Regulatory Scrutiny on Digital Assets

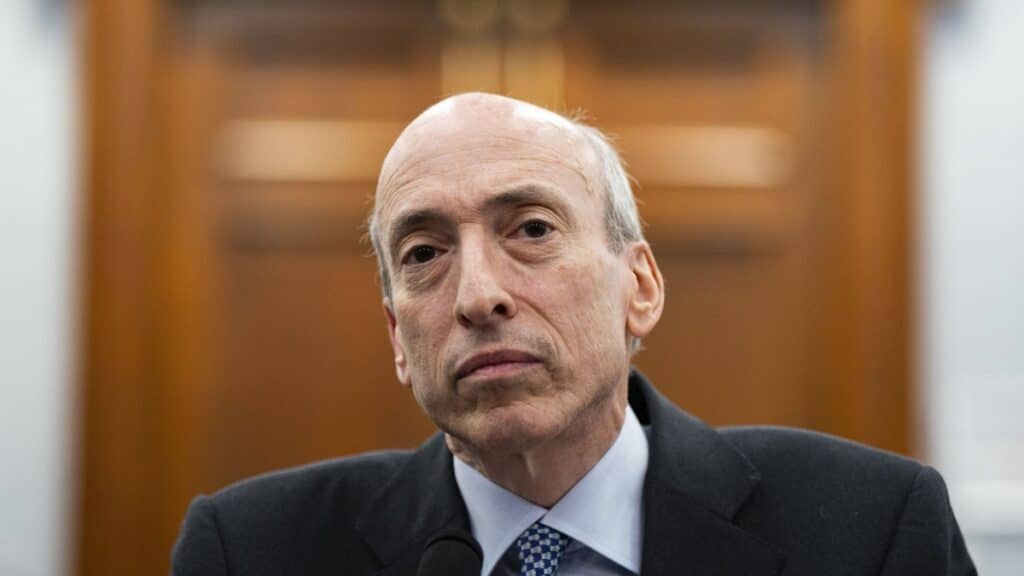

In a blunt message to investors around the world, former U.S. Securities and Exchange Commission (SEC) chair Gary Gensler has cautioned that nearly all cryptocurrencies, with the sole exception of Bitcoin, should be treated as highly speculative and risky investments.

Speaking in a recent interview with Bloomberg, Gensler stressed that only Bitcoin stands out for its regulatory treatment and relative maturity, while the thousands of other digital tokens often lack a clear underlying value.

“The American public and the worldwide public have been fascinated with cryptocurrencies,” Gensler said. “But it’s a highly speculative, volatile asset.” He added: “Putting aside Bitcoin for a minute… all the thousands of other tokens, not the stablecoins backed by U.S. dollars, but all the thousands of other tokens, you have to ask yourself: what are the fundamentals? What’s underlying it?”

Distinguishing Bitcoin from Other Tokens

Gensler’s comments underscore a long-standing regulatory distinction: Bitcoin is often viewed more like a commodity, whereas most other tokens resemble securities because they are often sold as investment contracts, raising money from the public with the promise that future profits will come from the efforts of a centralized team.

Under U.S. law, such assets should be subject to disclosure and registration requirements.

Intertwined Risks with Traditional Markets

The former SEC chair also referenced recent trading disruptions at the Chicago Mercantile Exchange (CME), implying that as cryptocurrencies become more entwined with traditional markets, the risks of volatility and systemic instability increase.