Institutional capital has favored gold over Bitcoin over the past year, according to a CryptoQuant report tracking relative performance and capital allocation. While Bitcoin consolidated below $100,000, gold surged to record highs, reflecting a clear divergence in investor behavior during a period of heightened caution.

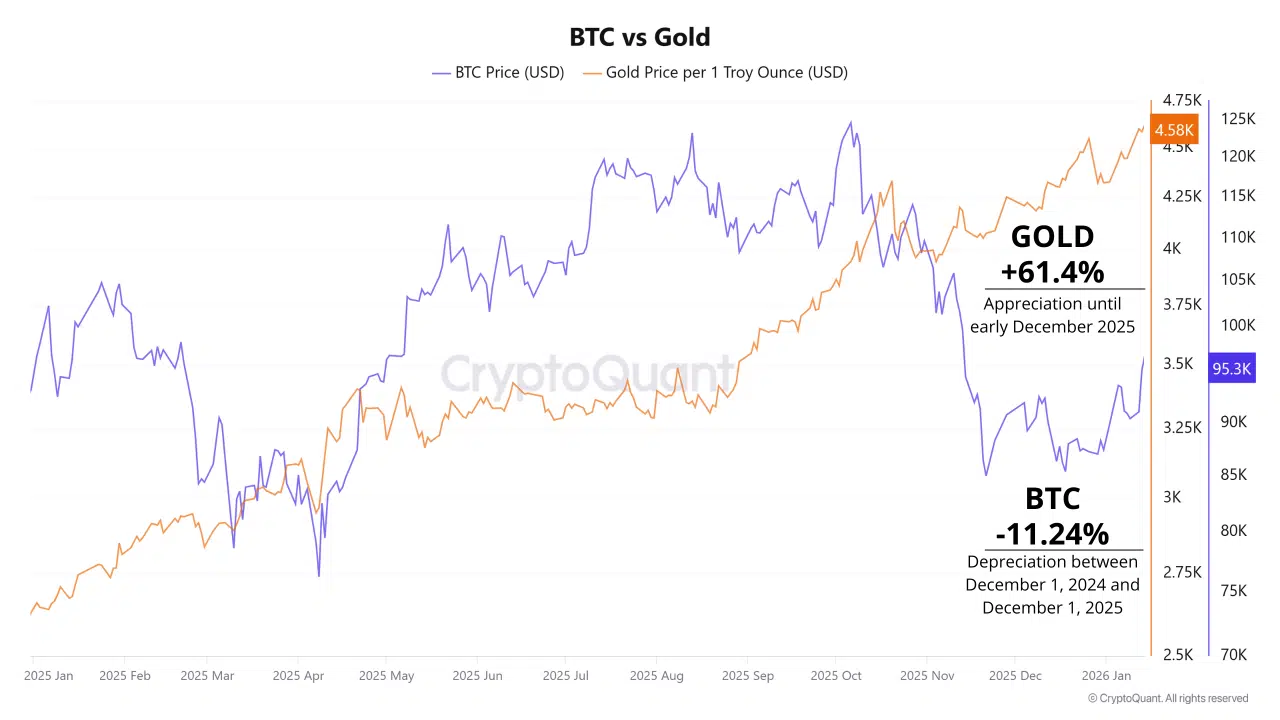

The data shows a pronounced split between the two assets. From December 1, 2024, to December 1, 2025, Bitcoin depreciated by 11.24%, while gold appreciated by 61.4% into early December 2025. At the latest reading, gold is trading near $4,580 per ounce, while Bitcoin sits around $95,300.

Performance Gap Highlights Risk Aversion

The CryptoQuant chart illustrates gold’s steady climb throughout 2025 as Bitcoin moved sideways to lower. Gold’s rally marked its strongest annual performance since 1979, culminating in a new record high near $4,600 per ounce.

Over the same window, Bitcoin failed to sustain upside momentum, slipping below prior highs and remaining capped under the $100,000 level. The report frames this divergence as a reflection of short-term risk aversion. With persistent inflation, geopolitical tensions, and a cautious policy backdrop, capital gravitated toward traditional protective assets rather than higher-volatility risk exposures.

Institutional Expectations Favor Gold Near Term

Market expectations cited in the report reinforce the tilt toward gold. Large financial institutions such as JPMorgan Chase and Bank of America project gold prices reaching $5,000 in 2026. In parallel, Polymarket assigns a 79% probability to that outcome, underscoring strong consensus around continued gold strength.

CryptoQuant attributes the rally to political stress surrounding the Federal Reserve and broader macro uncertainty, conditions that historically favor capital preservation over asymmetric growth.

Tokenized Gold Dominates Digital Commodity Exposure

Within digital markets, the rotation toward safety is also visible. Tokenized gold products account for the majority of on-chain commodity exposure, with Pax Gold (PAXG) holding roughly $1.1 billion in market capitalization and Tether Gold (XAUT) around $1.64 billion. Together, they represent close to 80% of the tokenized commodities sector, indicating where digital capital has concentrated during the gold rally.

Tactical Deviation, Not Structural Shift

The report concludes that the move away from Bitcoin is tactical rather than permanent. Institutional capital is described as temporarily capturing value in gold while awaiting clearer macro signals. Once the risk-averse cycle fades, CryptoQuant suggests that rotation back toward higher-potential assets could resume.

For now, the data shows capital prioritizing safety. Bitcoin’s underperformance relative to gold highlights where institutions have chosen to sit during uncertainty, and where they may eventually rotate once conditions change.