectory, with historical data highlighting resilience against cyclical headwinds.

Historical Precedents and Market Sentiment

Historical precedents demonstrate Galaxy Digital's tendency towards a cautious approach during similar market rotations. For instance, in 2023, a period marked by adjusted Bitcoin forecasts, the market subsequently experienced a notable recovery. This historical pattern suggests that Galaxy's current cautious stance, informed by evolving market conditions, may precede a period of renewed growth.

As of November 5, 2025, Bitcoin (BTC) trades at $103,541.24, with a market capitalization of approximately $2,065,039,734,481.05, indicating 59.94% market dominance.