Ethereum and the broader cryptocurrency market experienced a decline over the past 24 hours. This downturn was fueled by escalating geopolitical tensions between the United States and the European Union, which consequently led to increased risk aversion among investors.

In parallel, traditional safe-haven assets saw significant gains. Gold surged to fresh record highs, and silver also touched new peaks. These movements were driven by flight-to-quality flows, triggered by President Trump’s renewed tariff threats against several European nations concerning the Greenland dispute.

Spot gold climbed 1.1% to around $4,725 per ounce as of early trading on January 20, approaching its all-time high near $4,795 set late last year. The metal has extended its bull run into 2026, bolstered by safe-haven demand as investors brace for potential transatlantic trade disruptions.

The silver price also advanced by nearly 1% to hit a new record high of $95.3/oz.

ETH price was trading at $3,095 as of 4:29 a.m. EST, marking a 3.6% drop in the last day. The overall crypto market also fell over 2%, reaching a market capitalization of $3.15 trillion.

Crypto Market Rattled As Trump Tariffs Dent Risk

During the weekend, President Trump threatened to impose import tariffs of up to 25% on several major European nations, including Denmark and France, until they reached an agreement to transfer Greenland to Washington. These demands were widely rejected by European leaders, with France reportedly preparing retaliatory economic measures against the United States.

The exchange between the two regions has sparked deep losses across global risk-driven markets. Concerns have arisen over a potential dissolution of NATO, as Trump plans direct steps to acquire Greenland.

Adding to the tensions, Trump stated he would impose a 200% tariff on French wines and champagnes, expressing a desire for French President Emmanuel Macron to join his Board of Peace Initiative, aimed at resolving global conflicts. Trump remarked, “I’ll put a 200% tariff on his wines and champagnes, and he’ll join, but he doesn’t have to join.”

JUST IN – Reporter: Can you respond to Macron saying he will not join the board of peace?

Trump: Nobody wants him… I’ll put a 200% tariff on his wines and he’ll join pic.twitter.com/S5pTcTbTvn

— Insider Paper (@TheInsiderPaper) January 20, 2026

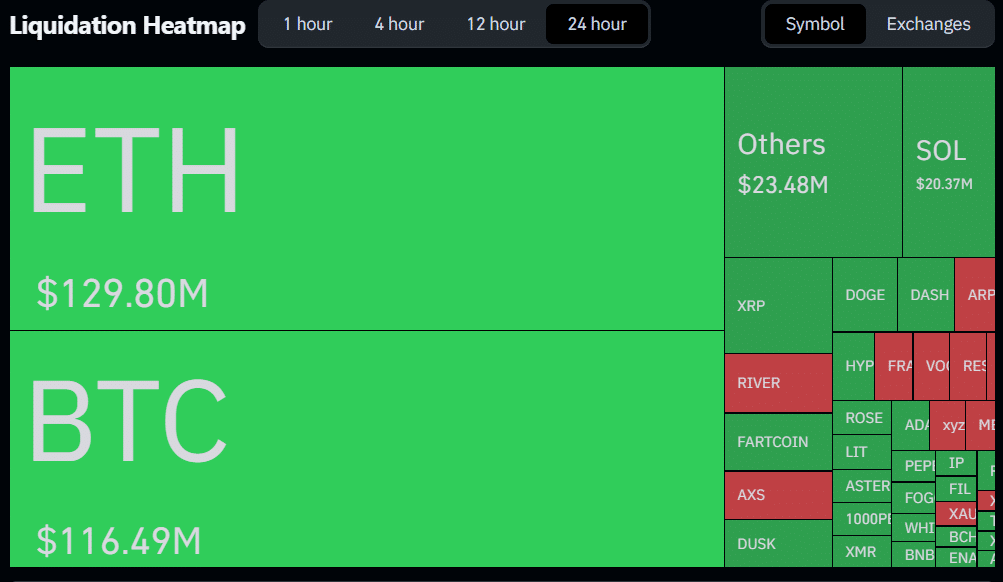

This situation sent jitters through the crypto space, resulting in total liquidations of $361 million, with $124 million stemming from Ethereum longs alone.

