Gigmile has released its 2025 Impact Report and confirmed the close of its seed round in Q3 2025. This marks a significant milestone for the mobility financing startup that operates across Nigeria and Ghana. The seed round was led by an follow-on investment from ENZA Capital, with participation from Seedstars International Ventures and the Norrsken Africa Fund. This funding reinforces Gigmile's standing as a leading provider of lease-to-own mobility assets for gig workers in Africa.

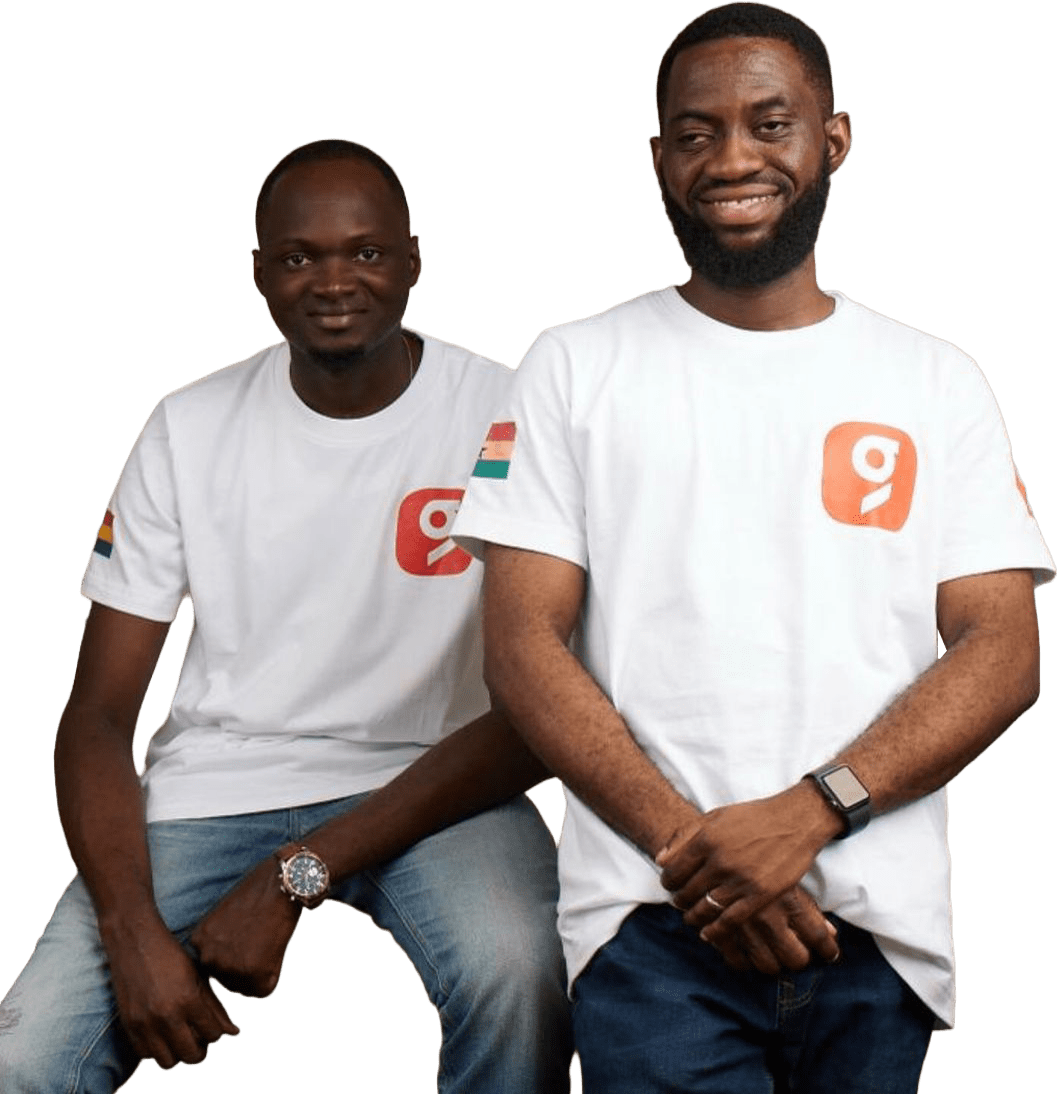

Founded in 2022 by former Jumia Country Managers Kayode Adeyinka and Samuel Esiri, the Lagos and Accra-based startup has rapidly become a crucial player in an underserved mobility credit market. This market previously excluded millions of delivery riders, ride-hailing drivers, and logistics workers. Traditional financial institutions often require collateral, credit history, and documentation that many gig workers are unable to provide, preventing skilled individuals from accessing income-generating vehicles.

Gigmile addresses this gap through its platform, Gamma Mobility. This platform finances motorcycles, tricycles, cars, and personal commuting vehicles via a flexible lease-to-own model designed for long-term financial inclusion. Daily repayments are structured to not exceed one-third of expected earnings, ensuring riders can maintain financial stability even during slower periods. To minimize operational challenges for gig workers, each lease includes insurance, maintenance, repairs, and full licensing.

The company reports that over 10,000 vehicles have been deployed to date. Of these, 8,500 are currently active on the platform, and 1,500 riders have successfully completed their ownership terms, establishing steady income and achieving long-term economic mobility. Gigmile's growth has been bolstered by strategic supply partnerships with Yamaha, TVS, Bajaj, and Hero, providing riders access to robust vehicles suited for African road conditions.

Gigmile has secured a total of $21 million in combined debt and equity financing. This capital infusion has enabled the company to expand its fleet, enhance its credit analytics capabilities, and scale its operations to 13 cities across Nigeria and Ghana. The firm intends to launch in over 15 new cities within the next year, supported by an advanced automation engine that manages onboarding, risk assessment, rider support, and repayment processes.

Inside the Gigmile’s 2025 Impact Report

The 2025 Impact Report provides detailed insights into Gigmile's financial and social achievements across its operational markets. According to the report, Gamma Mobility has financed more than 8,500 vehicles and has facilitated stable employment for over 15,000 gig workers.

Riders are now collectively earning over $2 million per month, and the platform has financed assets valued at more than $18 million. Gigmile has also extended health insurance coverage to 3,200 riders. The report highlights a strong repayment performance of 94 percent and a utilization rate of 95 percent, underscoring the model's capital efficiency and commercial viability.

Gigmile is preparing to expand its services beyond gig workers. Development is underway for personal mobility leasing targeted at salaried professionals, embedded finance products such as bill payment and savings tools, and new eco-friendly mobility options including electric and CNG vehicles. These new ventures are driven by the increasing demand for flexible vehicle ownership as African cities grow and transportation systems face mounting pressure.

Commenting on the report's release, CEO Kayode Adeyinka stated, "With this Impact Report, we are proud to show how technology, structured financing, and strong partnerships can unlock economic mobility at scale. Our model proves that mobility financing can be profitable, scalable, and deeply transformational. This funding enables us to serve more riders, onboard more women, and execute on our clean mobility roadmap."

Gigmile aims to surpass $100 million in financed mobility assets by 2027. With growing investor interest in fintech, climate mobility, and lending infrastructure, the company anticipates initiating discussions for a Series A funding round in 2026.

The 2025 Impact Report, which offers a comprehensive overview of the company's metrics and expansion strategies as it enters its next growth phase, is available for download.