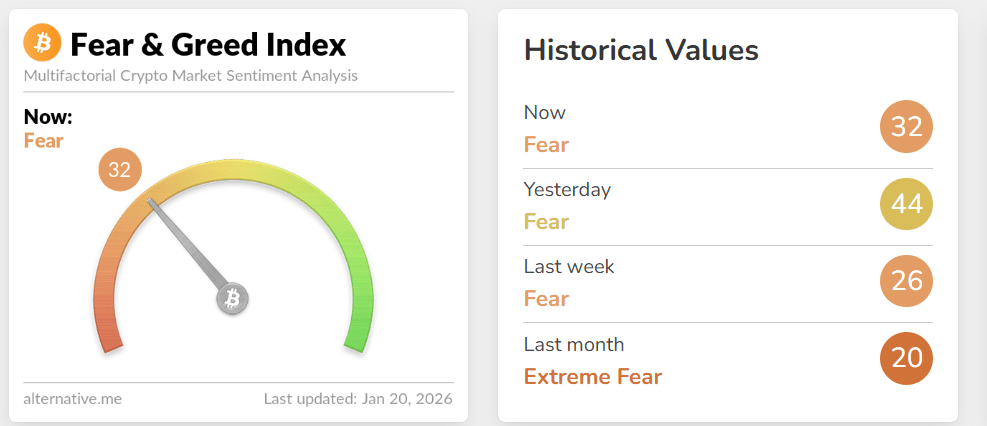

Furthermore, the crypto Fear & Greed Index remains in the fear zone after several weeks of extreme fear. This indicates that while investor sentiment has softened, it remains cautious, suggesting the market may be undervalued.

Ethereum Price Analysis: The Drop Is A Warning Sign

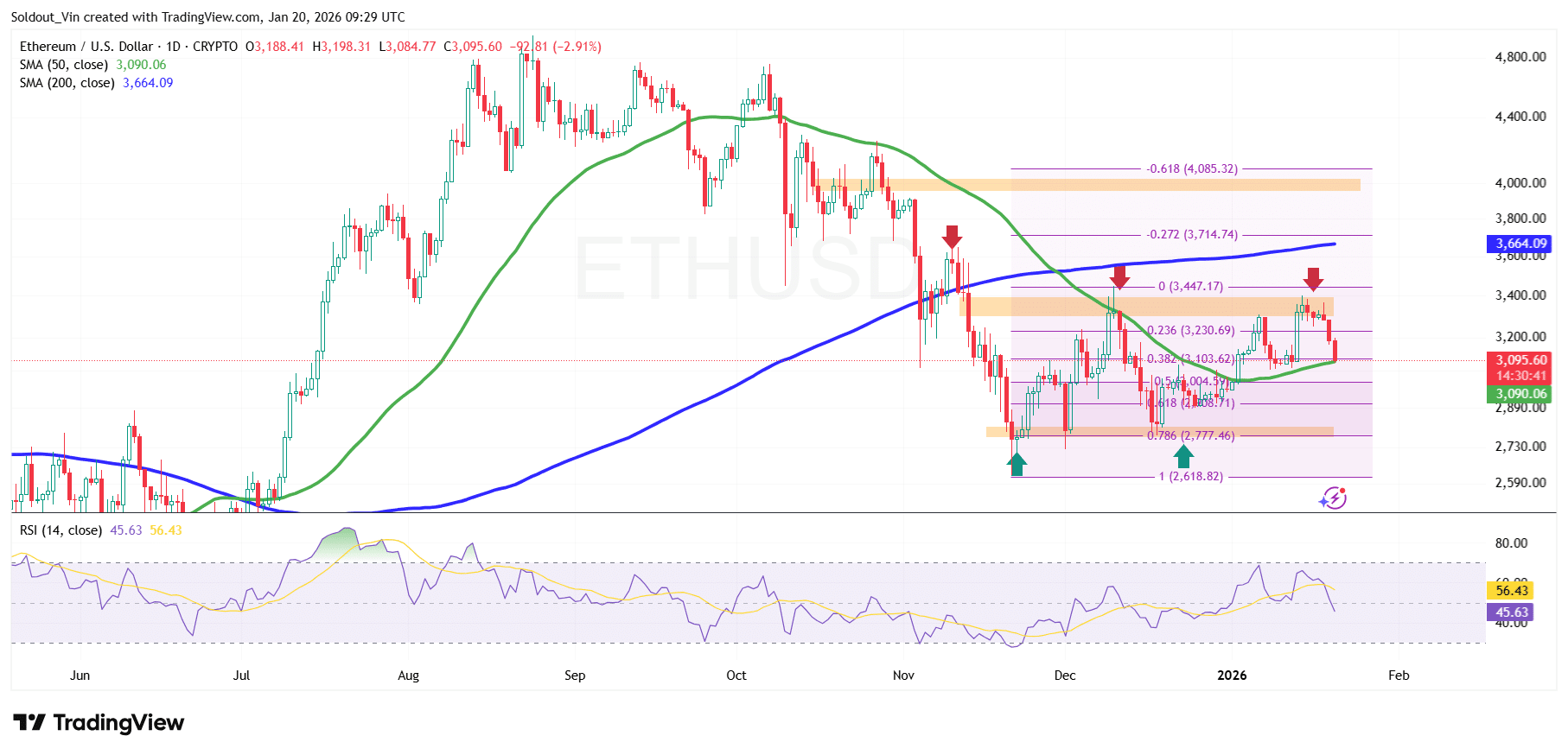

Ethereum's price is currently trading around the $3,050–$3,150 range, attempting to stabilize after a sharp decline. While buyers are defending the $3,000 psychological support level, the overall price action suggests caution rather than strength.

The recent downward movement followed a strong rejection from the $3,600–$3,700 region, where Ethereum failed to maintain its position above the 50-day Simple Moving Average (SMA). This resistance level triggered sustained selling pressure from bears, driving the price towards the $2,750–$2,800 demand zone, a historically significant support area aligned with the 0.786 Fibonacci retracement.

Ethereum is currently trading near the 50-day SMA, which is approximately $3,090, acting as short-term support. However, the price remains decisively below the 200-day SMA, which is near $3,660 and continues to serve as a major overhead resistance.

Momentum indicators also reflect this cautious sentiment. The Relative Strength Index (RSI) is hovering around 45, which is below the neutral 50 level. This suggests that bearish momentum has eased, but bullish momentum has not yet returned.

ETH Price Prediction: $2,600 Level In Sight

A failure to hold the $3,000 support level would increase the risk of another pullback toward the $2,800–$2,750 range, near the 0.786 Fibonacci level. A breakdown below this demand zone would expose the $2,620 cycle low, which remains a critical level for bulls to defend.

Conversely, Ethereum may attempt another push toward the $3,350 resistance zone. This area has repeatedly capped upside moves and prevented further gains.

A decisive breakout above this range could potentially lead to a retest of the $3,660 level, which coincides with the 200-day SMA.

For Ethereum to realistically re-enter a bullish structure and target the $4,000 region, a sustained trend reversal would be necessary. This would likely begin with a decisive close above the 200-day SMA.

Related News

- •NYSE Launches Blockchain Platform for 24/7 Trading of Tokenized Stocks and ETFs

- •Bitcoin Dips as Crypto Funds See Record Inflows, Altcoins Hold Steady

- •Cardano Founder Hoskinson Clashes With Ripple CEO Over US Crypto Bill